Military, weaponry, and defense stocks have steadily moved higher since bottoming in 4th quarter 2022.

This can be seen, in general, by looking at a chart of the Aerospace & Defense Sector ETF (XAR). Hint, that’s what we will be doing today.

The winds of war are in the air with conflicts in Ukraine and the Middle East. And the U.S. has upped its spending to aid allies in those regions. This continues to be a tailwind for XAR.

And should the unfortunate unfold with these conflicts broadening, XAR will only benefit further.

Let’s look at a longer-term chart of XAR.

Note that the following MarketSurge charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

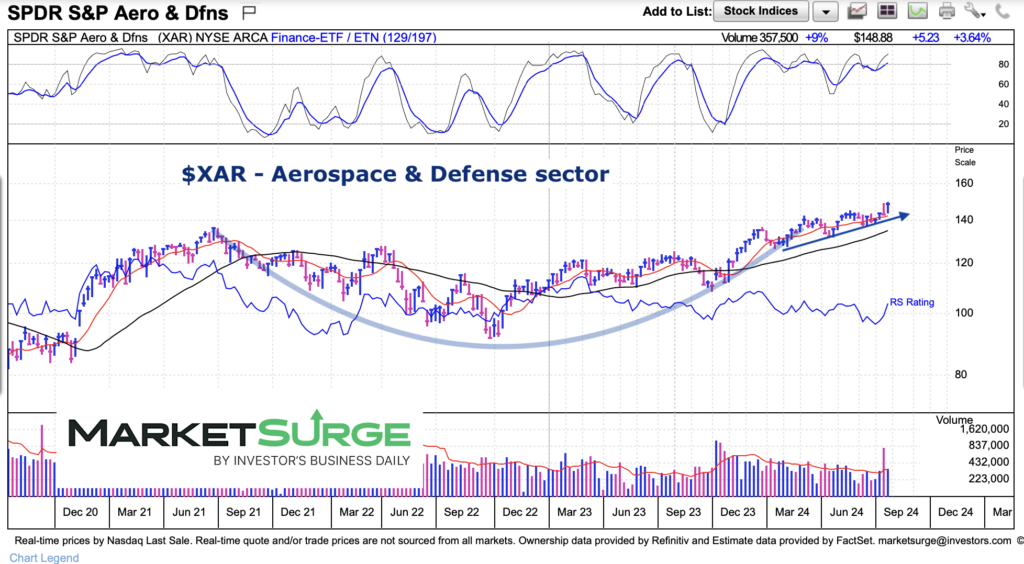

$XAR Aerospace & Defense sector “weekly” Chart

Here we can see the strong base that has been built off the Q3/Q4 2022 lows. In sum, it’s been a steady rise with buyers in control. 2024 has seen XAR breakout to new highs with buying continuation.

Note that both the 10-week and 40-week moving averages are rising. $135 to $140 is current support.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.