The Risk (continued)

If only 25% of the BBB-rated bonds were downgraded to junk, the size of the junk sector would increase by $650 billion or by over 50%.

Here are some questions to ponder in the event downgrades on a considerable scale occur to BBB-rated corporate bonds:

- Are there enough buyers of junk debt to absorb the bonds sold by investment-grade investors?

- If a recession causes BBB to BB downgrades, as is typical, will junk investors retain their current holdings, let alone buy the new debt that has entered their investment arena?

- Will retail investors that are holding the popular junk ETFs (HYG and JNK) and not expecting large losses from a fixed income investment, continue to hold these ETFs?

- Will forced selling from ETF’s, funds, and other investment grade holders result in a market that essentially temporarily shuts down similar to the sub-prime market in 2008?

I pose those questions to help you appreciate the potential for a liquidity issue, even a bond market crisis, if enough BBB paper is downgraded.

If such an event were to occur, we have no doubt someone would eventually buy the newly rated junk paper.

What concerns us is, at what price will buyers step up?

Implied Risk

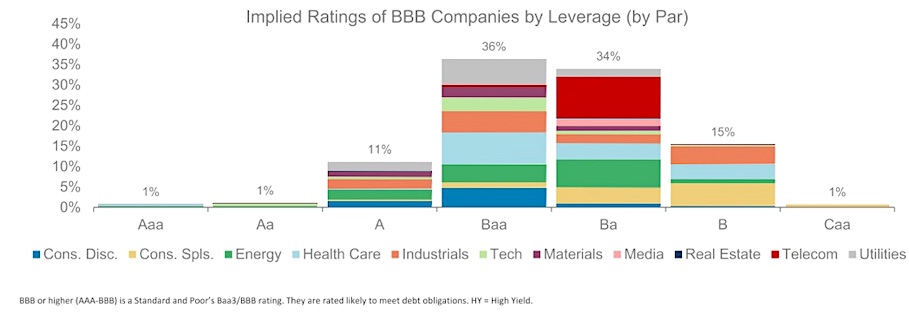

Given that downgrades are a real and present danger and there is real potential for a massive imbalance between the number of buyers and sellers of junk debt, we need to consider how close we may be to such an event. To provide perspective, we present a graph courtesy of Jeff Gundlach of DoubleLine.

The graph shows the implied ratings of all BBB companies based solely on the amount of leverage employed on their respective balance sheets. Bear in mind, the rating agencies use several metrics and not just leverage. The graph shows that 50% of BBB companies, based solely on leverage, are at levels typically associated with lower rated companies.

If 50% of BBB-rated bonds were to get downgraded, it would entail a shift of $1.30 trillion bonds to junk status. To put that into perspective, the entire junk market today is less than $1.25 trillion, and the subprime mortgage market that caused so many problems in 2008 peaked at $1.30 trillion. Keep in mind, the subprime mortgage crisis and the ensuing financial crisis was sparked by investor concerns about defaults and resulting losses.

As mentioned, if only a quarter or even less of this amount were downgraded we would still harbor grave concerns for corporate bond prices, as the supply could not easily be absorbed by traditional buyers of junk.

Final Thoughts

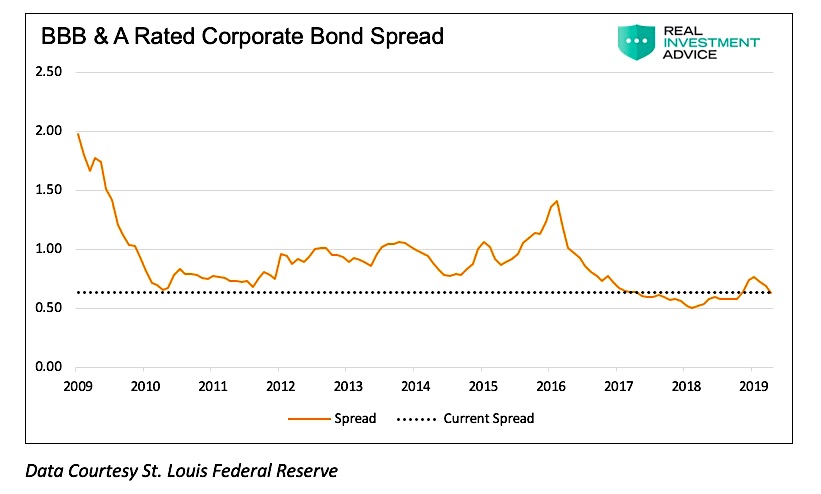

I think investors should stay ahead of what might be a large event in the corporate bond market. I think corporate bond investors should focus on A-rated or solid BBB’s that are less likely to be downgraded. If investment grade investors are forced to sell, they will need to find replacement bonds which should help the performance of better rated corporate paper. What makes this recommendation particularly easy is the fact that the current yield spread between BBB and A-rated bonds are so tight. The opportunity cost of being wrong is minimal. At the same time, the benefits of avoiding major losses are large.

With the current spread between BBB and A-rated corporate bonds near the tightest level since the Financial Crisis, the yield “give up” for moving up in credit to A or AA-rated bonds is a low price to pay given the risks. Simply, the market is begging you not to be a BBB hero.

Summary

The most important yet often overlooked aspect of investing is properly recognizing and quantifying the risk and reward of an investment. At times such as today, the imbalance between risk and reward is daunting, and the risks and/or opportunities beg for action to be taken.

I believe investors are being presented with a window to sidestep risk while giving up little to do so. If a great number of BBB-rated corporate bonds are downgraded, it is highly likely the prices of junk debt will plummet as supply will initially dwarf demand.

It is in these types of events, as we saw in the sub-prime mortgage market ten years ago, that investors who wisely step aside can both protect themselves against losses and set themselves up to invest in generational value opportunities.

While the topic for another article, a large reason for the increase in corporate debt is companies’ willingness to increase leverage to buy back stock and pay larger dividends. Investors desperate for “safer but higher yielding” assets are more than willing to fund them. Just as the French were guilty of a false confidence in their Maginot Line to prevent a German invasion, current investors gain little at great expense by owning BBB-rated corporate bonds.

The punchline that will be sprung upon these investors is that the increase of debt, in many cases, was not widely used for productive measures which could have strengthened future earnings making the debt easier to pay off. Instead, the debt has weakened a great number of companies.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.