CORN WASDE REPORT HIGHLIGHTS:

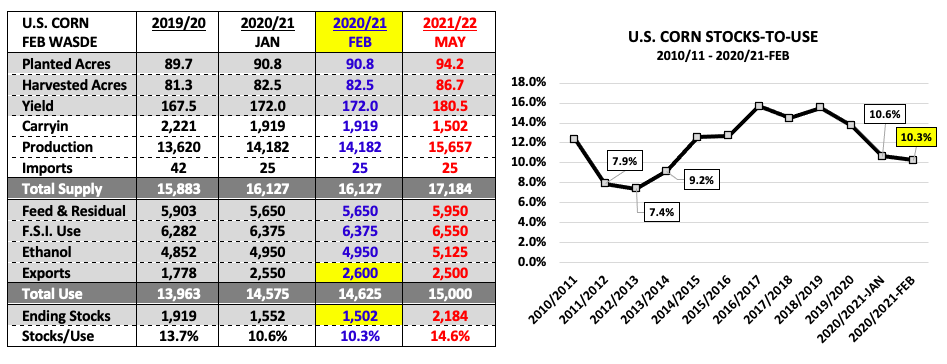

The USDA lowered 2020/21 U.S. corn ending stocks to 1.502 billion bushels, down just 50 million bushels versus January. This compares to the “average” pre-report trade guess of 1.382 billion bushels (low-to-high range of 1.108 – 1.515 billion bushels).

The U.S. corn stocks-to-use ratio was lowered to 10.3% versus 10.6% in January.

This does not support $5.65 – $5.75 March corn futures. Keep in mind the day high and new contract high of $5.74 ¼-cents per bushel established before the report was released was banking on a sub-1.200 billion bushel ending stocks forecast. Regardless of what was printed as the “average” trade guess, Corn Bulls had everyone leaning “long” going into this report. I saw several private analysts publishing sub-8.0% stocks-to-use ratios. Corn Bulls were lapping up the opportunity for $6.00 plus March corn futures. Clearly this report serves as a significant blow to that desired market outcome.

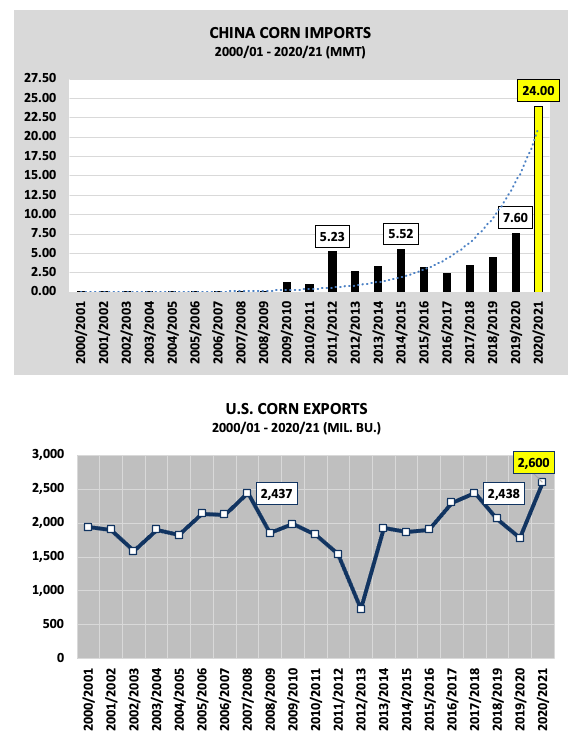

Where did the USDA fail to oblige Corn Bulls? The USDA only raised 2020/21 U.S. corn exports 50 million bushels to 2.600 billion. This despite the recent buys from China totaling over 230 million bushels. The USDA did however raise China’s 2020/21 corn imports up to 24 MMT versus 17.5 MMT in January (up 6.5 MMT or 256 million bushels). Therefore the USDA did seemingly account for China’s corn buys; however the impression is the USDA had already largely been accounting for most of the anticipated U.S portion of that Chinese business in their January export estimate.

