I thought I’d provide a quick update on the credit markets in the aftermath of BREXIT. In particular European financials.

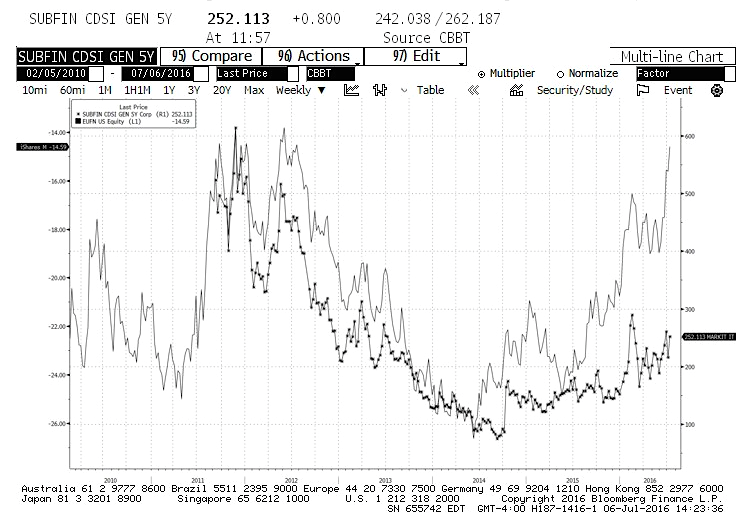

The attached chart below shows the price of an index of credit default swaps (CDS) on subordinated debt of European financials, and the price of the iShares MSCI Europe Financials ETF (NASDAQ:EUFN).

I have inverted the price of the ETF to better show the correlation between the two. The correlation is actually more like causality, because it is nearly impossible for a bank’s stock to decouple from the bank’s credit-worthiness on a sustained basis.

However, right now we are witnessing one of those rare moments. Despite the drumbeat of gloom and doom coming from overseas banks, and the beating those stocks have taken, credit players remain cool, calm, and collected with respect to the risk profile of the lower quality debt of such banks. Perhaps this time the credit markets will “catch down” to equities… but betting on it is without a doubt the low odds play in my opinion.

Thanks for reading.

More from Fil: Coming Credit Crisis? Bond Market Says No

Twitter: @FZucchi

The author is short EUFN July 15 puts at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.