Following yesterday’s close, the Fed released the final installment of its annual stress test (the CCAR) of the 30 largest TBTF “systemically significant” banking institutions in the US. In this final round of testing, the capital plans submitted by 5 of (STD, HSBC, RBS, ZION and C) the 30 banks were rejected, with Citigroup (C) the sole top-tier, mega-money center bank failing to make the cut. About the many-headed hydra of US Banking Citi’s embarrassing inadequacies, the Fed had this to say:

Pass or fail, most banks are under pressure today, with the KBW Bank Index ETF (KBE) off -1.4% and its regional banking peer KRE down comparably, shedding -1.3% in mid-day trade. Of all the institutions that squirmed in the naked light of the Fed’s microscope, though: at -5.85% off yesterday’s pre-results close Citigroup stock is faring the worst by far.

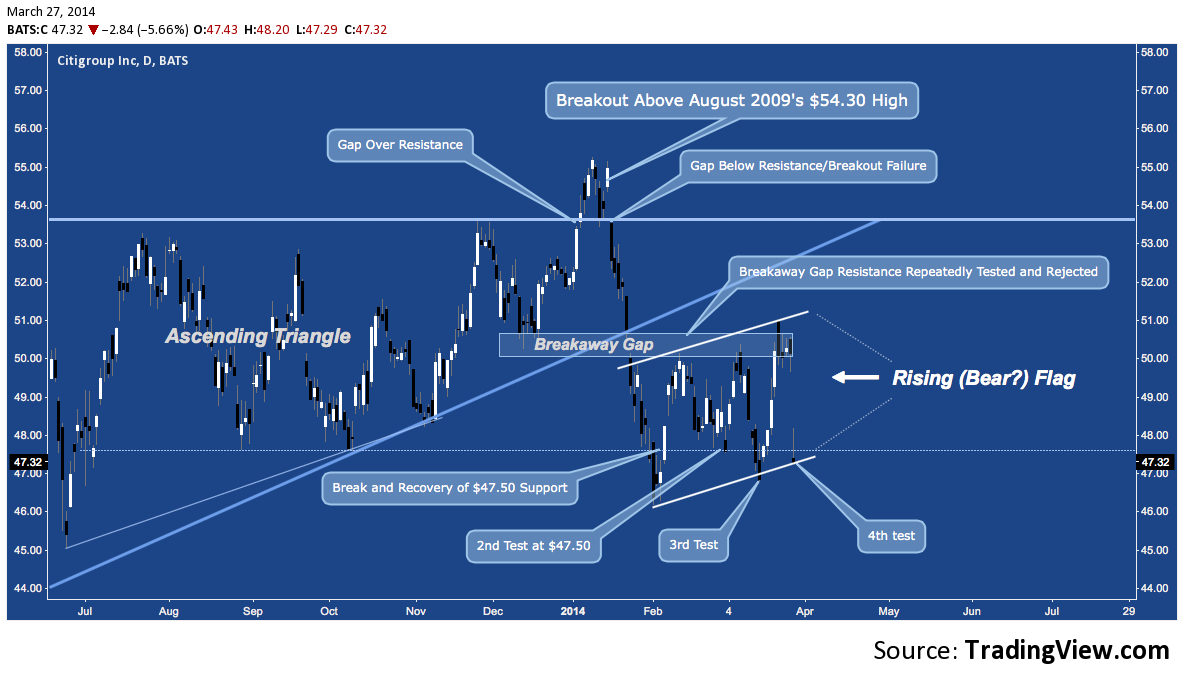

This continues Citi’s beleaguered status as the bank among it’s peers that just can’t get a break. With competitors like Bank of America (BAC) and JP Morgan Chase (JPM) recovering their January losses to press on to new multi-year highs on February, C staged only a modest bounce. This follows the crushing letdown the stock suffered in late January after failing to hold a pivotal breakout from it’s 2013 ascending triangle pattern and over August 2009’s post-crisis $54.30 high.

Not only did Citigroup’s breakout fail in mid-January, it then burnt through the ascending triangle range, gapped down through the pattern’s rising trend line support near $51 and continued lower until finding it’s footing near $46 sixteen sessions and -16.5% later. Since then (February 3rd), C has formed a broad corrective rising channel or flag :

Counter-trend channels/flags with steep declines (flagpoles) just preceding them like Citi’s tend to resolve in a trend continuation; especially where the primary trend has just shifted. The long and (so far) failing attempt to recover the rising trend off the Q4 2011 bottom the flag denotes only heightens the bearish assessment.

With today’s gap down into channel support and horizontal support at $47.50, C is facing a simple break/bounce scenario. Will it regain it’s composure and once again stage a push back over $50? Retaking the level at C would be constructive, setting the stage for a renewed attempt to break and hold over $54.30. But if C bulls can’t make that happen, a break down runs into support at B (02/03/14’s $46.19 low), while a completion of it’s ABCD pattern finishes what the stock started with it’s failed breakout in mid-January, dragging Citigroup stock 11% lower to tag D near $42.

Twitter: @andrewunknown and @seeitmarket

Author carries no position in any security mentioned at time of publication. Commentary provided is for educational purposes only and in no way constitutes trading or investment advice.

Charts courtesy of tradingview.com. CCAR excerpt courtesy of Ma’ Yellen. “Citifrown” image courtesy of thegraph.com.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.