During the ten months since we last wrote about copper futures, price has obeyed our copper futures price forecast by slowly creeping lower. If the U.S. Dollar continues to trend higher, and if expectations for economic growth in China and elsewhere remain gloomy, then the decline in copper should continue.

In this post, we present a slightly revised technical forecast and price target for copper futures, and we highlight what may become a short trade opportunity sometime during the next few months.

Copper Futures Price Forecast

If the Dollar resumes its long-term rally, which we described in this recent post, that will continue to put pressure on a variety of commodities… and this is likely working its way into the price action and lower Copper futures price forecast. Meanwhile, the nation that has been the biggest customer for copper continues falling short of expectations for economic growth. Until recently, China has been responsible for approximately 40% of copper demand globally. These are the right conditions to cause copper futures to push for completion of its current price pattern – essentially searching for the “reset button.”

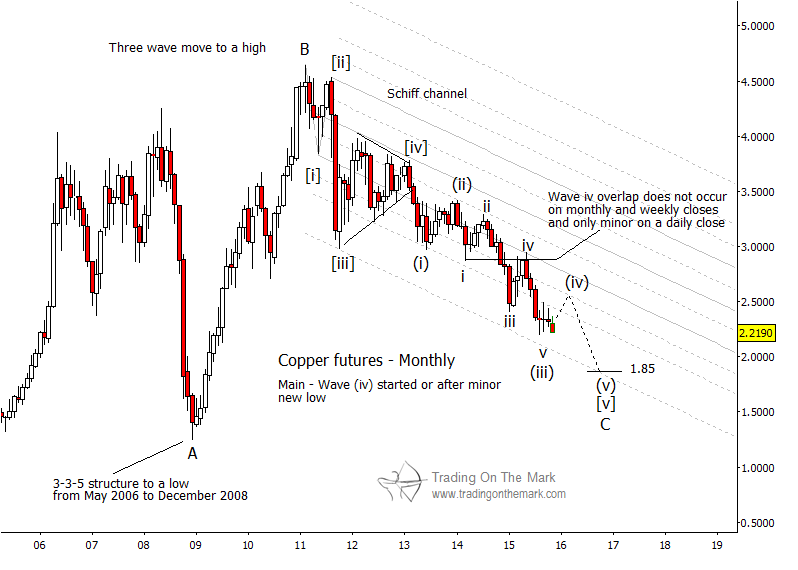

Since the 2010 price high, copper futures have made a steady series of lower highs characteristic of an Elliott wave impulsive move. In the larger picture, the decline from 2010 can be viewed as the counterpart of the steep decline of 2008. The current decline is progressing more slowly than the earlier one, affording traders and investors more opportunities to get ahead of the smaller moves (as you can see in the copper futures price forecast below)

Using the converging price formation of 2011-2012 as a landmark, and noting that fourth waves often have a triangular pattern, we are counting the decline from 2012 as the fifth wave in the big downward [i]-[ii]-[iii]-[iv]-[v] sequence. Although wave [v] should be the final part of the decline, it still appears to have farther to go. The middle segment (iii) has extended to test near channel support, which should leave at least one more substantial up-down move in waves (iv) and (v), as we have sketched on the chart.

Copper Futures Price Chart – Monthly

Based on this updated wave count and a corresponding change in the way the channel is anchored on the chart, we have revised our downward target to be near the 1.85 area – a bit lower than we had projected in our January post on the copper futures price forecast.

While we think upward, countertrend trades would be risky in this environment, there could be an opportunity in coming months to ride wave (v) of [v] of ‘C’ downward to near the rough target zone.

continue reading on the next page…