A sign of stability? Yes. However, for flows to stabilize, stocks need to stabilize. As long as the August 24th low on the S&P 500 is not breached, there is probably minimal risk of a pickup in outflows at this point in time. We could be looking at a different picture if those market lows get taken out.

Between August 27th and September 3rd, American Association of Individual Investors bears dropped 6.6 points to 31.7 percent, while bulls were essentially flat at 32.4 percent. These retail investors obviously expect things to stabilize. Hence the significance of the August 24th low. Similarly, Investors Intelligence bulls dropped to 27.8 percent this week – the lowest since 26.4 percent in March 2009. Back then, the market bulls count remained in the 20s for five straight weeks. In all those five weeks, stock market bears were in the 40s, rising as high as 47.2 percent. This week, bears were 26.8 percent. In a worse-case scenario, there is plenty of room for transition from bulls/neutrals to bears.

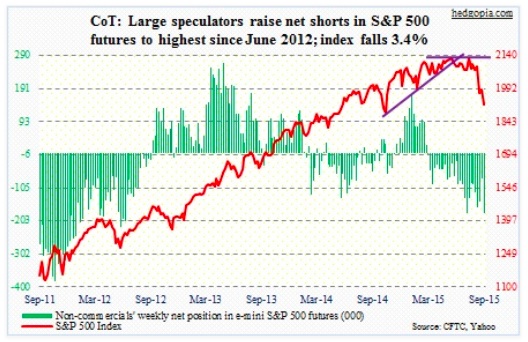

Non-commercials, in fact, expect this – having raised net shorts to the highest since June 2012.

COT Report Data: Currently net short 180.5k, up 104.8k.

Euro: This Thursday was Mario Draghi’s, ECB president, 68th birthday. European markets in particular were handed out a celebratory cake – so to speak. If the need be, there will be more stimulus, Mr. Draghi suggested. European bourses rallied strongly that day.

Both inflation and GDP forecasts for the Eurozone have been revised downward. Inflation forecast went from previous 0.3 percent rise to 0.1 percent rise this year, from 1.5 percent to 1.1 percent next year and from 1.8 percent to 1.7 percent in 2017, while GDP is now forecast to grow 1.4 percent this year, 1.7 percent next year and 1.8 percent in 2017.

The likelihood of the ECB stepping up its current €60 billion/month asset purchases – both size and duration – has risen. Mr. Draghi said asset purchases are intended to run until the end of September 2016, or beyond, if necessary. The ECB also increased the bond purchase limit – from 25 percent to 33 percent – which will increase the outstanding stock of QE-eligible bonds.

So far so good. He has succeeded in talking down the euro, which fell 0.9 percent on Thursday, followed by a 0.2-percent rise on Friday. By the way, Eurozone PMI was 54.3 in August, versus an earlier estimate of 54.1. Nonetheless, Mr. Draghi – and Germany, in particular – are probably not happy with the euro’s direction. Between the March 9th low of 104.62 and the August 24th high of 117.14, it has rallied 12 percent.

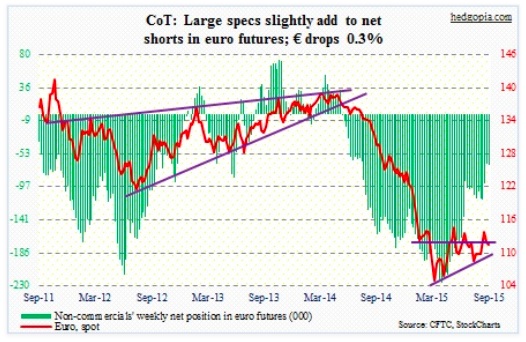

Prior to Mr. Draghi’s dovish comments, non-commercials only slightly added to net shorts, which are substantially below the March highs.

COT Report Data: Currently net short 67.9k, up 1.8k.

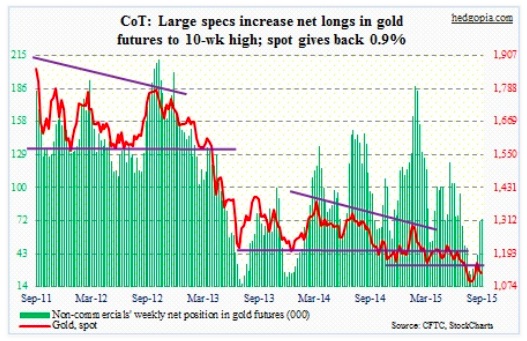

Gold: Gold bugs are probably disheartened by Gold’s inability to rally on Mr. Draghi’s comments. Technically, gold’s path of least resistance was already down in the near-term. Nonetheless, one would think news of more money-printing would help the yellow metal.

Having said that, per COT report data, non-commercials continue to build net longs. They have now added to Gold for five straight weeks.

COT Report Data: Currently net long 72.7k, up 2k.

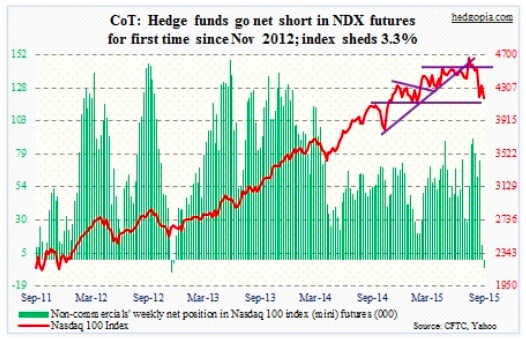

Nasdaq 100 Index (mini): As of July 28th, non-commercials were net long just a tad over 90,000 contracts. Then they started to cut back, with a mere 11,000-plus last week. This week, they have one-upped that. For the first time since November 2012, they are now net short the Nasdaq.

The good thing – if you are a bull – is that on Tuesday buyers stepped up to defend support at 4100. It is a must-hold level. The 50 day moving average is rapidly approaching the 200 day moving average from above. A mere 68 points separate the two. Of the major U.S. stock market indices, it, along with the Nasdaq Composite, is the only one not to have suffered a death cross.

COT Report Data: Currently net short 6.1k, down 17.5k.

Russell 2000 mini-index: Non-commercials are not showing the same aggressive bearish bias on the Russell 2000 as they have on the S&P 500 and the Nasdaq 100. For the week, net shorts were essentially flat. It is possible they decided to stay pat with what they have, as they had already built sizable net shorts, which for the third straight week were in excess of 40,000 contracts. But the fact that they are not adding is beginning to get reflected on the price.