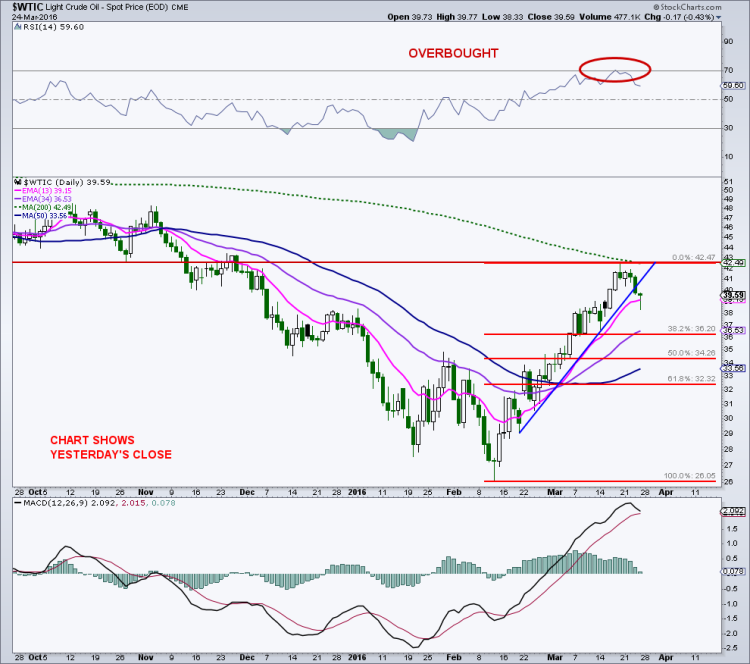

West Texas Intermediate Crude Oil (WTI) has run into a couple pieces of resistance and is likely to see a decent pullback here. We have seen a measured move higher in oil prices based on the size of the completed double bottom up to the low/mid $40’s.

The declining 200-day average and potential overhead supply also sits in the low $40’s. As well, oil prices ran right to a 61.8% fibonacci retracement of the decline since October.

And there’s more. The 14-day RSI recently cycled into overbought territory, a sign for buyers to take their foot off the gas (pun intended). The daily MACD is also rolling over. Commercial hedgers (smart money), which recently had their most bullish exposure in the past 3 years, have started to lower their exposure of late. This could be an early warning that this move into the $40’s may be it for this initial rally. Sentiment has improved, but has not yet reached neutral territory. All in all, this may lead to a pullback for crude oil and related energy stocks (more on the energy sector further below).

Let’s look at this on a daily chart of crude oil prices.

WTI Crude Oil – Daily Chart

So how far might WTI pull back before the next attempt to break all this tough resistance sitting on top of prices. As I illustrated above, I like to find support and resistance levels where there are a couple of separate pieces located in the same place.

So let’s “zoom” in on the daily chart of crude oil (see below). There are three pieces of support in the 34/35 per barrel area. A 50% retracement of the recent rally, the intervening top of the double bottom, and the 50-day simple average. The 50-day is rising so I’m projecting that it will reach the 34/35 region in the next week or two. There is also the possibility that a shallower pullback could be contained in the 36+ area as a 38.2% give back and the rising 34-day exponential sit in that zone. The advance since February looks to be 5 waves, so a bullish sign for crude oil prices would be an ABC (3 wave) decline from the recent peak.

WTI Crude Oil – Daily “ZOOM” Chart

Energy Sector & Stocks

Energy stocks may also be in line for a breather. The Energy Select Sector SPDR ETF (XLE) looks to have completed Wave 3 of its advance off the January lows. XLE has run into key trendline resistance, the falling 200-day simple average, and important overhead supply.

Since January 20, energy stocks have outperformed the S&P 500 and have been a leadership sector. The Energy Sector ETF (XLE) has rallied almost 29% from its intraday low on January 20 to its recent intraday high. If my Elliott Wave (EW) count is correct, Wave 4 should be an ABC correction (3-wave) and hold above the Wave 1 high near 58. Wave 5 should then follow to new recovery highs. Crude oil (WTI) has a different EW count as oil went to new lows in February while energy stocks traced out a higher low in February. Therefore, the rally in crude oil prices may have just seen the top of Wave 1, with a corrective Wave 2 in progress.

You can contact me at arbetermark@gmail.com for premium newsletter inquiries. Thanks for reading.

Read more from Mark: “Gold Rally Update: Be Careful With The Yellow Metal Here“

Twitter: @MarkArbeter

The author does not have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.