In The Graduate, a young Dustin Hoffman, upon his college graduation, is taken aside by a family friend for career advice. The friend offers Dustin one word; “plastics.” He encourages Hoffman’s character to pursue a career in the explosive growth, up-and-coming plastics industry. We may want to think of similar advice for our children and their friends with graduation ceremonies upon us.

It is also incumbent on us to consider the same advice regarding our portfolios. If we have a longer-term window and can ignore short-term volatility, should we invest in a volatile growth stock like Nvidia or a stable low growth company like Clorox?

Many investment pundits may rephrase the question as a choice between a value stock and a growth stock. The terms “value” and “growth” have become blurred in recent years. What appears to be a value stock may be in its reputation only.

Valuations Matter

Most readers with long-term investment horizons will answer our earlier question by selecting the semiconductor giant Nvidia.

I confidently state that the semiconductor industry will grow multiples of the bleach industry.

However, the value growth investment question is not which stock is considered growth or value, but which is priced cheaper given their distinctly different growth rates. At the right price, Clorox may be a much better investment than Nvidia, despite Nvidia’s substantial growth potential.

Unfortunately, many passive investors assume companies with long successful histories and mature products in low-growth industries are value stocks. Conversely, a semiconductor company or other high-growth technology must be a growth company in many investors’ eyes. Such assumptions get investors in trouble.

Nvidia or Clorox: Where is the Value?

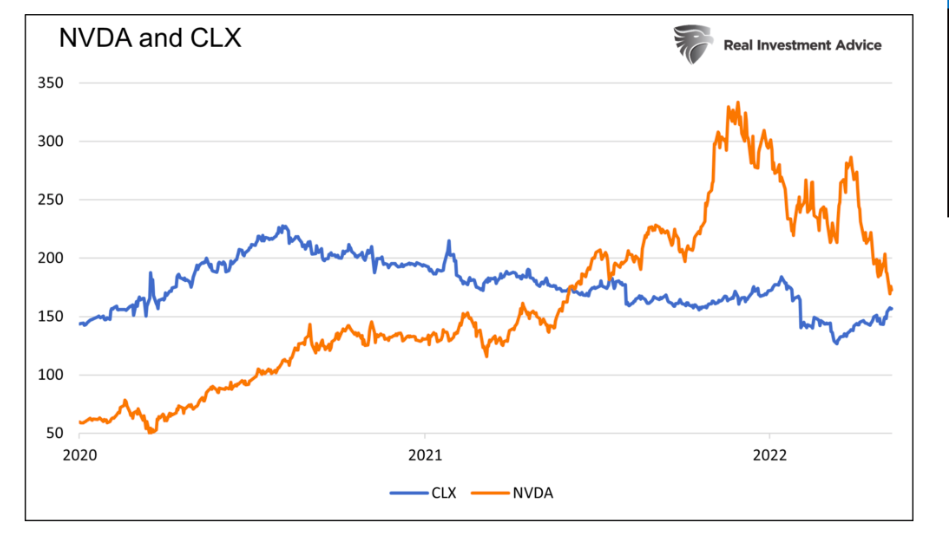

To help answer our question, we start with a cursory view of their share prices since 2020.

As the graph below shows, CLX had a nice run during the height of the pandemic as bleach was in high demand. After a 60% surge, it gradually erased the gains and is back to similar levels as two years ago.

NVDA initially fell by 35% in March 2020 but stormed back, growing from $50 to a peak of $333. Since hitting a record high in November 2021, it has fallen nearly 50%, although still trading at a reasonable premium to its pre-pandemic levels.

Fundamentals

While most investors stare at stock prices all day, fundamentals are what matter. Simply, what are you getting for the price? This is where the Nvidia and Clorox valuations and recent performance get interesting. Further, it is where the line between value and growth gets hazy.

Since 2020, NVDA has grown its revenue by 146%, while CLX has grown revenue by 15%. Sales are a significant consideration in stock analysis, but how well sales revenue translates into bottom-line growth is more important. NVDA has grown EBITDA by 242%, while CLX has seen a 23% decline in EBITDA over the same period. Earnings are a function of sales and margins. Operating margins at NVDA are up nearly 11 points since 2020, while CLX has dropped 7.5.

NVDA’s Price to Earnings ratio (P/E) has fallen by 14 since 2020. At the same time, CLX has risen by 13.5.

