The following is a recap of The COT Report (Commitment Of Traders) released by the CFTC (Commodity Futures Trading Commission) looking at futures positions of non-commercial holdings. This recap and analysis uses February 26 COT report data (as of February 23). Note that the change in COT report data is week-over-week.

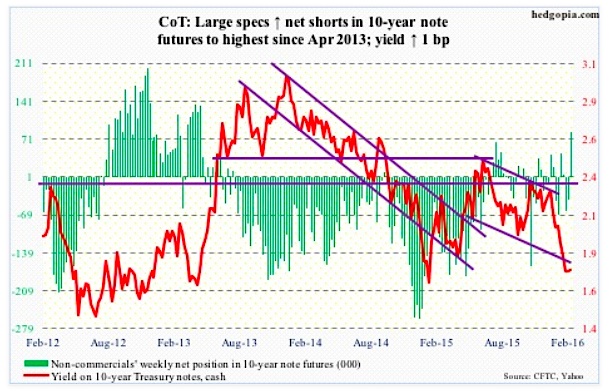

10 Year Treasury Note: Negative interest rates have suddenly become the topic du jour. Last month, Japan waded into negative interest rates policy (NIRP). This was totally unexpected, took the market by surprise.

With this, Japan joins central banks in Denmark, Sweden, Switzerland, and of course the Eurozone. The latter instituted its in June 2014.

Having tried near-zero interest rates as well as quantitative easing before moving onto NIRP, these central banks are tacitly admitting that their previous policies have failed to yield desired results.

What exactly did they want? The goal of course is/was to weaken the currency, ignite inflation, force companies and individuals to get on the risk curve, and consume.

Despite NIRP, the Swiss franc remains relatively strong. In Denmark, however, inflows did stop, enabling that nation to maintain its peg to the euro. The ECB has not had much success in pushing up inflation, but the euro is weaker by nearly 20 percent. Japan just introduced its on January 29th; since then, the Nikkei is lower, the yen substantially higher, and there are reports of cash hoarding. Talk about unintended consequences.

Enter the Fed.

Last week, Janet Yellen, Federal Reserve chair, told Congress that she was not aware of any law that prevented the bank from doing so, but at the same time hedged by saying they have not completely researched whether that would be legal.

Legality aside, when the next downturn hits, Negative Interest Rates Policy (NIRP) is one of the tools the Fed is likely to consider. Its conventional monetary toolbox is empty, and it already tried ZIRP as well as three iterations of QE. After all this, we are still talking stimulus! The ten-year yield has slipped back below two percent.

Sadly, in all likelihood, negative interest rates (i.e. NIRP) is not the panacea that the Federal Reserve, and other major central banks, are pining for.

Stanley Fischer, Federal Reserve vice chair, has a point when he said the other day the Fed is looking at negative interest rates but has no plans to use them.

February 26 COT Report Data: Currently net long 84.7k, up 124.9k.

30 Year Treasury Bond: Major economic releases next week are as follows.

Monday brings us the pending home sales index for January. December was up one-tenth of a percent to 106.8. The cycle high was reached last May at 112.3 – the highest since May 2006. Existing home sales, which track pending home sales, rose 0.4 percent month-over-month in January to a seasonally adjusted annual rate of 5.47 million units. The cycle high of 5.48 million units was reached in July last year – the highest since 5.79 million in February 2007.

February’s ISM manufacturing index is published on Tuesday. The index has been sub-50 the past four months. This is the first time in the current recovery this has happened. The new orders index has been sub-50 three out of last five months, with a rise of 2.3 points to 51.5 in January.

The ISM non-manufacturing index for February comes out on Thursday. Non-manufacturing has been faring much better than manufacturing – relatively speaking. But even here, momentum is in deceleration. The index was 63.4 last July, and was at 53.9 in January. That said, it is still above 50. Ditto with new orders, with January coming in at 56.5; the last time it dipped below 50 was in July 2009.

