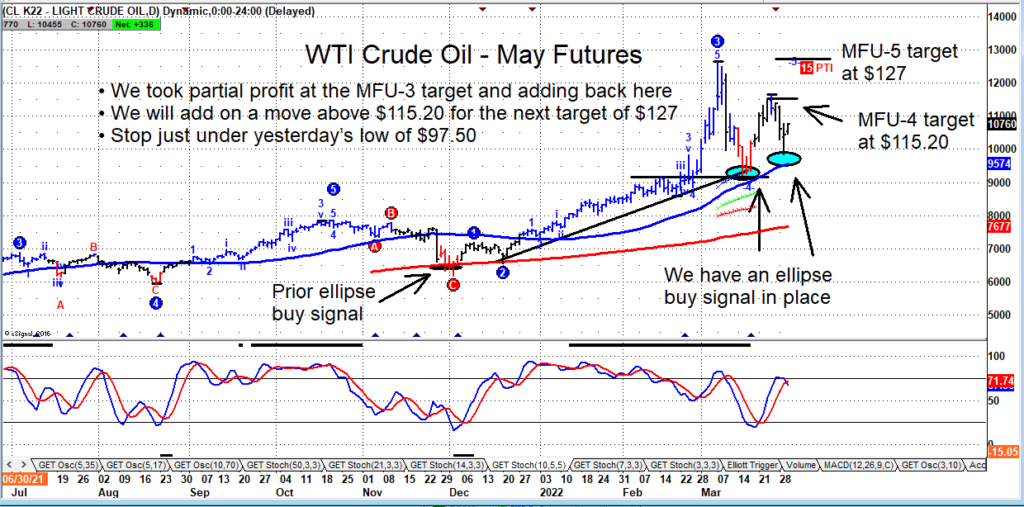

The near-term targets in WTI Crude Oil were hit, and traders got a pullback to buy into.

Now is where things get tricky. The latest bullish reversal produced an ellipse buy signal and perhaps we test the MFU-4 price target at $115.20 (we already hit this and wrote about it here).

Only a break above $115 would signal a retest of the high and potential move to $127 (MFU-5 target). A move back under the recent low (latest reversal area) would bearish.

I still like the energy space and the $XOP. There are many stocks in this sector that continue to screen well in my work. ETFs like $XOP and $OIH allow trend trading exposure without stock picking.

Crude Oil Futures Chart

Twitter: @GuyCerundolo

The author or his firm have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.