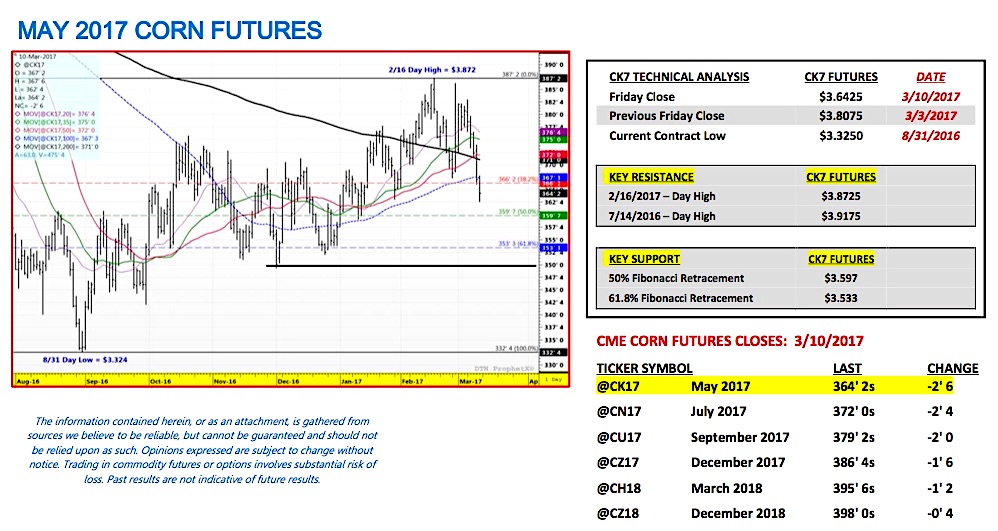

May corn futures for 2017 moved sharply lower this week, closing down 16 ½-cents per bushel week-on-week, finishing on Friday (3/10) at $3.64 ¼.

Friday’s close was disappointing for Corn Bulls with May corn futures unable to hold the 100-day moving average at $3.673. May corn futures had not closed under that key price support since December 30th, 2016.

WEEKLY MARKET HIGHLIGHTS (3/6 – 3/10):

On Thursday (3/9) corn futures reacted negatively to the release of the USDA’s March 2017 WASDE report with May corn futures closing down 5 ¼-cents per bushel at $3.67 that afternoon. The USDA made only minor tweaks to the U.S. 2016/17 corn balance sheet.

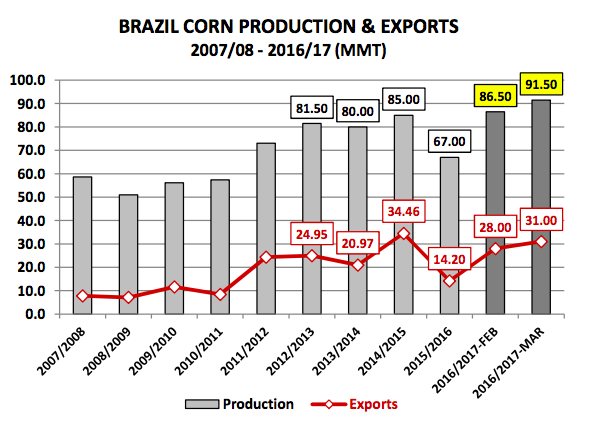

Corn-Ethanol demand increased 50 million bushels to 5,400 million; however there was an equal offset with Feed and Residual use dropping 50 million bushels to 5,550 million. Therefore month-on-month U.S. corn ending stocks were unchanged at 2,320 million bushels versus 1,737 million in 2015/2016. That said the biggest surprise was a significant increase to Brazil’s 2016 / 2017 corn production estimate. The USDA raised its forecast for Brazilian corn production to 91.5 MMT versus the average trade guess of 87.8 MMT and the February estimate of 86.5 MMT. 2016 / 2017 Brazilian corn exports also improved to 31 MMT versus 28 MMT in February and just 14.2 MMT in 2015/2016. Brazil is the world’s second largest corn exporter, trailing only the United States in that regard.

What is the potential corn futures price impact of record large 2016/17 Brazil corn production on the U.S. market?

