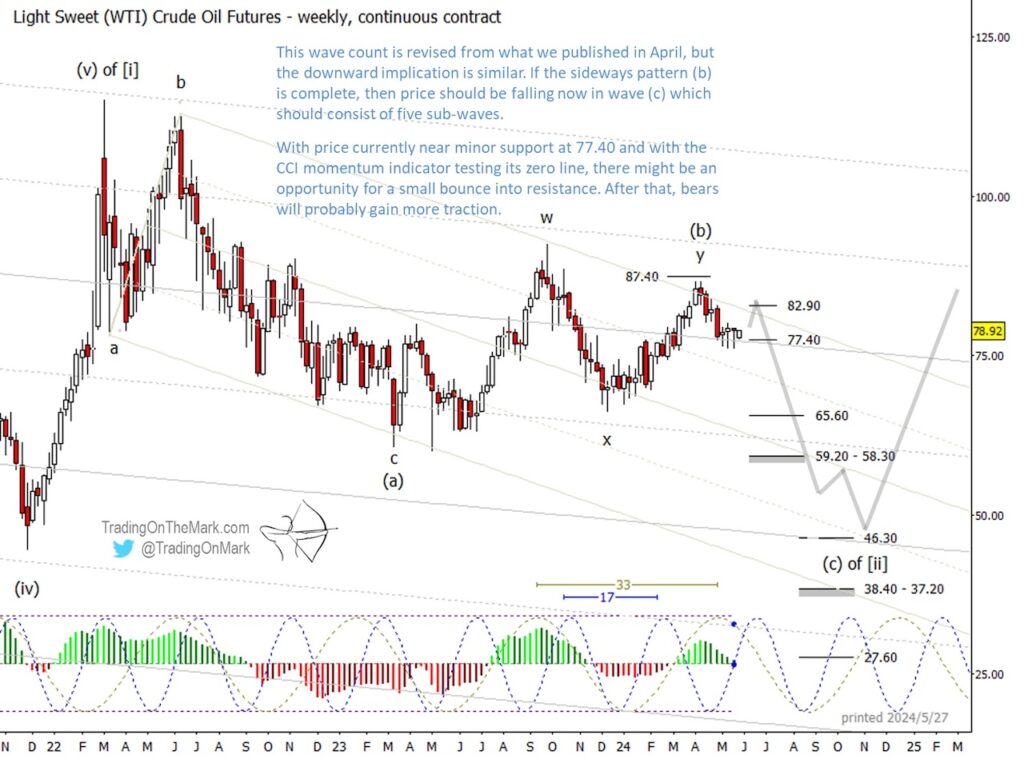

Crude oil futures appear to have begun the next big downward push which could persist into autumn or winter. On a faster time frame though, a minor upward retrace is probably due.

In this update, we show our current crude oil Elliott wave count which is slightly revised from what we posted here in April.

We believe the sideways corrective pattern (b) finished with the April 2024 high, making the more recent decline likely the first segment of downward wave (c).

Let’s discuss the chart below.

Even though we think the larger crude oil Elliott wave trend is now downward, there are several reasons to watch for a minor upward retrace from near the current area. We see geometric support from one of the parallels in a long-term channel, and there’s also Fibonacci-related support near 77.40. In addition we note that the CCI momentum indicator is testing its zero line now, which often coincides with the start of a retracement, and we see that the 17-week cycle should be on an up-swing.

Beyond those factors, the recent minor decline can also be counted as being a possibly complete sub-wave with five segments. This is visible on a daily chart, not shown here but available to subscribers.

The bigger price move probably will come as the middle segment of downward wave (c), and bears will probably fish for entries if price tests either of the resistance areas shown at 82.90 or (less likely) at 87.40.

Eventually we would like to see price test near 46.30 or the zone near 38.40-37.20 to finish wave (c), and a very rough timing projection based on the 17-week price cycle suggests CL might reach the low around December. After that, price should embark on the next big upward push.

Twitter: @TradingOnMark

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

![Key Insights On Consumer Strength, Tariffs, and the AI Revolution [Investor Calendar]](https://www.seeitmarket.com/wp-content/uploads/2025/03/consumer-weakness-218x150.png)

![Key Insights On Consumer Strength, Tariffs, and the AI Revolution [Investor Calendar]](https://www.seeitmarket.com/wp-content/uploads/2025/03/consumer-weakness-100x70.png)