The spread of the coronavirus in central China has added a new risk for the markets and the global economy.

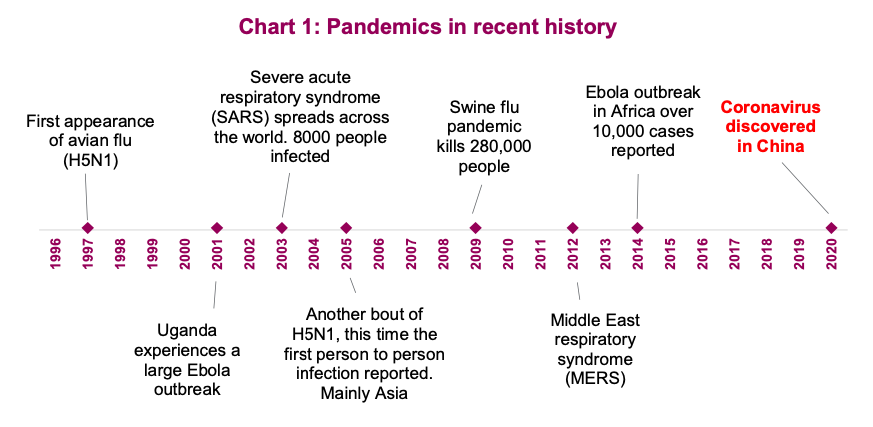

Memories of SARS, avian flu and the Ebola outbreaks are being rekindled and global stock markets are reacting.

At the moment, the World Health Organization (WHO) is not calling this a global health emergency as the cases of infection remain primarily localized. It is believed the coronavirus started a month ago in a seafood and wildlife market in Wuhan, spreading from infected animals to humans. As of January 27, there are 2,744 confirmed cases in China and there have been 80 deaths.

China has reacted by restricting travel for some 11 million people, shortly thereafter increased to 40 million—a prudent move given the Lunar new year holiday period, which sees a high level of travel throughout China. They have also now extended the holiday to delay the return of those who have already traveled.

Still, there have been a few cases of those infected with coronavirus traveling to various countries including Japan, Thailand, Singapore, U.S. and Canada. China has also reported coronavirus cases in 32 of its 34 provinces.

At the moment, the deaths have been largely the result of the virus in combination with other health issues in the victims. And human-to-human contagion has been limited to those with close contact with infected patients.

However, we are now learning the virus can be contagious during the incubation period which can last from 1 to 14 days. This is different than SARS and makes detention potentially more challenging. The WHO continues to monitor the situation along with other health agencies and the situation could escalate or dissipate. This is the unknown.

In the past, the WHO has come under fire for sounding the alarm too early (the flu pandemic of 2009, for instance, which dissipated quickly) or too late (Ebola in Africa). It does highlight a risk to our society, which travels more than ever before.

This virus is in the same family as SARS. One good news aspect is China is being much more transparent and is taking action rather quickly, compared to the SARS outbreak in 2003. Our society may travel more than ever, but we also learn quickly from past mistakes.

Market lessons from past pandemic scares

We are neither doctors, nor have we ever played doctors on TV, so we will not attempt to predict the future path of this health issue. However, we know the history of markets and investor psychology, which can provide some context on how the market and economy may react—some of which has already become clear.

The key factors will be whether it spreads materially to other regions and, if so, how quickly, how contagious it is and what the mortality rate will be. This remains very uncertain and will largely drive investor reactions. We’d like to caution relying too much on models published in the media that outline the potential spread of the disease. Historically, such as during the SARS episode, most proved overly alarming.

Economy

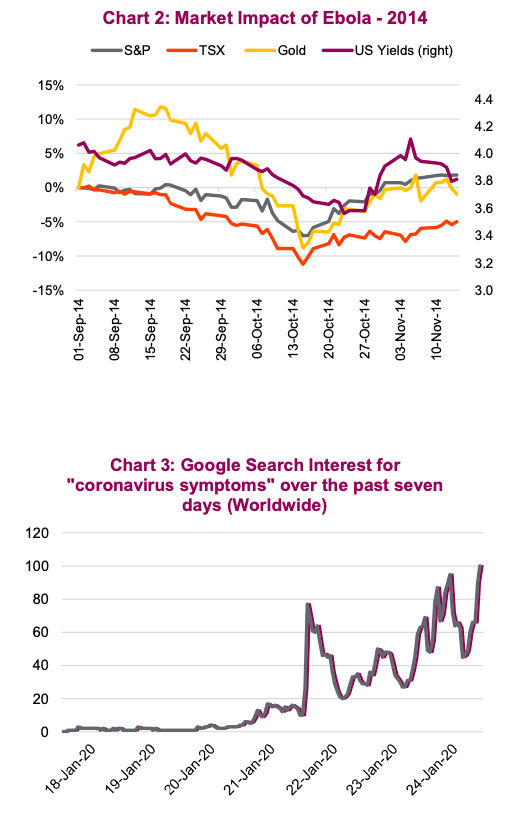

Looking at past pandemics, the economic hit to the global economy is typically limited. SARS, for example, is estimated to have created a drag of 0.15% on global GDP. That being said, there were exceptions if you go back further in time. The major flu outbreaks (1918, 1957, 1968) did have a global economic impact and contributed in most cases to the start to subsequent recessions. More recently, the economic impact tends to be primarily in the region where the health issue started (SARS, Ebola). Despite ebola being largely confined within Africa, Chart 2 shows that it was a market-moving event.