Short-term I believe it will serve as more of an overhead resistance factor on rallies as opposed to something that pushes corn futures substantially lower for several trading sessions in a row. Approximately 65% of Brazil’s 2016/17 corn production has just been planted in the form of its safrinha crop. The state of Mato Grosso, the largest producer of safrinha corn in Brazil, is reportedly nearly 100% planted with other key producers Parana and Mato Grosso do Sul closer to 50% planted. The reality is most of this corn won’t be harvested until the June-July-August timeframe. Therefore as far as trying to determine when Brazil will most likely be in a position to displace U.S. corn export business going forward, I’m anticipating a more tangible market impact in Q4 2017.

HOWEVER the one U.S. Supply & Demand related figure already incurring increased debate following the recent March revisions to both Brazilian corn production and exports is the USDA’s 2017/18 U.S. corn export forecast of 1,900 million bushels at the Ag Outlook Forum in February. There are those in the trade now arguing that projection is too high by as much as 100 million bushels. With the USDA already projecting 2017/18 U.S. corn ending stocks at 2,215 million bushels, Corn Bulls certainly don’t want to see any bushels added to that figure heading into the 2017 U.S. corn growing season.

KEY CK7 PRICING CONSIDERATIONS FOR THE WEEK ENDING 3/10/2017: May corn futures (CK7) closed on Friday (3/10) at $3.64 ¼ finishing down 16 ½-cents per bushel week-on-week.

Key takeaways from this week’s price action:

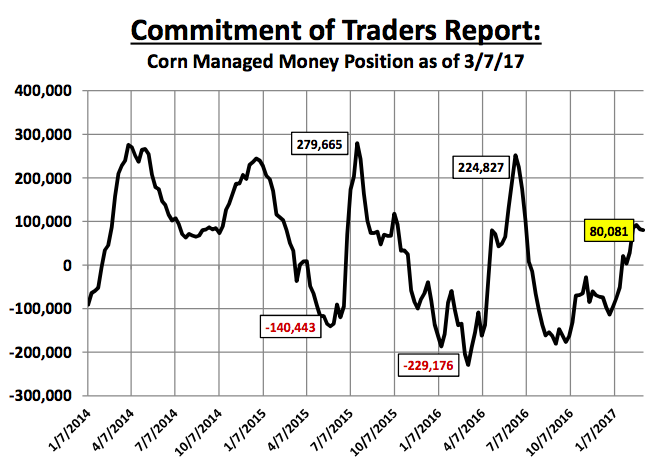

- Friday’s close was not good for Corn Bulls. May corn futures closed below the 100-day moving average ($3.673), a key price support that had served in sustaining rallies since December 30th, 2016. Therefore from purely a technical standpoint, this week’s price action suggests a deeper downward correction is now possible. Two potential downside targets on renewed selling pressure early next week are the 50% Fibonacci retracement at $3.597 followed by the 61.8% Fibonacci retracement at $3.533, which also coincides with a key day low on 12/23/16 at $3.52. The latest Commitment of Traders report showed the Managed Money net long decreasing slightly week-on-week to 80,081 contracts; however that was as of the market closes on Tuesday, March 7th. I would assume that net long position has been further reduced following Thursday’s March 2017 WASDE report, which resulted in May corn futures closing down 5 ¼-cents per bushel that afternoon.

- The other corn fundamental price pressure at the moment (not including the aforementioned increase to Brazilian corn production from page 1) was the USDA’s revisions to the U.S. 2016/17 soybean supply and demand balance sheet. Corn and soybean futures often have an analogous pricing relationship going into spring planting, especially when they are competing for acres. U.S. soybean ending stocks increased to 435 million bushels, up 15 million versus a month ago. This was largely attributed to a 25 million bushel cut to projected U.S. soybean exports. The export decline was a function of the USDA increasing its 2016/17 Brazilian soybean production forecast to 108 MMT versus 104 MMT in February. The USDA also increased 2016/17 Brazilian soybean exports to 61 MMT versus the current U.S. forecast of 55.1 MMT. May soybean futures responded by closing down 31-cents per bushel week-on-week.

I’m still not a seller of corn futures on breaks. Rather my objective remains to position for a longer-term upside play this summer if and when May corn futures continue to drift downward back into the low $3.50’s.

Thanks for reading.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service