The following is a recap of The COT Report (Commitment Of Traders) released by the CFTC (Commodity Futures Trading Commission) looking at futures positions of non-commercial holdings as of December 1, 2015. Note that the change in the December 1 COT report data is week-over-week.

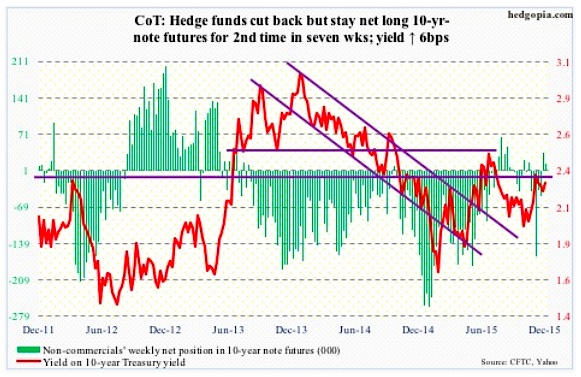

10-Year Treasury Note: Will it or won’t it? Will the Federal Reserve switch into a tightening mode in the face of U.S. manufacturing nearing contraction?

In November, the ISM manufacturing index dropped below 50, to 48.6 – the first sub-50 reading in three years. And for the first time since May 2013 the orders component dipped below 50.

Still, the answer to the question above is a probable ‘yes’. Janet Yellen, Federal Reserve chair, this week signaled – once again – that an interest rate hike is near. To quote her from a speech she gave on Wednesday:

“Were the FOMC to delay the start of policy normalization for too long, we would likely end up having to tighten policy relatively abruptly to keep the economy from significantly overshooting both of our goals. Such an abrupt tightening would risk disrupting financial markets and perhaps even inadvertently push the economy into recession. Moreover, holding the federal funds rate at its current level for too long could also encourage excessive risk-taking and thus undermine financial stability.”

“Excessive risk-taking” jumps out in the paragraph above. If Ms. Yellen and her team have decided to focus on that phrase, then this marks a sea change. The Ben Bernanke-led Fed urged/convinced investors to get on the risk curve, and the latter obliged. There are signs of excesses in a whole host of asset classes. Unwinding those would not come without cost. So not sure Ms. Yellen meant to drive that point home.

That said, she succeeded in convincing the markets that an interest rate hike in the middle of the month is all but certain, which was further buttressed by November’s jobs report. The two-year treasury yield rose as high as 0.96 percent. For a change, the 10-year treasury yield rose as well, to 2.28 percent, with the spread between the two at 132 basis points, up eight basis points from just a couple of days ago.

COT Report Data: Currently net long 15.5k, down 19.6k

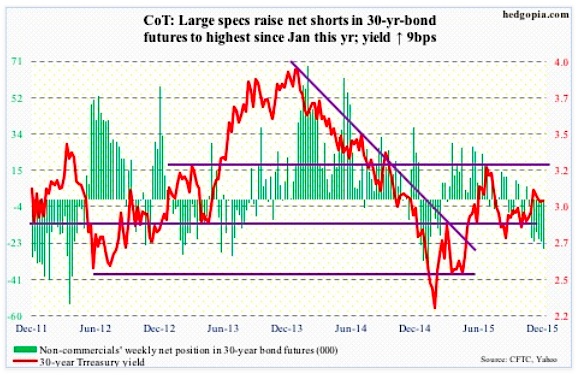

30-Year Treasury Bond: This week’s major economic releases are as follows.

At $3.5 trillion, consumer credit continues to chug along. In September, it was up 7.1 percent annually – the fastest pace since November 2011. Of note, student loans have reached $1.3 trillion, and auto loans $1 trillion. October’s numbers will be published on Monday.

The National Federation of Independent Business optimism index for November comes out on Tuesday. October was unchanged at 96.1, down from 100.4 in December. The latter was the highest since October 2006.

Also on Tuesday, October’s JOLTS is published. In September, job openings rose 149,000, to 5.5 million. Openings peaked at 5.7 million in July. Non-farm payroll averaged an addition of 255,000 in October and November, versus 149,000 in August and September.

Friday’s releases include producer prices and retail sales for November, and the University of Michigan’s preliminary reading of consumer sentiment for December.

The producer price index decreased 0.4 percent in October month-over-month, and core PPI fell 0.3 percent. Prices fell 1.6 percent from a year earlier – the 10th consecutive year-over-year decline. Core prices were up 0.4 percent from a year ago.

Retail sales were only up 0.05 percent in October month-over-month. The year-over-year increase of 1.7 percent was the lowest in six months, and growth has been decelerating since 4.8 percent in April last year.

