The Federal Reserve is seemingly adjusting policy the same way algos trade stocks for pennies. As I type, the Brexit fans hold a 7% lead (good for them if you ask me). Our political backdrop is as enticing as that of my “old country” (Italy); this is no small feat. As well, earnings growth is nowhere to be found and corporate balance sheets are levering up for massive mergers and buybacks. Looking around the world, the middle east is in full “Mad Max” mode, and China is uncertain at best. In short, there are lots of reasons to fear another credit crisis.

These are just some of the refrains used to suggest that the financial markets are supposedly on the verge of a repeat of the ’07-’09 financial meltdown and credit crisis. Many bloggers and pundits also point to the added thrill that this time there will not be a government safety net.

What are corporate bonds (of all grades) saying?

This column is not going to be about rebutting all those worries. They have been around in one form or another since 2009, they have not mattered since then, and they are not likely to matter for the foreseeable future. Rather, below are four screenshots, which in my opinion go a long way toward explaining why none of those problems have amounted to much.

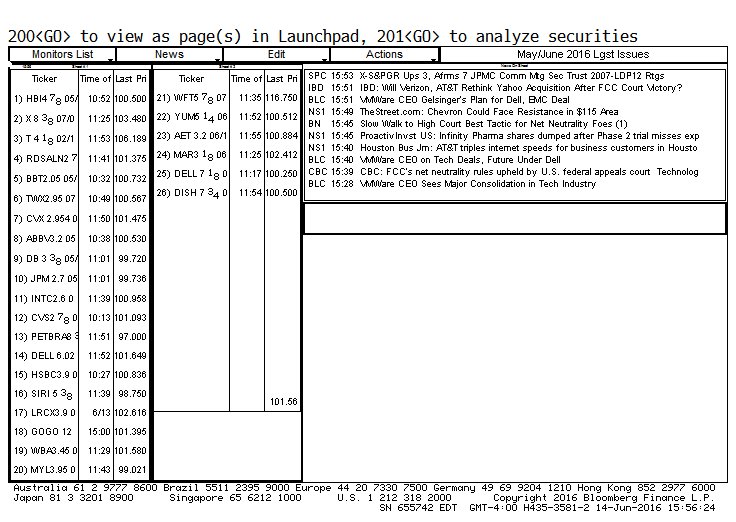

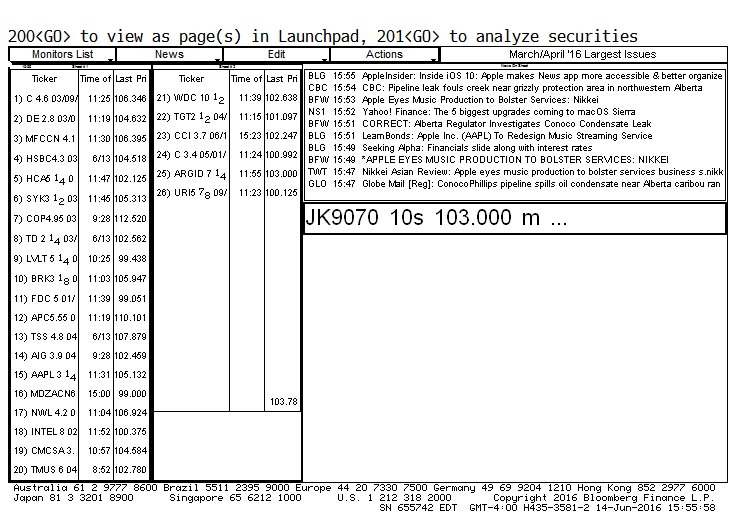

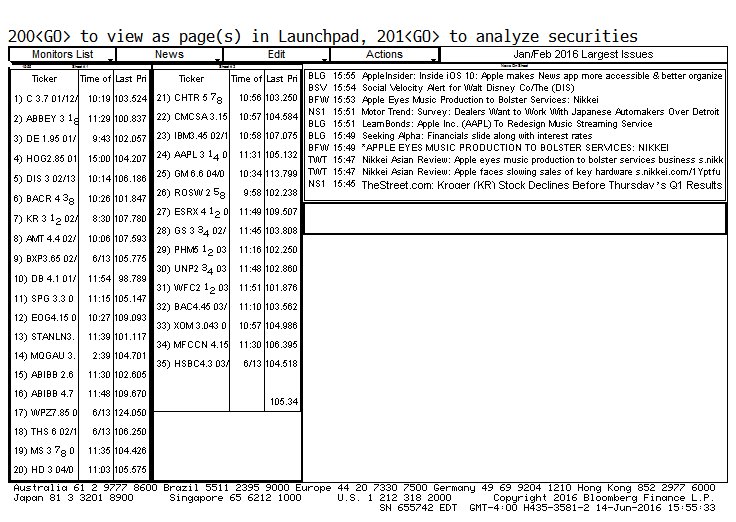

The screens show the performance of the largest corporate bond issues sold in 2016 (each list below covers about two months: May/June, March/April, Jan/Feb. I could have gone back to issues sold in ’09, ’10, ’11, etc., and you can bet that there would not be that much difference. I selected bonds among as many industries as possible, including investment grade bonds and junk bonds. I also made sure to include bonds sold to finance large M&A deals.

The price at the bottom of each list is the current average trading price of those bonds. This is THE one data point that basically defeats all bearish arguments, and the reason for that is simple. The critical ingredient to a credit crisis is forced deleveraging by bondholders as their positions sink in price and margin calls follow. To the extent that prices of bonds are steady or – as those screens reflect – move higher, margin calls and deleveraging are simply not going to happen. Therefore, no matter the bears’ protestations, odds of a credit crisis are slim to none. And slim may be dead.

In fact, to the extent that the bond prices are reflective of the performance of the $1.28 TRILLION dollars of corporate bonds sold from September through May, bondholders have every incentive (and cash) to continue buying bonds. And just because the bears don’t like and can’t conceptually accept this dynamic, it doesn’t mean that it is not going to happen.

Corporate Bonds (Largest Issues) – May/June

Corporate Bonds (Largest Issues) – March/April

Corporate Bonds (Largest Issues) – January/February

Thanks for reading and Happy Trading!!

Twitter: @FZucchi

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.