This post was written by Craig Basinger of Richardson GMP.

Last summer something started out rather small, that has been slowly gaining momentum ever since – the return of economic growth. If you can ignore the media, day-to-day focused news reporting, and look into the less exciting economic data in the background, we are seeing broad based improving momentum. This has only briefly occurred during the past decade as economic growth appeared to rotate from one economy to another in fits and starts as you looked around the globe. Everyone bounced back after the recession of 2008/09, but since then there hasn’t been an extended period of synchronized global growth.

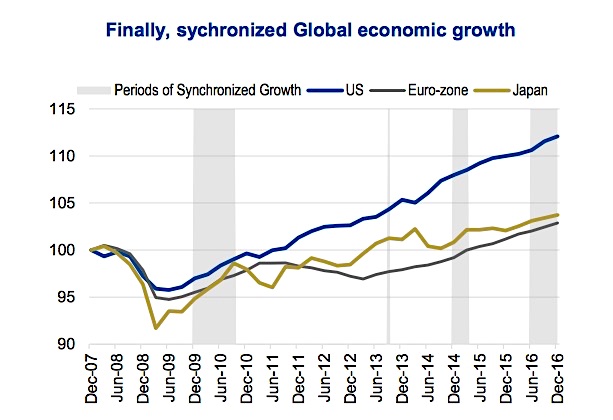

In 2010, Japan faltered and dipped back into negative economic growth, while the U.S. stalled. Japan and the U.S. started to grow again in late 2011 but Europe began shrinking until 2013. Late in 2013 the U.S. stalled and Japan’s economy started to shrink again. The U.S. resumed growing but Japan didn’t until 2016. Sprinkle in developing economies, which are more tied to the price movement of commodities, and it is easy to see why this economic expansion has had such difficulties. The 1st chart below has the GDP of the U.S., Euro- zone and Japan over the past decade. The shaded areas are the only periods that had all three expanding by at least 1% a year. Synchronized global growth…

If you included developing economies as a group into this chart, the 2014 shaded bar would disappear and the current shaded bar would not have started until Q3 of 2016. But make no mistake, we now have improving GDP growth in the U.S., Euro-zone, Japan and developing economies. This momentum does appear to be on the rise as well. One of the problems over the past decade has been when the data began to improve, it was fleeting and would revert back to either negative or very anemic growth. Now, we are seeing the consensus economic forecasts on the rise.

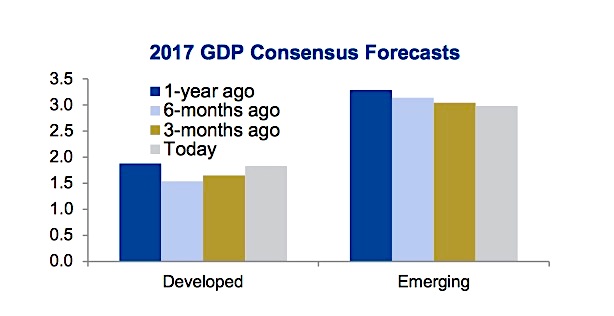

The 2nd chart below is the consensus GDP forecasts for 2017 for Developed and Emerging economies. The chart shows the forecast from a year ago until today. Emerging may be seeing estimates trimmed a little, but keep in mind the group had 2.2% growth in 2016, so they are growing. The Developed economies are seeing forecasts increase.

It’s Not Just America Becoming Great Again

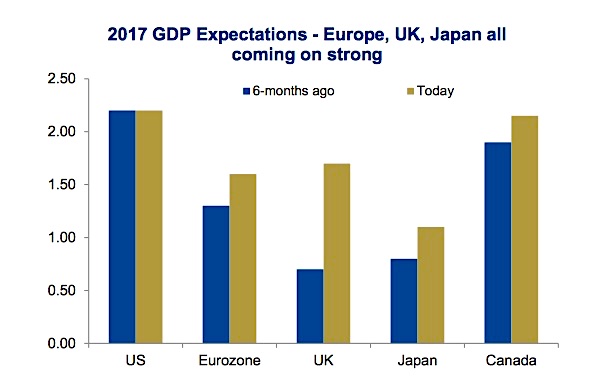

It was only a couple quarters ago when the U.S. was the only bright spot in the global economy. The U.S. still appears to be the driver, but other economies are starting to close the gap. The next chart (below) contrasts 2017 expectations in more detail. We would note big improvements in the UK, and notable increases for Eurozone, Japan and Canada.