Consumer sentiment rose 1.3 points in November, to 91.3, and has been decelerating since 98.1 in January this year. That was a 11-year high.

Only one Fed official is on schedule to speak on weekdays.

COT Report Data: Currently net short 25.5k, up 3.6k.

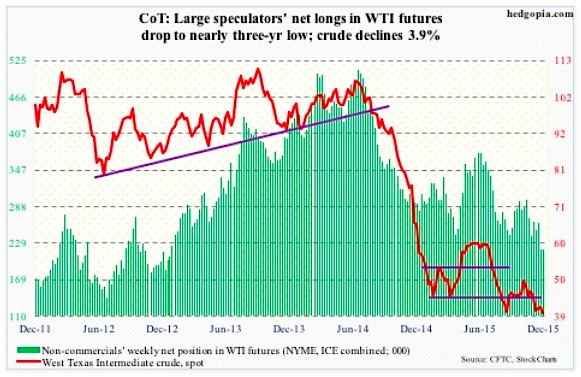

Crude Oil: The EIA data for the week ended November 27th was predominantly negative.

Crude oil stocks rose 1.2 million barrels, to 489.4 million barrels. This was the 10th straight weekly increase, with stocks at the highest since the April 24th week.

Gasoline stocks rose by 135,000 barrels, to 216.9 million barrels – a five-week high.

Distillate stocks rose 3.1 million barrels, to 144.4 million barrels – a six-week high.

Crude production rose by 37,000 barrels a day, to 9.2 million barrels a day – a 13-week high. Oil production peaked at 9.61 mbpd in the June 5th week.

Crude oil imports rose by 414,000 barrels a day, to 7.7 million barrels a day – a 13-week high.

The only positive was refinery utilization, which continued to rise – now at 94.5 percent. It has now risen for seven straight weeks, from 86 percent in the October 9th week. Utilization peaked at 96.1 percent in the August 7th week.

Until Thursday, spot WTI crude oil was down for the week. Then came the rumor that Saudi Arabia next year plans to propose a deal to balance the market with non-OPEC help, leading the spot to rally 2.9 percent in that session. Come Friday, OPEC agrees to roll over its policy of maintaining crude oil production in order to retain market share.

Business as usual. Saudi Arabia wants to drive out high-cost producers, and it is sticking with the status quo.

Crude oil price now sit on the August lows, and have room to head lower on a weekly chart. It dropped 3.9 percent in the week.

Per COT report data, non-commercials were right to reduce net longs, which are at a three-year low.

COT Report Data: Currently net long 217.8k, down 981.

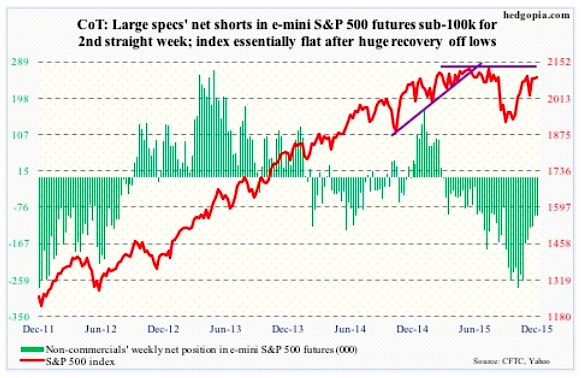

E-mini S&P 500: It is not the economy, it is the flows, stupid.

Since September 30th, inflows into U.S.-based equity funds have only totaled $10.8 billion. For the week ended Wednesday, $920 million exited these funds (courtesy of Lipper).

Off the September 29th stock market low through the intra-day high in early November, the S&P 500 index rallied 13 percent. Well and good, but that is yet to attract a lot of money.

Foreigners have been shunning U.S. stocks for a while anyway. In September, the 12-month rolling total of net foreign purchases of U.S. equities was minus $95 billion. The last time this metric was positive was in October 2013.

From bulls’ perspective, some good news came out of NYSE margin debt in October. It rose $18 billion, to $471.9 billion – first month-over-month rise in four months. Margin debt peaked in April at $507.2 billion.

The October rise in margin debt probably went a long way in the eight-percent rise in the S&P 500 in the month. But as elevated as margin debt is, it is hard to keep up the momentum in stocks. And that is a problem for the stock market – flows not cooperating, foreigners avoiding, and margin debt elevated.

That said, bulls did put their foot down on Friday.

Non-commercials continue to cut back net shorts – now sub-100,000 contracts for two weeks – and that has helped stocks (per the COT report).

COT Report Data: Currently net short 96.4k, down 1.7k.

continue reading on the next page…