March corn futures traded down to a day low of $4.92 ½ on Monday, a 49-cents per bushel break in just 7-trading sessions versus the current contract high of $5.41 ½ established on January 13.

The sell-off in corn was primarily attributed to Money Managers liquidating a percentage of their near-record corn length (last estimated at +349,495 contracts as of the market closes on 1/19/21).

However by market close on Monday afternoon March corn futures had recovered closing up 11-cents per bushel, finishing at $5.11 ½. On Tuesday that uptrend continued with March corn accelerating back up over $5.30 per bushel, closing at $5.32 ¼.

What can we learn from both the short-term downward correction in March corn futures followed by the immediate sharp reversal back higher?

Key technical support in March corn futures appears to be positioned at the 20-Day Moving Average followed by the 38.2% Fibonacci retracement at $4.92 ½ (which proved to be the exact stopping point for the sell-off in CH21). Recent Managed Money selling (down -25,219 contracts versus 1/12/21) also helped cure “overbought” RSI indicators with the Relative Strength Index falling back under 70.0.

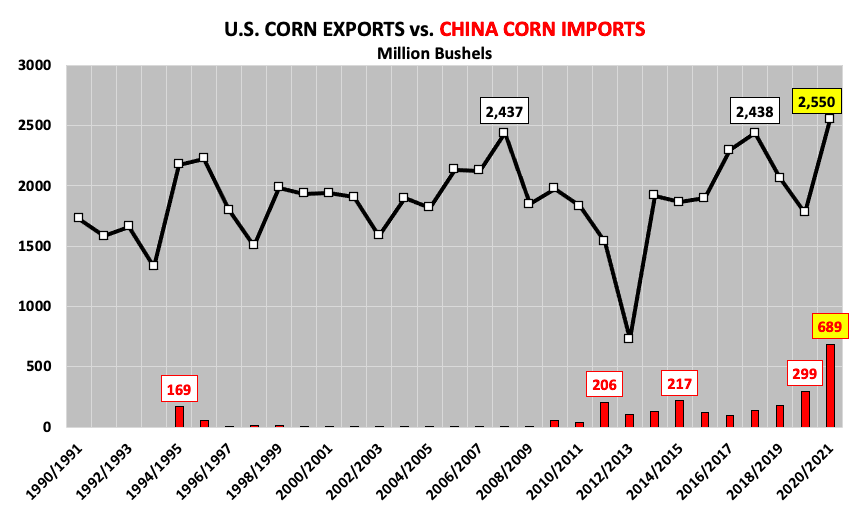

Secondarily, if the U.S. corn export market remains healthy, price breaks in corn will likely continue to be bought versus key support levels. Monday’s weekly export inspections report showed U.S. corn shipments of 54.8 million bushels for the week ending 1/21/2021. Year-to-date corn inspections are now up 84% versus a year ago. Then on Tuesday the USDA announced U.S. corn sales of 53.5 million bushels to China for the 2020/21 marketing year.

Ultimately, Money Managers will remain interested in owning corn futures even at elevated price levels as long as they perceive China actually intends to receive physical shipment of the U.S. corn they’ve already committed to “on paper.”. China’s history of canceling U.S. corn purchases is well documented.

That said, if physical corn shipments to China continue, several private analysts still believe the USDA is underestimating U.S. corn exports for the 2020/21 marketing year by as much as 250 million bushels. In the January 2021 WASDE report the USDA surprised many by lowering U.S. corn exports 100 million bushels to 2.550 billion bushels. It felt unjustified at the time and even more so now. Therefore given the recent surge in corn shipments coupled with “fresh” U.S. corn sales to China, the USDA will likely be forced to reconsider their rational for the export reduction in their upcoming February 2021 WASDE report.

What’s the potential long-term impact on the U.S. corn “new-crop” balance sheet for 2021/22?

The math is pretty simple, if the USDA increases corn exports it will likely lower 2020/21 U.S. corn ending stocks, which have already fallen to a 7-year low of 1.552 billion bushels (10.6% stocks-to-use ratio). That decrease in effect lowers 2022/21 U.S. corn carryin stocks, which invariably puts an even greater emphasis on U.S. corn acreage expanding to 93 to 94 million acres this spring acres versus the 90.8 million acres planted in 2020/21. It also places a premium on the 2021/22 U.S. corn yield approaching “trendline,” which many are already now defining as 180.5 bpa, which would be record high.

For this reason I fully expect price breaks of 45 to 50-cents per bushel in Mar/May corn futures to be bought until there is more clarity on the aforementioned U.S. corn sales to China, as well as, the 2021 corn versus soybeans acreage mix. Looking specifically at new-crop December 2021 corn futures, if November 2021 soybeans futures gravitate back toward $12.00 per bushel, that supports $4.60 CZ21 applying a 2.60 soybeans (SX21) / corn (CZ21) price ratio.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.