Current Valuations

The above data certainly points to NVDA as the higher growth company with more robust fundamentals. However, we want to stress that price and fundamentals matter, but only in the context of valuations.

A company can have poor growth rates and weakening margins, but it may be an excellent investment at a low enough valuation. Conversely, a company like Tesla is experiencing tremendous growth, but its market cap equals that of the entire auto industry.

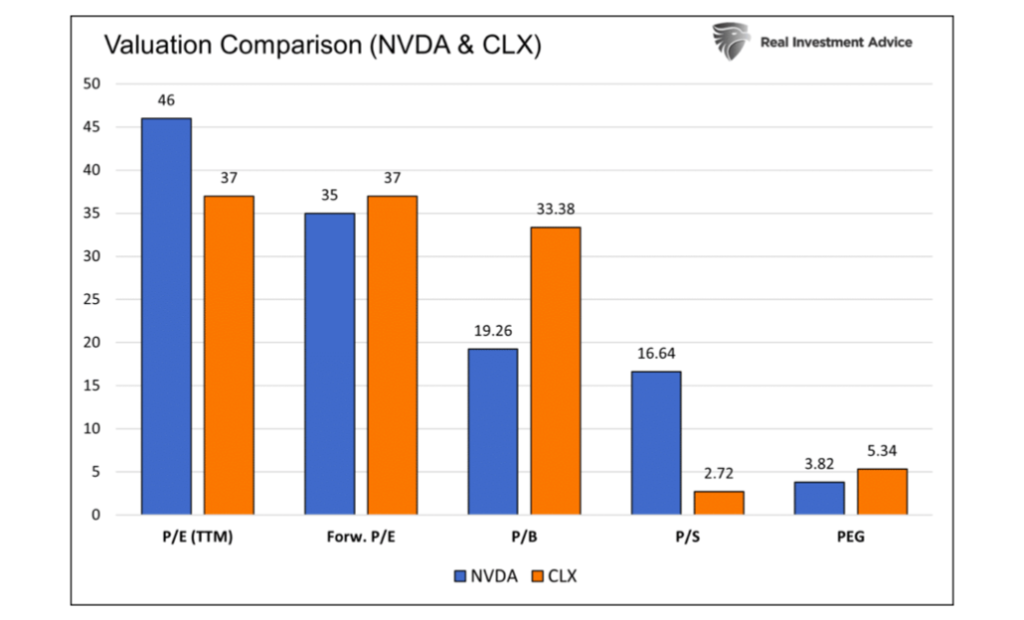

With that background, let’s compare NVDA and CLX valuations.

If you only looked at the table above and didn’t know which companies they were, you would likely struggle to pick the value stock. NVDA has a higher P/E but a lower forward P/E. NVDA also has a much lower price to book value but a much higher price to sales ratio.

To help break the tie, let’s compare their PEG ratios. The PEG ratio or price to earnings growth is the price to earnings ratio divided by earnings growth. This ratio helps make sense of P/E within the context of expected growth. A P/E of 100 may be cheap, for instance, if earnings are growing at 200%. Conversely, a P/E of five may be expensive if earnings are shrinking.

A PEG ratio of one typically defines the border between over and undervaluation. By this metric, both companies are overvalued, with ratios well above one. However, NVDA’s PEG ratio is decently lower than CLX.

We believe that NVDA is trading at a lower valuation than Clorox based on the data above.

