TransCanada (NYSE:TRP) and Enbridge are two of those names. Major pipeline projects have faced major opposition as of late, increasing the scarcity of new capacity and infrastructure. These are two of the largest, most established players which both continue to grow organically and through tuck-in acquisitions. Enbridge’s acquisition of Spectra entrenched them as a North American market leader. It added a lot of debt to the corporate structure, but below $50 the valuation becomes appealing again. We like how TransCanada has diversified their business south of the boarder as mainline gas prices have come under pressure in Canada. In 2013, they generated 34% of revenue from the U.S., today that number is closer to 60%.

The other core of our Energy complex is made up of large cap integrated companies.

An integrated energy company is one that has three avenues for free cash flow generation downstream (gas stations), midstream (pipelines) and upstream (wells). Suncor is a prime example. It is a core holding of ours that offers an attractive 3.3% dividend, supported by good production growth and slowing capital spending. Their Fort Hills operations should add about 180,000 barrels a day to production and have an offshore project nearing completion. The risks reside in their reliance on the Canadian oil sands, once projects are in production they are competitive, but new growth initiatives are quite costly and not competitive on a global scale.

Husky is our other integrated holding. The company has stated that they are focused on reinstating the dividend. Recent resolution on their dispute with CNOOC, and with new projects in Indonesia and the Midwest U.S. nearing completion, we anticipate an increasing potential of the dividend coming back, should commodity prices stabilize or trend higher. They became free cash flow positive in 2016 and have firmed up the balance sheet with asset sales.

Rounding out our energy basket are names we would not consider core to the portfolio but that offer growth at a reasonable price. Bonterra is our highest beta energy name at this point and our producer of choice because of their attractive dividend yield, quality assets and potential upside if we are wrong and oil prices move meaningfully to the upside.

MATERIALS

Our country’s reliance on natural resources is part of the fabric of our nation, propelling our economic development into one of the best places to live in the world and strengthening our position in global trade. But in the digital era, our economy has diversified and our reliance on the sector has diminished. However, innovation has created great opportunities for early adapters to thrive, creating great investment opportunities across a myriad of sub-sectors.

The metals and mining sub-sector has been challenged as China’s economic growth has been normalizing (slowing) for several years which has been weighing on raw materials. Adding to the issue is that they are now net exporters of steel, putting more downward pressure on prices. Materials do not present many opportunities for dividend investors as shrewd companies recognize the cyclicality of their business models and are weary of distributing too much capital to shareholders.

Our only holding is in Franco Nevada, one of very few gold companies in Canada that offers a dividend. Despite reasonable fundamentals we like the gold exposure to mitigate some of our long U.S. dollar exposure, as the asset class tends to increase when the dollar weakens. It also is a safe haven asset that investors flock to during times of geo-political unrest, which is a glaring concern in several parts of the world right now.

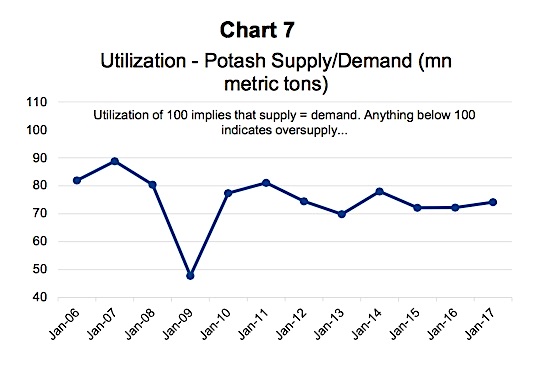

We own a small position in Agrium; potash and nitrogen production are key to aiding farmers in increasing yields. Population growth and socioeconomic gains are increasing demand for food and more protein. The stock offers a solid dividend yield and the company is nearing the close of a deal with Potash which should provide synergies. The reason for our small position size is that there is uncertainty around contract renewals and pricing concerns in what appears to be an oversupplied market (Chart 7).

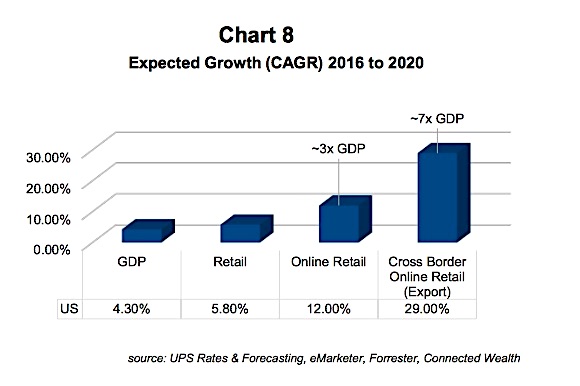

The North American consumer is alive and well, unemployment is low, wage growth is present, and home prices are rising, adding to the wealth effect that increases consumer confidence. We recently published a two-part series on the consumer: Part 1 & Part 2. This has percolated down to spending and business confidence. Those tailwinds are a boon for International Paper, another of our material stocks which make boxes for online shopping shipments (Chart 8) as well as paper products for industrial applications. Their three largest customers according to Bloomberg are Amazon, FedEx and UPS. Should the shift away from brick and mortar to online continue, this company should be a beneficiary. This trend is glaringly obvious and has attracted new players to the space, which is a risk to the company, but there are no major facilities slated to be completed until the end of next year.

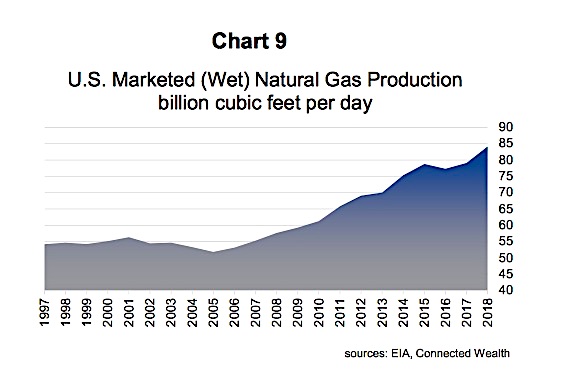

A core holding of ours, which has been doing quite well since closing a mega merger, is the new DowDupont Inc (NYSE:DWDP). The overarching thesis behind this diversified chemical company is that a glut of natural gas in North America (Chart 9) will provide them with years of cheap feedstock to create their downstream products. Demand for these plastics, agricultural and specialty chemicals has accelerated during this time of synchronized economic growth. There is also a new catalyst on the horizon as it is believed the company will eventually split into three separate entities. The risk is that the integration is challenged and synergies expectations disappoint.

Thanks for reading.

Charts are sourced to Bloomberg unless otherwise noted.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.