The two-day Federal Reserve meeting, the year’s last and a highly anticipated one, ends Wednesday. And a rate hike is widely expected. The fed funds rate has been stuck near zero for the past nine years.

The market currently expects either a ‘one and done’ or a very shallow tightening cycle for interest rates.

Depending upon whether or not the Federal Reserve obliges at the December Fed meeting could have huge implications for stocks… especially with elevated levels of short interest across the market.

Here are some considerations and scenarios.

With stocks under pressure in recent sessions and amidst favorable market seasonality, a dovish message – perceived or real – could potentially act as a tailwind. Especially in a market with high short interest.

The S&P 500 Index dropped 3.8 percent this week and is north of five percent away from its all-time high set in May of this year.

In this scenario, short interest could help – the equity bulls, that is.

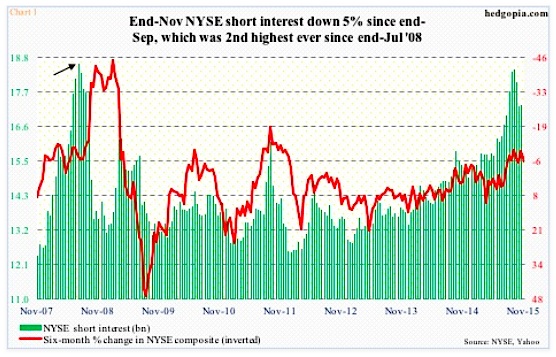

In the most recent period (end of November), NYSE short interest rose 1.4 percent to 17.5 billion shares. Since the end of September, short interest has dropped five percent. The 18.4-billion high reached two months ago was the second highest ever, after 18.6 billion at the end of July 2006 (arrow in casdhart 1 above).

Assuming the bulls have the means to force a squeeze, the elevated level of short interest is a powerful tool they have at their disposal.

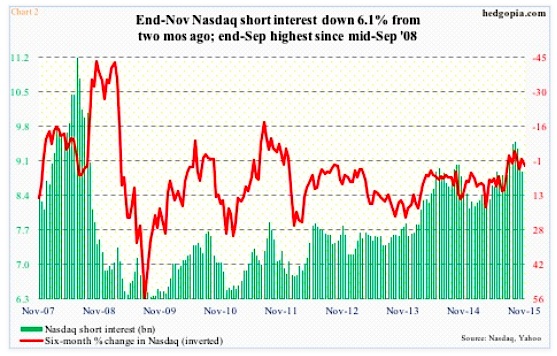

Over on the Nasdaq, it is the same phenomenon. Short interest was essentially unchanged in the latest period. Off the end-September high of 9.5 billion shares – the highest since 10.1 billion shares in the middle of September 2008 – short interest is down 6.1 percent (chart 2 below). Once again, in the right circumstances, this is a recipe for squeeze.

This is one side of the coin, and favors the bulls, the other side not so much.

In a scenario in which the Federal Reserve does not quite sound as dovish as markets are currently priced for, shorts can lick their lips. They have doggedly remained bearish and will be rewarded if the Fed does not signal a ‘dovish hike’.

Two days after the FOMC decision next week, December options expire. Here is how open interest in SPY ($205.34), the SPDR S&P 500 ETF, looks in the 204-206 strikes: calls, 159,000 contracts; puts, 320,000 contracts.

There is room for a surprise reaction (by stocks) next week which will be on the downside, not up.

Thanks for reading!

Twitter: @hedgopia

Read more from Paban on his blog.

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.