Fear response

The bigger impact of past health issues has been the sudden change in people’s behavior. For instance, the SARS mortalities in Hong Kong were not materially different than a normal flu season, yet the local economy got crushed as retail sales plummeted. People in the region, and elsewhere, attempted to avoid public places (one more advantage for Amazon).

There are often misplaced reactions as well. Tamiflu, the antiviral medication, was ordered en masse after SARS and even stock piled, with limited evidence it would have helped. Similarly, sales of Cipro, the prescription antibiotic medication, rose amid the anthrax mailings scare in the U.S. Unknowns and uncertainties, combined with human nature and the need to react or do something, can lead to mistakes. It also leads to an information vacuum, which can cause anxiety levels to skyrocket. This is the information age, with teraflops of information at our fingertips. We’re hungry for answers as evident by global search interest for “coronavirus symptoms” rising 1,050% last week. (Chart 3)

Market response

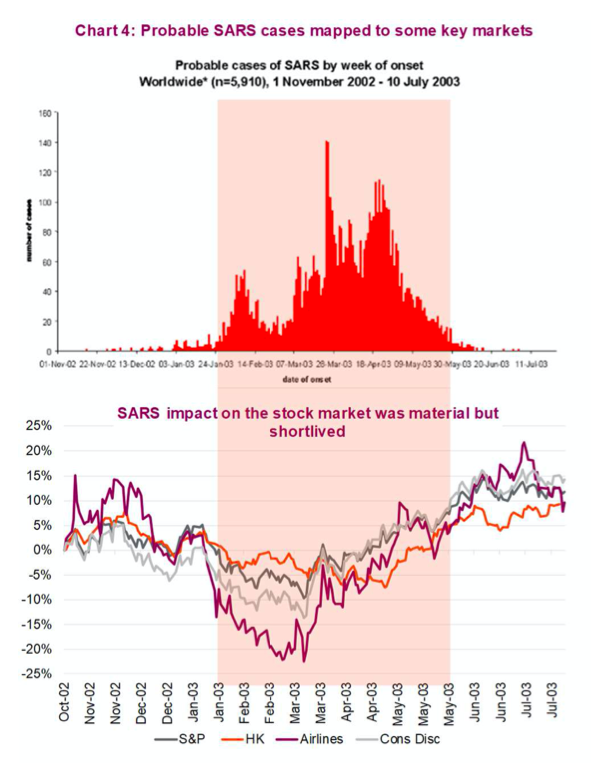

Trying to ascertain the market impact of past health scares or pandemics is difficult. As humans, many of us want to draw a direct cause and effect between events and the markets. But it is rarely that simple. For instance, the market’s reaction during SARS was also near the market bottom at the end of a 3- year bear market. Volatility was already elevated and markets had already started to slide before the number of SARS cases ramped up. Perhaps it created a great buying opportunity or did it just coincide with the start of a bull market? Given we are 11 years into a bull market, we would argue today is different already. So with limited conviction, here goes.

Market impacts tend to be short-term in nature, and highly speculative (Chart 4 on next page). A lot depends on daily new cases and the global spread of the virus. Airlines are at risk if people dial back on travel. This was the case in 2003 with SARS. This past week, travel on Air Canada has fallen by over 8%, and the S&P 500 Airlines sub-industry index has fallen by nearly 4%. Other travel-sensitive sectors such as lodging and cruises, typically come under pressure.

Testing and diagnostic companies that can test for the virus may see increased demand. But history has shown that while pandemics can create a significant opportunity for specific companies, they tend to be short lived. While surgical face-mask shortages in China might be good news for global manufacturing group 3M, it’s hardly enough to move the needle in its $32 billion annual sales.

Retail stocks were negatively impacted during SARS, in particular luxury sales. When people travel, they like to shop, especially in European destinations such as Paris. Non-resident spending amounts to around half of European luxury sales. LVMH is the largest luxury brand in the world and fell by 6% last week, solely on investor sentiment. Another important thing to consider is the large amount of direct Chinese exposure to these luxury brands that did not exist back in 2003.

Bond yields have already started to fall globally, attempting to price in this new risk. And this is yet another reason to add to gold exposure. Crude prices are off by more than 10% in the past week (January 20-27), yet fell by over 30% in less than two months during SARS. Don’t forget, it was during a period near the end of a bear market so eco data wasn’t supportive either.

So now, in the virus’s midst, is that elusive buying opportunity that many have been waiting many months for materialized? Well, North American markets are still pretty close to all-time highs. Based on the futures ahead of the market open on the 27th, the S&P is down 2.5% from its high set five days ago. Not enough of a move yet. Chinese shares fell over 4% last week and select sectors have taken a hit. Their markets are now closed for the holiday.

In our view, the lower prices do not warrant a broad opportunity at this point. This can change if the WHO raises the warning to a global level and/or we see a bigger drop in prices. If prior instances are any guide (always a big ‘if’), this is likely just a short-term problem; a distraction if you will from the key fundamentals that drive value. U.S. markets have shown a tremendous amount of resilience in recent months. Earnings season is upon us, and while a quarterly earnings release does not generate as many ‘clicks,’ it can have more of a lasting impact on the value of a stock.

No action recommended at this time (unless you need another reason to add some gold exposure). If a bigger sell off develops, we may change our tune and believe it would likely be a buying opportunity.

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP unless otherwise stated.

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP unless otherwise stated.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.