Inflation pressures are increasing as the economy tries to digest a prolonged period of higher commodity prices.

While select commodities have pulled back (and this has investors hopeful that inflation moderates), the broader commodities arena remains elevated.

So what’s next? That may depend on one major influence — the U.S. Dollar.

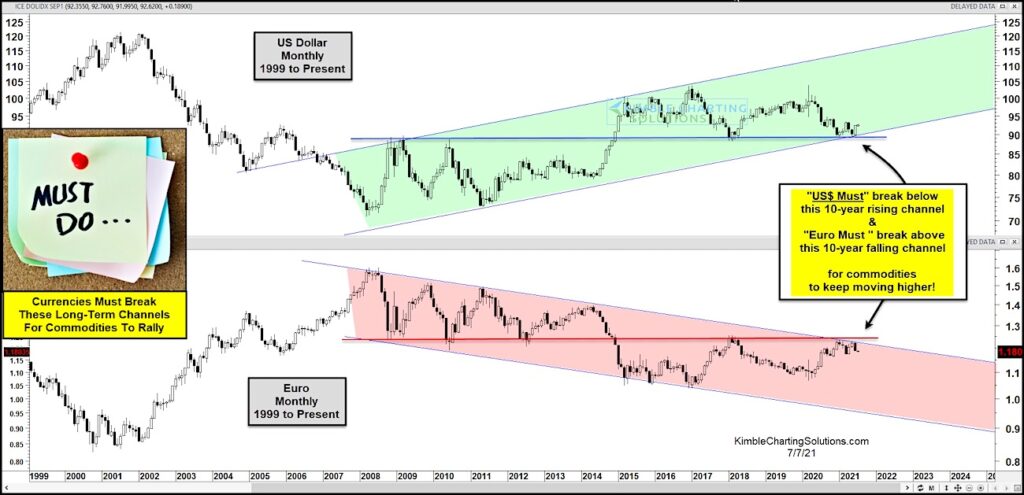

King Dollar has been weak over the past year and that has been a tailwind for commodity prices. But the US Dollar is currently testing an important technical support level marked by its rising up-trend channel and horizontal support (2009/10 highs and recent lows). Commodity bulls hope the US Dollar breaks down and continues lower…

For reference, the chart below also shows the Euro. A stronger Euro also is good for commodities. The Euro is currently testing major resistance and commodity bulls would love a breakout here.

If the US Dollar breaks down below trend support and the Euro breaks out, commodity prices could surge once more. If not, they may come back to earth. This is a BIG trend test. Stay tuned!

US Dollar Index “monthly” Chart

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.