Else, the green line in chart 3 above will have some catching up to do.

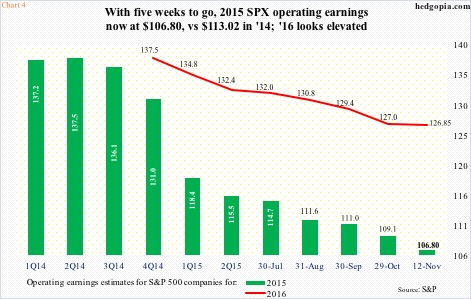

This is particularly so considering 2016 consensus operating earnings estimates for S&P 500 companies look elevated. Estimates have come down from $137.50 at the end of last year to $126.85 (as of November 12th), but they are expected to grow nearly 19 percent over 2015.

For reference, at the end of the second quarter last year, 2015 operating earnings estimates were $137.50 – expected to grow north of 21 percent over 2014’s $113.02. Once it was realized that they would not be met, out came the knives. Estimates have been chopped down by more than 22 percent.

That is the risk for next year. Lots of things have to go right for 2016 estimates to be met. The green line in chart 3 has a lot riding on the red line in chart 4.

Thanks for reading!

Twitter: @hedgopia

Read more from Paban on his blog.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.