Covestro, a German specialty plastics maker that was spun off from Bayer in October, recently raised $5.56B in debt in part to fund acquisition to boost profitability, according to the CFO in German magazine Euro am Sonntag. According to the report Covestro is seeking to build up and strengthen its coatings, adhesives and specialties business, its smaller segment compared to its polyurethane and polycarbonates segments.

Looking through Covestro’s recent investor presentations it made it clear that it is seeking deals that are high margin, and with defendable competitive advantages.

In its competitive landscape slide one notable company in this industry is Evonik, which recently paid $3.8B for Air Products (APD) Performance Materials Unit, so Covestro is likely looking for a similar deal to respond to its competition.

In looking for potential publicly traded US companies that may fit Covestro’s acquisition appetite, the initial screen is for Specialty and Diversified chemical names in the $300M to $4B market cap range, leaving 18 names. Clearly, Covestro may buy a privately held company, a division of a public company, or a foreign company, but in an attempt to make money off a potential deal, I want to look at US traded companies.

Before I get into my research, I want to be clear that I do not have a current position in names mentioned at the time of this writing, and as well, I have no knowledge of an impending M&A deal. I am simply making an educated guess based on the available information. Speculation.

Of the names, a few immediately stick out from the perspective of seeing unusually active call buying in the past few weeks, these being Olin Corp (OLN), Huntsman (HUN), Platform Specialty (PAH), Chemours (CC), and Kraton (KRA).

Options activity in these names includes:

- Olin (OLN) – On 4/18 and 4/19 the August $20 calls were bought to open 5,000X at $1.05 to $1.15. The August $23 calls saw small buys in early May and then on 5-25 a large buy of 4,500 at $1.30 to $1.35 taking open interest above 8,000. Total call open interest of 33,288 compares to put open interest of 9,143.

- Huntsman (HUN) – Total call open interest at 61,696 compares to put open interest of 18,294. On 5-4 a trader bought 1,875 June $14 calls $1.35/$1.40, on 4/19 the June $15 calls bought 2,500X to open $1.075, and June $16 calls currently with 4,780 in open interest have also seen recent accumulation. On 5-13 a trader opened 2,700 August $13/$11 bull risk reversals, rolling a May $10 call position and on 5-25 the August $16 calls bought to open 1,820X at $0.70 to $0.75.

- Platform Specialty (PAH) – On 2/29 a block of 8,130 August $12.50 calls opened at $0.20, near the bid on a $0.15-$0.55 bid-ask, but unusual. On 5/6 a trader bought 10,000 June $10 calls to open at $0.50, adding to the 5,000 bought to open at $0.85 back on 4-20.

- Kraton (KRA) – Unusual call activity in KRA started on 4-8 with 820 July $17.50 calls bought $2.30 to $2.50 and then on 4/15 another 1,880 bought $3.14/$3.15. The 2,740 July $17.50 calls remain in open interest pricing now at $9.50. On 4/18 and 4/19 KRA also attracted opening buys of 3,000 October $25 calls at $1.25 to $1.40.

Another name on the list, Ferro (FOE), confirmed earlier this month it is seeking strategic options including a potential sale.

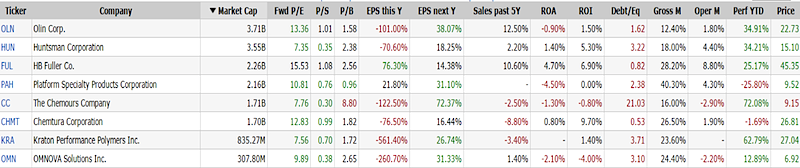

Drilling down this list more to the Coatings/Adhesives market, the list shrinks to, in order of largest to smallest market caps, Olin (OLN), Huntsman (HUN), HB Fuller (FUL), Platform Specialty (PAH), Chemours (CC), Chemtura (CHMT), Kraton (KRA), and OMNOVA Solutions (OMN). A look at these 8 names with relevant metrics are below:

Of the names, from a value for growth angle, and seeing it with the least levered balance sheet, fundamentally, Chemtura (CHMT) makes the most sense as an acquisition target and the $1.7B market cap fits nicely. The issue with CHMT is its large exposure to Petroleum Additives and Urethanes, which does not appear to be the types of end-markets Covestro is targeting.

Platform Specialty (PAH), on the other hand, is an interesting target as a margin leader in the group and with the options activity previously cited. PAH also allows entry into niche end-markets for Performance Solutions, though its Agricultural Solutions business does not seem to fit Covestro’s target, so it is possible PAH could elect to sell the Performance Solutions division. PAH closed a $2.1B acquisition of Alent at the end of 2015. Bill Ackman remains the largest shareholder in PAH, a 20%+ stake. PAH, itself, is a roll-up that seeks acquisitions, so a sale may prove difficult.

HB Fuller (FUL) may be the highest quality company on the list, though its $2.25B market cap would make for a large deal. FUL is trading at a premium valuation, but a name with a strong weekly bull flag on the charts and under recent accumulation. FUL is a leader in Adhesives with diverse market segments and low customer/supplier concentration in growing end markets. In the adhesives market Henkel is the clear leader with a 25% market share, but FUL is 2nd with a 5% share, a highly fragmented market. FUL is undergoing a portfolio shift to higher growth and more profitable segments.

Kraton Polymers (KRA) is the final name I want to look at, which fits the bill for unusual options activity, strong equity price-action with elevated volumes, and is above peer averages for EBITDA margins and EPS/Sales growth while trading at a major discounted valuation. KRA has three product families, Cariflex (13% of revenues) is a rubber/latex product used in surgical gloves, condoms, and medical components, Specialty Polymers (33% of revenues) is in end markets such as Oil gels, medical, lubricant, additives, auto, and personal care, and lastly Performance Products (54% of revenues) in end-markets such as paving, roofing, labels, printing plates and personal care. KRA’s 1,440 patents granted or pending underpins its global differentiated market position, and has a strong global footprint. KRA is also undergoing a series of initiatives to lower costs, expected $70M in annual savings by 2018.

In closing, KRA fits exactly the type of acquisition target Covestro is seeking, and its $835M market cap can easily be digested with the recent capital raised. KRA would likely demand a 35% premium to current market price, so I could envision a deal price around $35/share. If Covestro is seeking a bit larger of a deal, I like HB Fuller (FUL), as a deal would immediately vault it into a leadership position in the adhesives market it is targeting a larger presence.

Disclosure: Author has no current position in names mentioned as of this writing, and also no knowledge of an impending M&A deal, just making an educated guess based on the available information.

Thanks for reading and have a great week.

Twitter: @OptionsHawk

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.