The US Dollar has received a fair amount of attention over the past year, as pandemic-spurred government stimulus and assistance programs and a softer stance from the Federal Reserve have weakened the buck.

And commodity bulls have benefited enjoying a broad rally over the past 12-18 months.

But not all is lost for King Dollar. And commodity bulls need to pay attention.

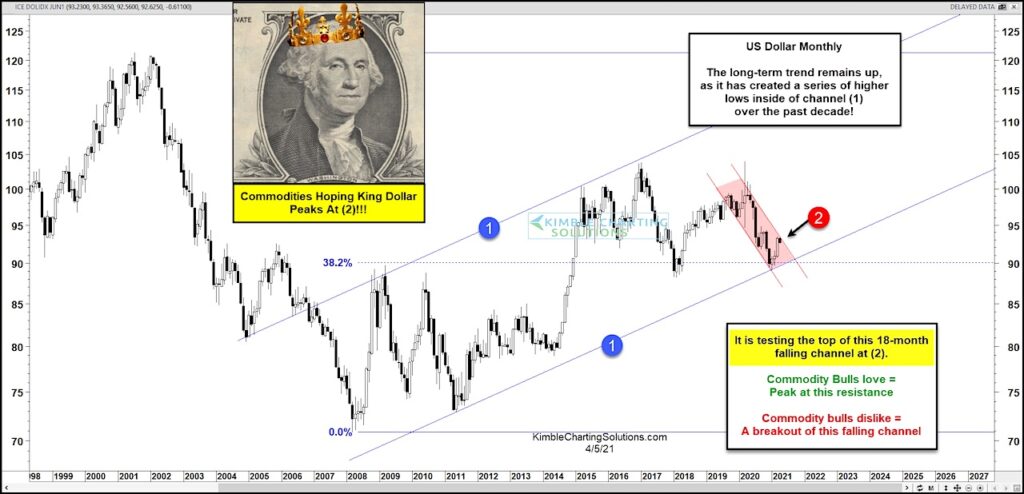

Looking at today’s long-term “monthly” chart, we can see that the US Dollar has been in a long-term rising trend marked by each (1). King Dollar recently bounced off the lower rising trend line and is now testing its short-term falling channel resistance at (2).

What the buck does here is important. Commodity bulls are hoping for a peak and turn lower from here. On the other hand, a breakout would signal a strengthening dollar and an emerging headwind for commodities. Stay tuned!

US Dollar Index “monthly” Chart

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.