The following chart and data highlight non-commercial commodity futures trading positions as of February 27, 2017.

This data was released with the March 2 COT Report (Commitment of Traders). Note that these charts also appeared on my blog.

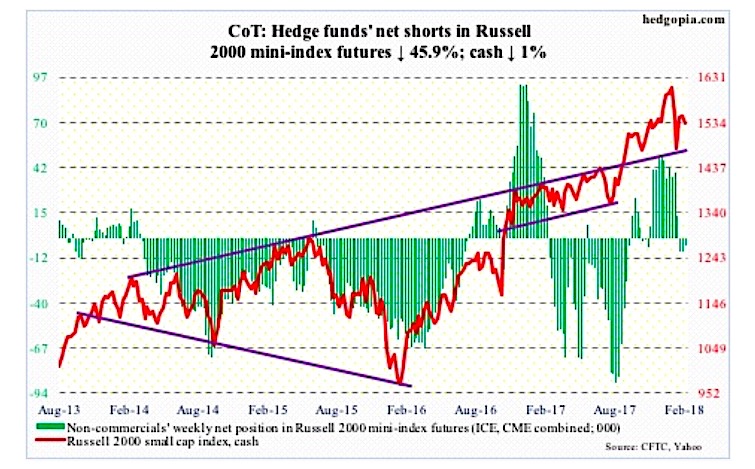

The chart below looks at non-commercial futures trading positions for the Russell 2000 futures. For the week, the Russell 2000 traded lower by -1.0%.

Russell 2000 Futures

March 2 COT Report Spec positioning: Currently net short 4.5k, down 3.8k.

Since losing the 50-day moving average a month ago, the Russell 2000 Index has managed to close above the average just once. That was this past Monday. The 200-day moving average lies beneath. Until either one of these two important moving averages gives way, the Russell 2000 is trapped between them.

Relative to large-caps, small-caps have underperformed for a while now.

In the week to Wednesday, iShares core S&P small-cap ETF (IJR) lost $28 million, while $190 million moved into iShares Russell 2000 ETF (IWM). Although year-to-date, flows remain tentative. Through Wednesday this year, IJR gained $126 million, but IWM lost $2.9 billion (courtesy of ETF.com).

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.