Thursday also brings revised productivity numbers for the fourth quarter. The preliminary reading showed non-farm output per hour decreased at a three percent annual rate. Annual average productivity increased 0.6 percent from 2014 to 2015. This follows growth of 0.7 percent in 2014, a flat 2013, and growth of 0.9 percent and 0.2 percent in 2012 and 2011, respectively. Very subdued!

January’s advance durable goods report was reported this week. The full report comes out on Thursday. Momentum is completely out of this series. Orders for non-defense capital goods ex-aircraft – proxy for business capital expenditures – fell 2.9 percent year-over-year in January to a seasonally adjusted annual rate of $69 billion. This was the 12th straight y/y decline. Orders peaked at $74 billion in September 2014.

Friday is big. February’s employment report is on tap. With non-farm payroll addition of 151,000, January broke the momentum of 4Q15, which produced an average 279,000. Overall, momentum is decelerating, with an average 228,000 in 2015, down from 251,000 in 2014. That said, trend is improving in wages. Average hourly earnings of private-sector employees have grown north of 2.5 percent annually in three out of the last four months. December’s 2.68 percent was the highest since 2.69 percent in July 2009.

Only one Fed official has a public appearance scheduled during weekdays.

February 26 COT Report Data: Currently net long 23k, up 9.5k.

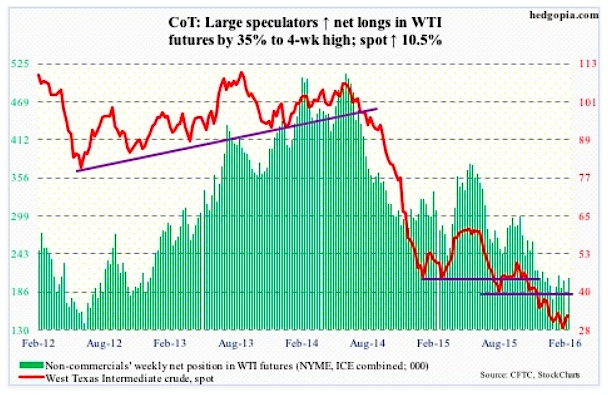

Crude Oil: Well, that did not take long. Iran poured cold water on hopes of a mega deal to cut oil production. Its oil minister apparently said the oil production freeze is “a joke,” because it does not allow that nation to regain its production share lost during the sanctions.

Last week, OPEC bigwig Saudi Arabia along with fellow members Qatar and Venezuela agreed with non-OPEC Russia to freeze output at January levels, which were near record highs. The market is already oversupplied by an estimated one million to two million barrels a day. They need a cut, not a freeze. This week, S. Arabia ruled out oil production cuts.

No wonder, the IEA says “…in the short term there is unlikely to be a significant increase in prices,” adding that the current glut of cheap oil will keep prices low into next year at least.

The IEA also said U.S. shale oil production could fall by 600,000 barrels per day this year and another 200,000 bpd in 2017.

In fact, from the peak, U.S. oil production has already declined by 500,000 bpd. Production reached a record 9.61 mb/d in the June 5th (2015) week. For the week ended February 19th, production fell 33,000 b/d to 9.1 mb/d. For some perspective, production has doubled in the past decade.

Secondly, if the afore-mentioned freeze is implemented and production does come down, helping oil price stabilize, it is very possible that a lot of U.S. shale production that would otherwise shut off survives. How that would impact the glut situation is anyone’s guess.

For the week ended February 19th, U.S. crude oil stocks jumped another 3.5 million barrels, to a new record 507.6 million barrels.

Stocks jumped despite crude imports dropping 117,000 b/d to 7.8 mpd. Imports have dropped by 454,000 b/d in the past four weeks.

Refinery utilization fell one percentage point to 87.3. Utilization peaked at 96.1 percent in the August 7th (2015) week.

Gasoline and distillate stocks had something good to report. Both fell – the former by 2.2 million barrels to 256.5 million barrels (prior week was a record), and the latter by 1.7 million barrels to 160.7 million barrels.

