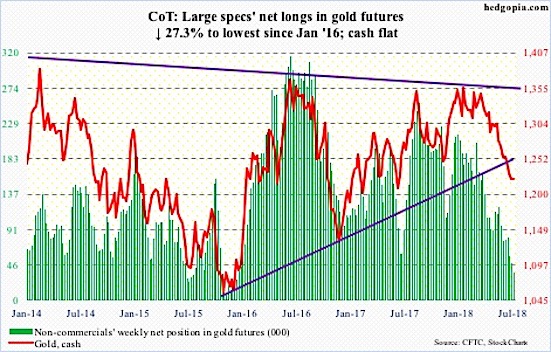

The chart and data that follow highlight non-commercial commodity futures trading positions as of July 31, 2018.

This data was released with the August 3, 2018 COT Report (Commitment of Traders). Note that this chart also appeared on my blog.

The chart below looks at non-commercial futures trading positions for Gold futures. For the week, the GOLD spot price finished even, while the GOLD ETF (NYSEARCA: GLD) closed down -0.7%.

Here’s a look at GOLD futures speculative positioning. Scroll further down for commentary and analysis.

Gold futures are trying to firm up around 1210-1220, but a technical breakdown / buyers strike has bulls on the ropes.

Let’s look at the COT data and technical to see what’s next…

Gold: Currently net long 35.3k, down 13.3k.

Gold futures prices dipped down as low as 1210.70 on July 19 and now stands at 1223.20. Not much movement. The trend has been lower since mid-April.

Buyer strike? Seems gold bugs are simply waiting to see if overhead resistance or lower support gets taken out first. Note, though, that the trend line from 2015 has been taken out.

The week ending on Wednesday saw the GOLD ETF $GLD bleed $127 million (courtesy of ETF.com).

Looking at the Commitment of Traders (COT) data, non-commercials continue to reduce net longs. Even so, the Gold spot price managed to finish flat.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.