That said, I fully expect Ag Resources, RJO’Brien, etc. to dispute and dismiss the USDA’s U.S. corn export revision; hoping if they challenge it daily, they can literally buy time until the March 2021 WASDE report corrects this perceived injustice. I will say I believe that’s a tall task with U.S. corn ending stocks of 1.502 billion bushels now on paper and traders projecting 94 plus million corn acres for 2021/22. To recreate the momentum CH21 had before this report came out, traders will likely need China to step in and buy more U.S. corn, and/or, see continued, serious delays in the planting of Brazil’s safrinha corn crop.

OTHER NEGATIVES FOR CORN BULLS

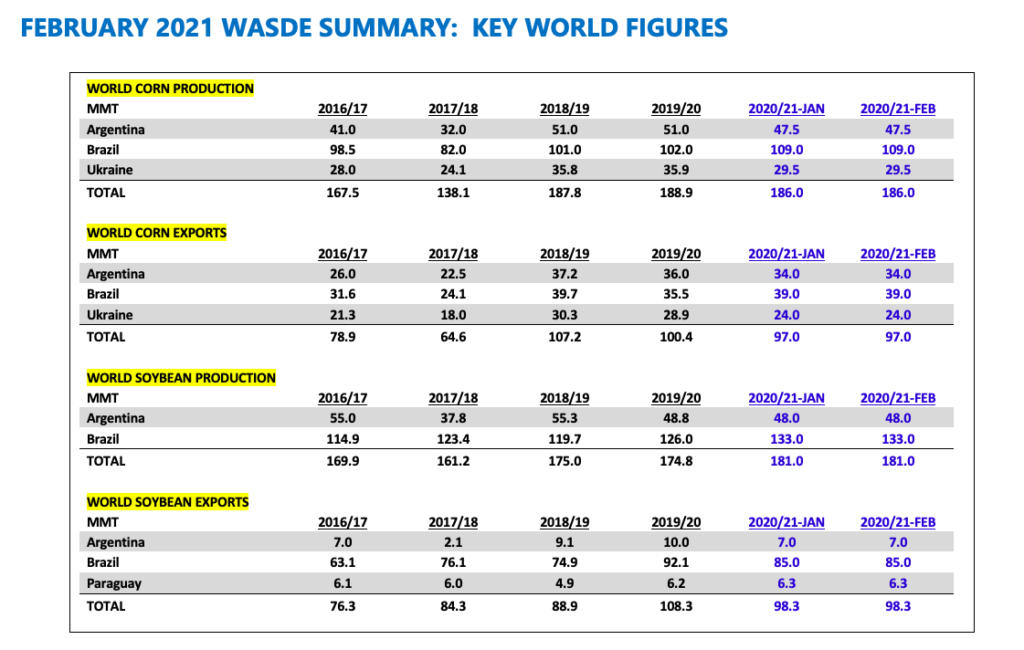

The USDA did NOT lower their RECORD 2020/21 Brazil corn production estimate of 109 MMT, despite the aforementioned planting delays to Brazil’s second corn crop (safrinha), which accounts for approximately 70% of total Brazil corn production. In addition, Argentina’s 2020/21 corn production forecast was also left unchanged at 47.5 MMT. 2020/21 total corn exports from the top 3, non-U.S. corn exporters (Brazil, Argentina, and Ukraine) held steady at 97 MMT; down just 3.4 MMT from 2019/20 (-134 million bushels).

The USDA seems to be implying they want to continue watching the timing and pace of U.S. corn inspections/shipments (versus sales) before getting more aggressive on their U.S. corn export figure for 2020/21. Again this has everything to do with China being no stranger to canceling U.S. corn purchases in the past. As of the USDA’s most recent weekly export inspections report (for the week ending 2/4/2021), crop year-to-date U.S. corn shipments totaled approximately 845 million bushels (32.5% of the USDA’s 2020/21 export forecast).

This then means that the U.S. would still need to ship 1.755 billion bushels of U.S. corn between now and the end of August 2021 to hit 2.600 billion bushels of exports. By comparison in 2019/20, total crop year U.S. corn exports, shipped over 12-months, were 1.778 billion bushels. Keep that in mind as Corn Bulls go to work over the next couple weeks discrediting the USDA. That’s not to say they don’t deserve their fair share of blowback over recent stocks and acreage adjustments. I’m all for piling on the USDA…however in this example, I can actually see and defend the USDA’s hesitation from automatically increasing 2020/21 U.S. corn exports to 2.850 to 2.900 billion bushels because of who the counterparty is. China is China.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.