As rising growth expectations have spread globally, this has also been one of the reasons the U.S. trade weighted dollar has been under pressure. Better growth in Europe and Japan certainly improve the prospects for the Euro and the Yen. Of course few of our readers, and to a degree even ourselves, don’t care too much about the U.S. trade weighted dollar. For Canadians, the main focus is on the C$ exchange rate. We still prefer U.S. dollar exposure, unhedged, but this preference has become much milder than in years past. In fact we have reduced some of our U.S. dollar exposure in a number of portfolios and increased international (non-U.S.) investments.

Looking Forward

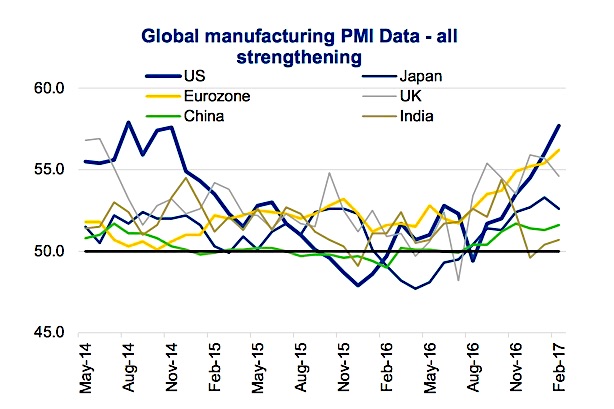

The positive global economic momentum does not appear to be slowing. Some of the more forward looking indicators for global growth are on the rise. This includes copper prices, Baltic freight rates and global purchasing managers indices (PMI). PMI data is very forward looking and has historically been a good predictor of turns in the economy. It is manufacturing focused, which tends to be one of the more volatile components of global GDP. All of the major PMI surveys are above 50, indicating rising manufacturing activity (see chart below).

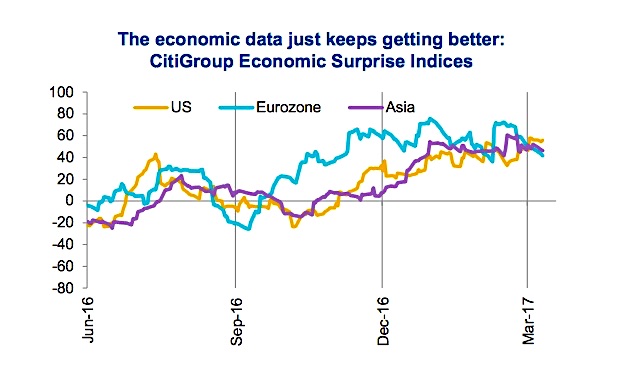

Even with rising growth expectations, the data has been coming in even better. Expectations will catch up with the data at some point, but the periods when the data beats the economists views, tends to be a good period for the markets. Currently, the major economic regions are all enjoying their respective CitiGroup Economic Surprise Indices solidly in positive territory (chart below).

Investment Implications

The relationship between the economy and the markets is not nearly as strong as many believe. So while better global economic growth is positive compared to the contrary, the market impact can be mitigated by a number of factors. First, the market tends to be rather forward looking, often wrong but certainly forward looking. So much of 8% advance in global equities in the past six months may have been predicated on the improving economic data. Then there is the knock- on effects. We have been living and investing in a world with quantitative easing, uber low interest rates and a greater risk of deflation than inflation. If these changes are due to better economic data, much of the investment strategies that have worked for the past ten years may come under pressure.

We do believe this synchronized growth will put upward pressure on yields and continue to tilt our portfolios accordingly. This includes remaining shorter on the duration side, underweighting the more interest rate sensitive sectors in the equity markets and overweighting sectors prone to benefit from greater economic growth and/or higher yields.

Thanks for reading.

Charts are sourced to Bloomberg unless otherwise noted.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.