The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- S&P 500 EPS growth for Q2 is set to come in at 4.2%, the lowest level since Q4 2020, and lower than expected at the start of the season

- Mostly disappointing results from banks push expected growth lower

- The LERI points to more companies showing signs of uncertainty heading into Q2 reports

- Earnings to watch this week: NFLX, TWTR, TSLA

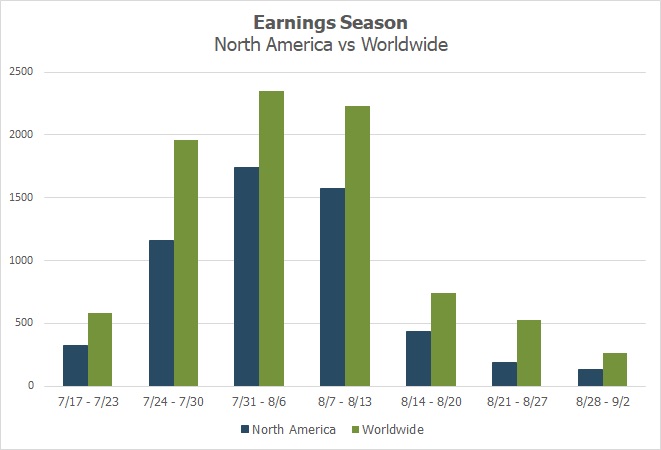

- Peak weeks for Q2 season from July 25 – August 12

Big Banks Have Spoken

After getting off to a rough start with poor results from JPMorgan, Morgan Stanley and Wells Fargo, results from Citigroup on Friday and Goldman Sachs on Monday morning showed strong equity and bond trading helped offset poor investment banking revenues and higher costs. Those strong results weren’t enough to help the sector at this point, or the overall S&P 500.

Disappointing bank results further solidified the Financials sector as the biggest laggard of the season, with expected EPS growth falling to -25.2% (from -23.9% on July 8) and revenue growth of 2.0% (from 2.3% on July 8). Blended profit growth for the S&P 500 also took a dip, falling slightly to 4.2% from 4.3% the week prior. (Data from FactSet).

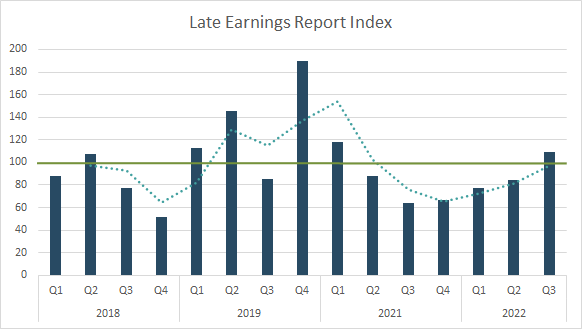

LERI Continues to Show More Companies Delaying Earnings Dates vs. Last 5 Quarters

We’ve been diligently tracking “corporate body language” for the last 15+ years, that is the non-verbal cues that publicly traded companies send to the market both intentionally and unintentionally. One tell a company can give regarding their financial health is the timing of their earnings release. Academic research shows when a corporation reports earnings later in the quarter than they have historically, it typically signals bad news to come on the conference call, and the reverse is true, an early earnings date suggests good news will be shared. The idea is that you’d prefer to delay bad news, but when you have good news you want to run out and share it.

The LERI (Late Earnings Report Index) encapsulates this sentiment. It looks at the number of outlier earnings date confirmations and whether companies are confirming earnings dates that are later than they have historically reported, or earlier. A LERI reading over 100 indicates more companies are delaying reports, and is meant to be watched carefully. Thus far we see a LERI of 109 for the Q2 season, just lower than the 5-year average of 111, but notably higher than the last 5-quarter average of 77, suggesting the good times corporations enjoyed in the post-COVID bull market are slowly starting to fade. In terms of raw numbers, 34 companies have confirmed earlier Q2 earnings dates, while 41 have confirmed later than normal earnings dates.

Source: Wall Street Horizon

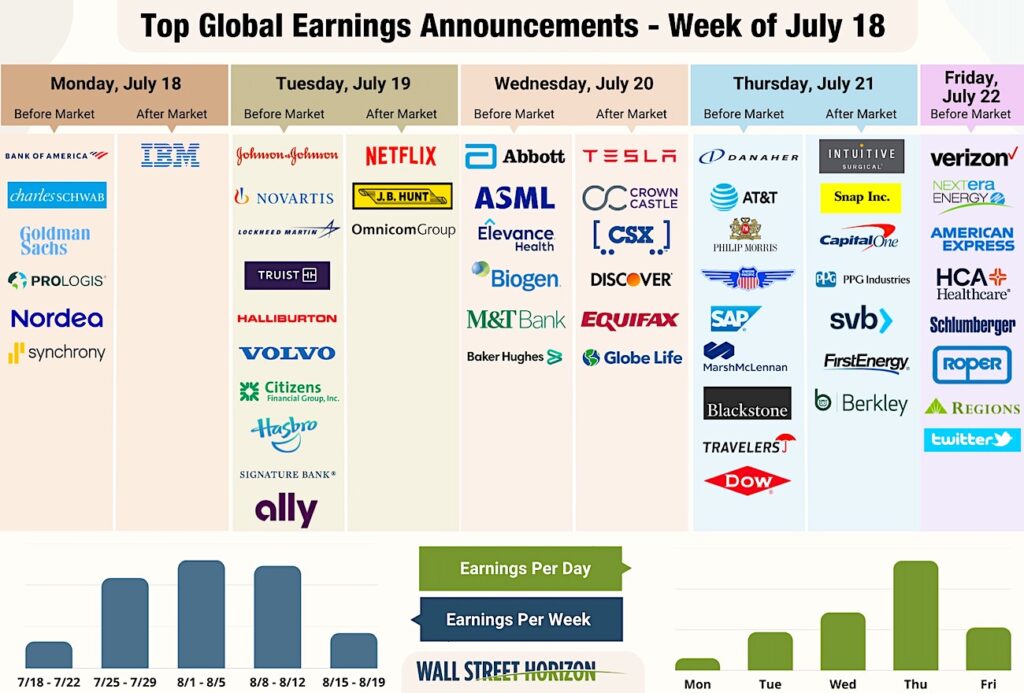

Not Quite Peak Earnings Season

Peak earnings doesn’t kick in until next week, but we can still look forward to a packed calendar this week. We’ll get highly anticipated results from the likes of Netflix, Tesla and Twitter, hot off the heels of their layoff announcements. Several Health Care names report this week as well, including Johnson & Johnson, Novartis and Biogen.

Source: Wall Street Horizon

Earnings Wave

This season peak weeks will fall between July 25 – August 12, with August 4 predicted to be the most active day with 1,079 companies anticipated to report. Roughly 50% of companies have confirmed at this point (out of our universe of 10,000 global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.