Many are calling the recent market activity similar to the great depression of the 1930’s.

And clearly there are some comparisons.

But what did not exist in the 1930’s was this level of QE.

During 1932, with congressional support, the Federal Reserve purchased approximately $1 billion in Treasury securities.

Now that the Fed has bought up debt to an unprecedented level and the government is spending trillions on stimulus, a depression is not out of the question.

I show you (and I believe this is completely original and unique content) that there is a better comparison though, to the mid 1970’s.

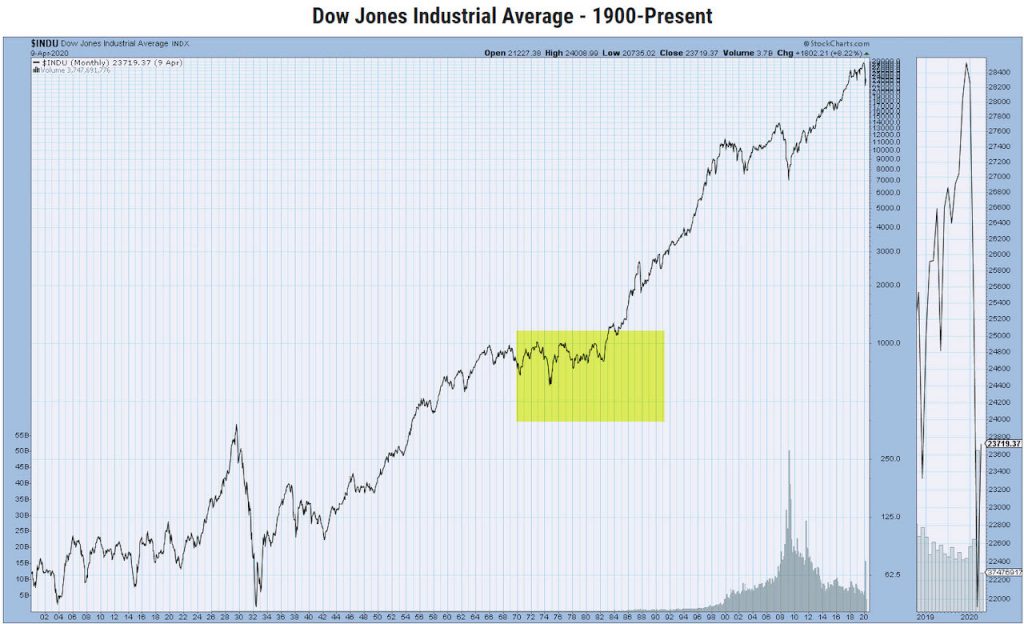

In the chart of the Dow Jones Industrial Average (DJIA), you can see the depression, which hit a nadir in 1932 then came roaring back.

From 1954 (when the pre-depression highs were taken out) until 1970 the market enjoyed a huge run from 200 to 1000 in the DJIA.

Then, the first crisis hit with the Yom Kippur wars.

Then came the oil embargo when OPEC formed and tripled oil prices.

Gas lines and oil prices spiked. We have a different type of oil crisis now-as in nobody using it and there is an oversupply.

The Dow Jones Industrial Average went from a peak in 1971-72 at 1000 and dropped to 577.60 in 1974. It took nearly 10 years for the market to return over 1000.

In 1972 oil was priced at around $22 per barrel.

Now, in 2020, with oil trading around those 1970 lows, what happens once the demand returns?

Throughout the last 60 years, every time oil has gotten down to around 20, something dramatic has happened to raise oil prices.

In my recent StockChartsTV video, I show you oil, gold, the bonds, governement spending, the dollar, GDP, unemployment, agricutural prices and CPI and how they all play a part in the comparison.

S&P 500 (SPY) 287-290.45 (retrace to the MA breakdown)

Russell 2000 (IWM) 114.55 support 118-120 pivotal. 125.80 2018 November low resistance

Dow Jones Industrials (DIA) 240 pivotal

Nasdaq (QQQ) 205 support. 220 big resistance

KRE (Regional Banks) 33.10 pivotal support

SMH (Semiconductors) Confirmed Bullish phase 128 support to hold

IYT (Transportation) Really needs to clear 150 to get interesting

IBB (Biotechnology) 120 pivotal support

XRT (Retail) 31.00 support 36-38 resistance

Volatility Index (VXX) 35 the 50-DMA

Junk Bonds (JNK) 100.66 the 50-DMA.

LQD (iShs iBoxx High yield Bonds) Inside week. 129.10-132 range to watch break. 135 resistance

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.