CVS Health (NYSE: CVS) fell 9% on Wednesday morning, after posting mixed earnings and disappointing guidance.

This likely marks the beginning of an extended downside move over the coming weeks.

The retail pharmacy company reported earnings per share of $2.14 and total revenue of $54.4 billion, compared to analyst estimates of $2.09 and $54.6 billion. For the current year, management expects earnings of $6.68-6.88, below the consensus of $7.41 per share.

CEO Larry Merlo cautioned that, “This will be a year of transition as we integrate Aetna and focus on key pillars of our growth strategy. We are aware of the need to address the impact of headwinds that exerting a disproportionate impact.”

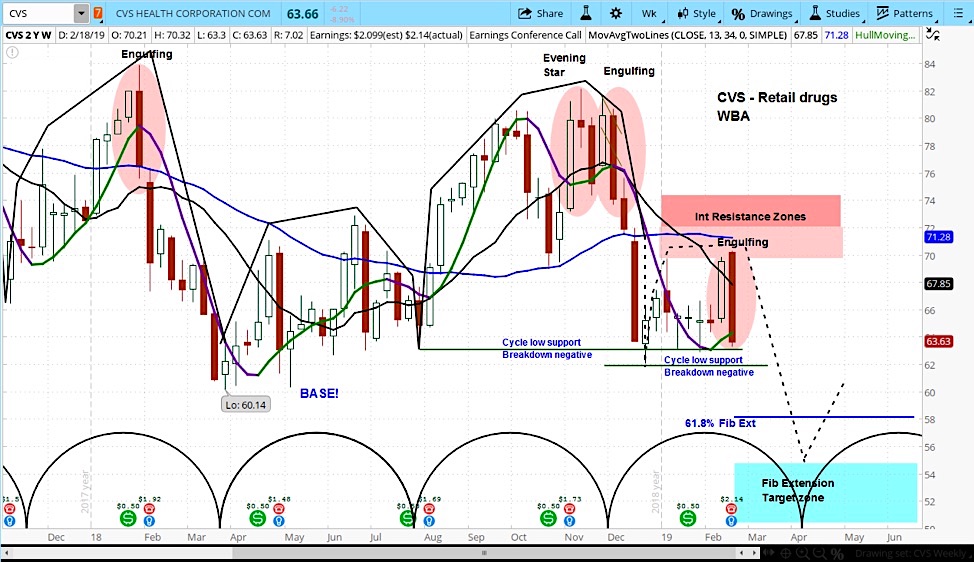

In analyzing the market cycles for CVS, we can see it is likely now in the declining phase of its current cycle. The stock had a negative intermediate cycle pattern and failed in resistance.

Our projection is for the stock to fall to $58, and as low as $55 by late March.

CVS Health (CVS) Stock Weekly Chart

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.