It’s hard to score profits by trading on news headlines, and the current environment makes it even harder. We prefer to rely mainly on technical analysis instead, and right now technical factors make a good case that crude oil is reaching “overbought” territory.

In this research report, we explore Elliott wave analysis to see what the charts say about Light Sweet Crude Oil futures (trading symbol: CL).

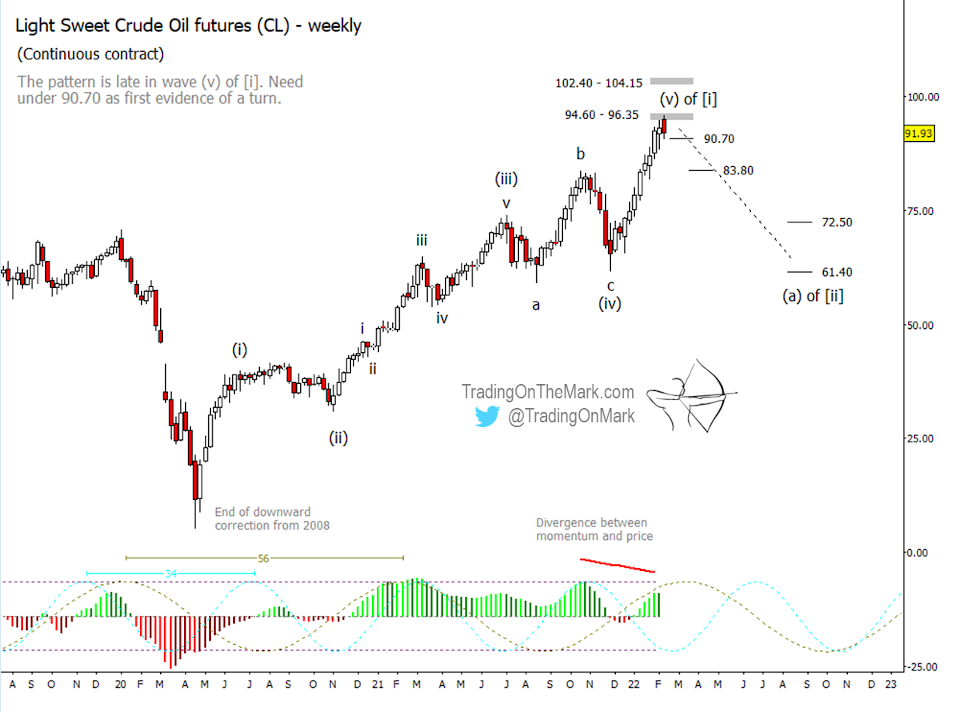

At the start of the pandemic, when front-month future prices briefly went negative, we felt confident in calling it the end of the downward corrective pattern that had begun in 2008. On a continuous-contract chart like the one shown below, the April 2020 low was 3.48 (above zero), but it still remained a durable low.

With that as a foundation, our next step has been to look for the underlying structure in the climb out of the hole. This is where Elliott wave methods can be so helpful, because they provide an almost an x-ray view into market sentiment. Right now we are looking for an impulsive (five-wave) pattern, the completion of which will mean bullish sentiment has peaked.

On the weekly chart, we can count five waves up following the classic impulsive form:

- Wave (i) acted as a decisive signal to technical traders that the market had been overextended to the down side.

- Wave (ii) gave some bullish traders a chance to catch their breath or reposition, while the “dumb” money was looking for downward continuation.

- Wave (iii) was the strongest, making it hard for late-comers to get on board.

- Wave (iv) was the embodiment of “indecisive”

Now we’re probably witnessing the completion of upward wave (v) to finish the pattern. Note how price has been contending with the first band of Fibonacci-based resistance near 94.50 to 96.35. Another resistance band might serve as a backstop near 102.40 to 104.15.

Note also the divergence between our preferred momentum tool and price. Momentum is printing a lower high right now.

The first confirmation signal for crude oil bears who are trading on this time frame would be a weekly close beneath 90.70. As of this writing it looks as though that might happen very soon, but we can’t rule out another test of resistance. An international security scare could cause that to happen regardless of technicals.

When the decline begins in earnest, we’ll be watching support near 83.80 and expecting it to break eventually. Lower targets await near 72.50 and 61.40. The lower of those probably represents the bottom of what will become a new range for traders, with the area near current highs capping the range.

Dominant price cycles of 34 weeks and 56 weeks suggest an ideal time for a price low would be around October or November 2022, and that might represent the bottom of the first leg of a correction.

You can get daily charts and updates for this and other highly traded markets via our subscription page on Substack and on Twitter.

Twitter: @TradingOnMark

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.