Non-commercials raised net longs by 35 percent. This was the largest week-over-week increase since October 2010. Spot West Texas Intermediate crude rallied nearly 11 percent in the week, and was up 16.7 percent at one time. Friday, it could not hang on to early gains. Once again, resistance at $34-$34.50 came on the way. Daily indicators are now overbought.

February 26 COT Report Data: Currently net long 206.7k, up 53.9k.

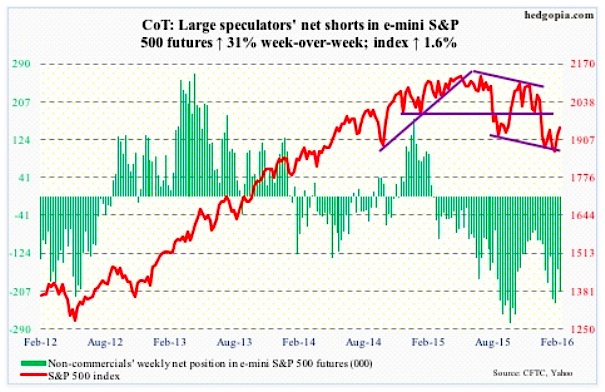

E-mini S&P 500: Does it ever stop? Outflows that is.

In the week ended Wednesday, the S&P 500 was essentially unchanged, with swings both ways. But on Monday, it was repelled at its 50-day moving average, which at the time was just under 1950. Since January 13th, this was the third time the index had tried to take out 1950, and failed.

It is possible this failure led longs to continue to withdraw money. In that week, another $2.8 billion came out of U.S.-based equity funds (courtesy of Lipper). Since the year began, nearly $44 billion has left. This despite the fact that the index is now only down 4.7 percent for the year. At one point, it was down north of 11 percent. Investors/traders are using strength to exit.

Will this behavior change now that the index is past its 50-day moving average and is once again knocking on that 1950 resistance?

At least by Wednesday, SPY, the SPDR S&P 500 ETF, lost nearly $4 billion (courtesy of ETF.com). Recall that that session saw a massive intra-day reversal, with the S&P 500 rallying 2.1 percent from the low. This was followed by a Thursday mini breakout, but Friday saw it going back below 1950.

The path of least resistance near-term is down.

February 26 COT Report Data: Currently net short 208.1k, up 49.3k.

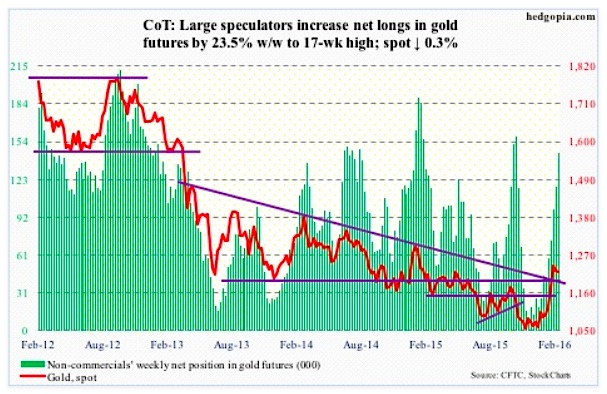

Gold: Less than $5 separate from completing a potentially bullish golden cross.

Money continues to flow into gold ETFs. In the week ended Wednesday, GLD, the SPDR Gold ETF, pulled in another $1.9 billion (courtesy of ETF.com).

That said, gold increasingly is sending out signs of fatigue near- to intermediate-term.

In the past couple of weeks, non-commercials’ net longs have gone up by 47 percent, gold is down 1.3 percent.

Off its December 3rd low ($1045.4) through February 11th high ($1263.9), spot gold prices rallied nearly 21 percent. Since that high, gold has essentially gone sideways.

For the past nine sessions, gold has traded around its 10-day moving average, which is now pointing lower. Daily MACD just completed a bearish crossover. And this week produced a long-legged doji/spinning top, after a hanging man in the prior week.

Gold wants to go lower for now. In the event of a pullback, support lies at $1180, followed by $1140.

February 26 COT Report Data: Currently net long 145k, up 27.6k.

continue reading on the next page…