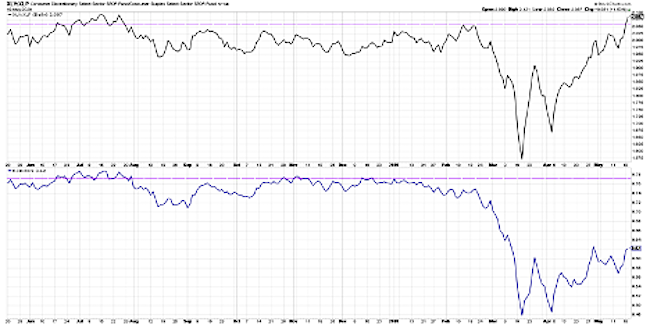

$XLY to $XLP Consumer Discretionary to Staples Ratio Chart

Today we’re looking at Consumer Discretionary vs Consumer Staples, but in two different forms.

This is one of the ways I love to look at offense vs defense in the equity space.

The top panel shows the ratio of the XLY (Consumer Discretionary Sector SPDR) versus the XLP (Consumer Staples). The ratio is relatively flat with Consumer Discretionary (travel, hotel, retail) and Consumer Staples (beverages, personal products) essentially in line.

They were moving in a similar pattern in the 4th quarter of last year, and slightly accelerated into the market high in February.

After that, the ratio really took a turn to the south. As the market sold off, people flocked toward Consumer Staples, like General Mills and Campbell’s Soup for example, and away from luxury goods and travel. The market bottomed out on March 23rd, but this ratio actually turned a couple days earlier in the 3rd week in March.

It then rallied and put in a higher low the first week of April, and since then has continued higher. The last couple days this ratio has gone to a new swing high above its February high, which illustrates a rotation back to traditional offense. It’s also fairly unique, as the average S&P 500 stock has not gotten back to these levels. Even the S&P 500 is still down around its 61.8% retracement of the February to March selloff.

But here’s the kicker (and this is why I love this chart).

The bottom panel shows the same ratio of Consumer Discretionary vs Consumer Staples, but it’s using the equal-weighted version. RCD is an equal-weighted Consumer Discretionary ETF, and RHS is an equal-weighted Consumer Staples ETF.

Until the March low, both ratios were pretty similar. They both broke down through their most recent swing lows, although you’ll notice the equal-weighted version actually broke down first. In mid-February, the equal-weighted version was already rolling over while the cap-weighted version was still above its low from January. I find this happens more often than not, where the equal-weighted version tends to lead and signals first.

What’s interesting right now is while the cap-weighted version is going to new highs for 2020, the equal-weighted version is nowhere near its peak from the beginning of the year. This is because of the outsized weight within the Consumer Discretionary ETF of a couple mega-cap names. Names like Amazon (about 24% of the ETF) and Home Depot (about 13% of the ETF) dramatically affect the value of the cap-weighted XLY.

An equal-weighted ratio levels the playing field. It displays more of the average Consumer Discretionary stock vs the average Consumer Staples stock. To put another way, it’s how the group of stocks in Consumer Discretionary is performing vs the group of stocks within Consumer Staples.

While the equal-weighted version has been favoring Consumer Discretionary since the market bottom in late March, it’s still nowhere near the strength in the cap-weighted version. This points to a relatively narrow story, where a small number of mega-cap Consumer Discretionary names have done well, and some mega-cap Consumer Staples names have been struggling. As a result, the ratio seems pretty exaggerated to the upside.

This tells me there are stock picking opportunities across the board. There are opportunities to differentiate yourself as an investor by identifying some of these pockets of relative strength and underweighting the pockets of relative underperformance within most sectors. The dominance of Consumer Discretionary over Consumer Staples since the market bottom has been driven, especially in the last 3-4 weeks, primarily by those mega-cap Consumer Discretionary names.

One of the key indications I would look for is a failure of this ratio of Consumer Discretionary vs Consumer Staples. If and when this ratio rolls over, I think you’ll see weakness first in the equal-weighted version. In a potential downturn, people tend to flock toward some of those big mega-cap names, which means the cap-weighted version will remain stronger while the equal-weighted version will show weakness.

To watch this in video format, just head over to my YouTube channel!

Twitter: @DKellerCMT

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.