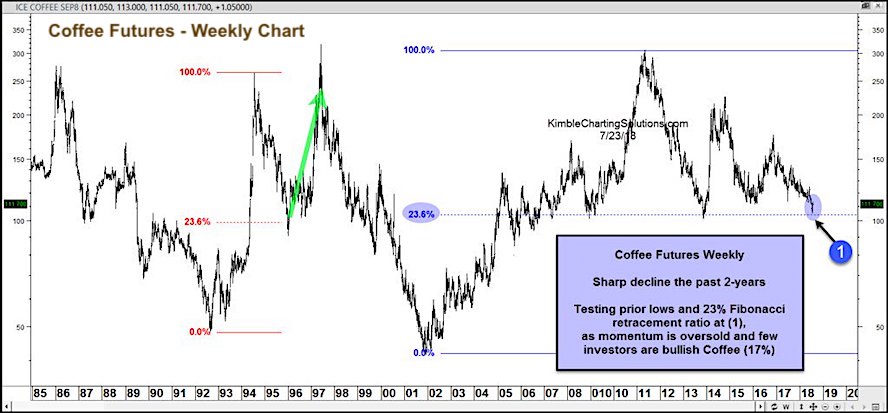

The last 2 years have not been kind to Coffee, seeing spot prices decline almost 40%.

The decline has Coffee testing a pretty important band of support dating back to 2007.

In fact, current coffee prices are testing a lateral band of price support made up of the 2007, 2008 and 2013 lows.

Each of those times resulted in a rally. As well, Coffee prices are also testing the 23.6% Fibonacci retracement at point (1).

A similar Fib retracement occurred during the mid-1990’s and resulted in a rally.

Lastly, the decline has bullish sentiment down to 17%. From a contrarian standpoint, this is getting bullish. In all, this looks like a good risk/reward setup (with a stop).

Note that Coffee is still in a downtrend. So traders need to keep this in perspective. But a short-term counter-trend rally looks likely in the coming weeks…. unless coffee prices break support. Then all bets are off!

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.