SimpleVisor Models

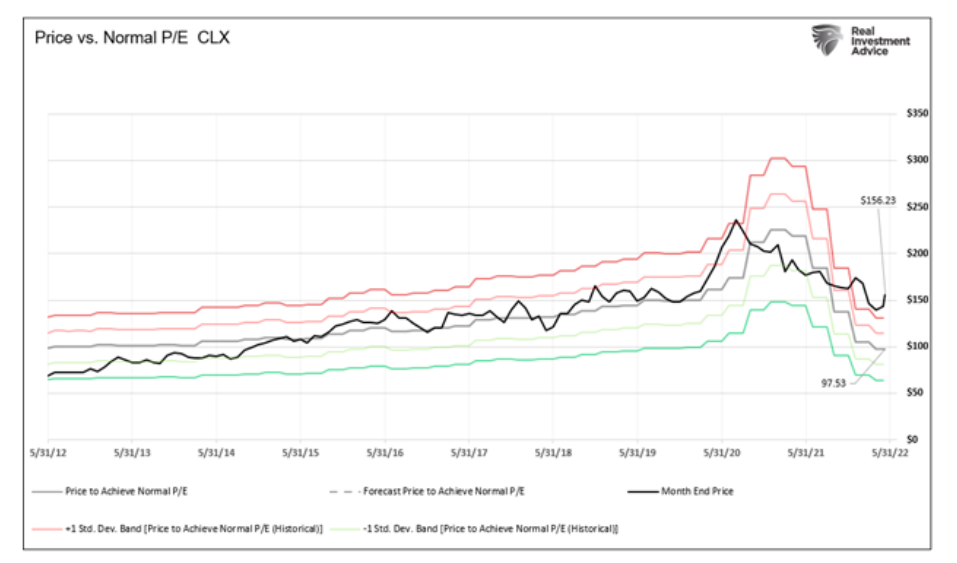

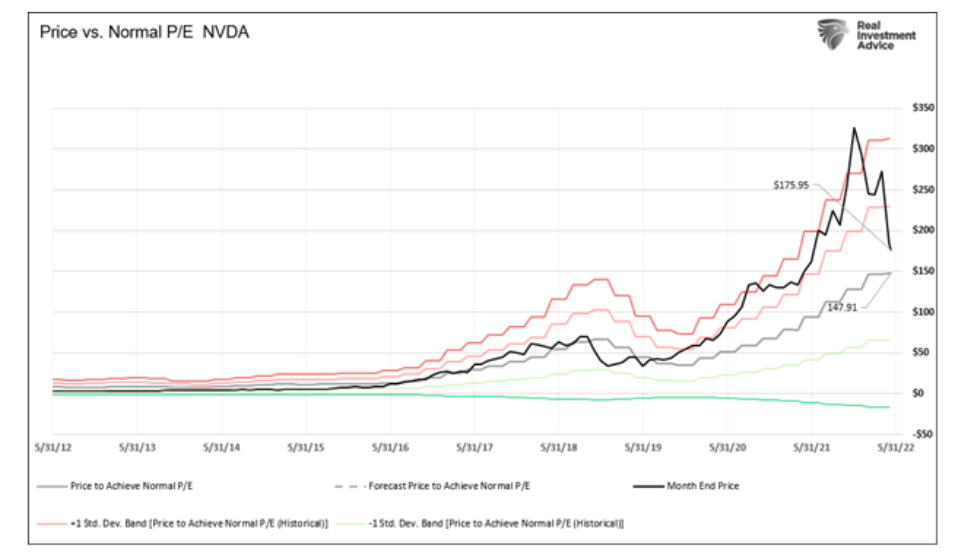

To add to the analysis, we share our internal model. The model helps assess if stocks are rich or cheap to their long-running normalized valuations. The model assigns a fair value price based on its normalized P/E ratio. It then tracks how the stock price trades around that ratio.

In the Clorox graph below, the stock price (black line) tended to gravitate around the gray fair value line from 2012 to 2019. When it was above the gray line, we would say Clorox stock is overvalued and vice versa for when it is below. Currently, Clorox is over two standard deviations or 60% above the model’s fair value.

The following graph shows a similar analysis for NVDA. From 2012 to 2019, it also bounced around its fair value level. However, once the pandemic struck, it traded well above fair value. Until November 2021, Nvidia stock, like Clorox, was over two standard deviations above its fair value. Since then, it has fallen back much closer to fair value, currently trading at a 19% premium.

Neither stock is cheap using this model, but the model asserts Nvidia, not Clorox is the more reasonable of the two companies. Dare I say if I must pick a value stock from the two choices, it would be Nvidia, not Clorox.

Summary

NVDA is growing earnings and revenues much faster than Clorox. That in and of itself is not a surprise. The real revelation is that these two companies trade at similar valuations despite vastly different growth trajectories.

Given that NVDA is proliferating and CLX growth appears limited, our analysis questions why hold a “value” stock in CLX versus a “growth” stock in NVDA. This article is not a prompt to buy Nvidia or sell Clorox stock, but it highlights that some stocks are perceived as value stocks despite valuations that are on par with growth stocks offering significantly greater growth potential.

Investors tend to lump certain stocks within broad classifications. Clorox, for example, is widely touted as a value stock. NVDA is known as a high-growth stock. The problem with these classifications is that it is not the underlying business that matters; it is the price you pay for their earnings potential.

Twitter: @michaellebowitz

The author or his firm may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.