By Andrew Nyquist

By Andrew Nyquist

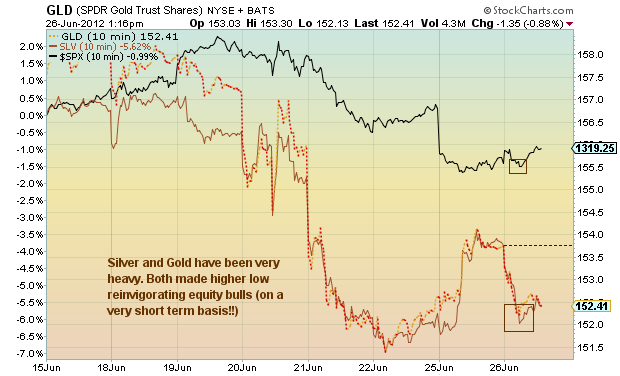

As fear hit the indexes again early this morning, a funny thing happened… the Volatility Index (VIX) recorded a lower high and Gold (GLD), Silver (SLV), and the S&P 500 (SPX) recorded higher lows (see chart below). This reinvigorated the S&P 500 for a run back at the daily highs and near term descending trend line. Note the index is on bar 6 of a DeMark sell setup that should continue IF the index sustains a break above 1320. Note as well that a break above 1320 would likely bring a move to 1325-1330 by end of day or early tomorrow.

Again, this is a very short term setup and predicated on a break of 1320 which IS strong resistance. Note I have a position in SSO (2x S&P 500) with a mental stop at equivalent of 1314.

———————————————————

Twitter: @andrewnyquist and @seeitmarket Facebook: See It Market

Position in S&P 500 related SSO at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of his employer or any other person or entity.