Investors read a lot about the persistence of low volatility in the markets throughout 2017.

And just 3 trading days into 2018 and volatility is losing once more, slipping from 11.04 to 9.22.

Market volatility remains suppressed with the VIX Index trading near the 9 handle. It’s good to note, however, that “low” doesn’t mean a turn is imminent.

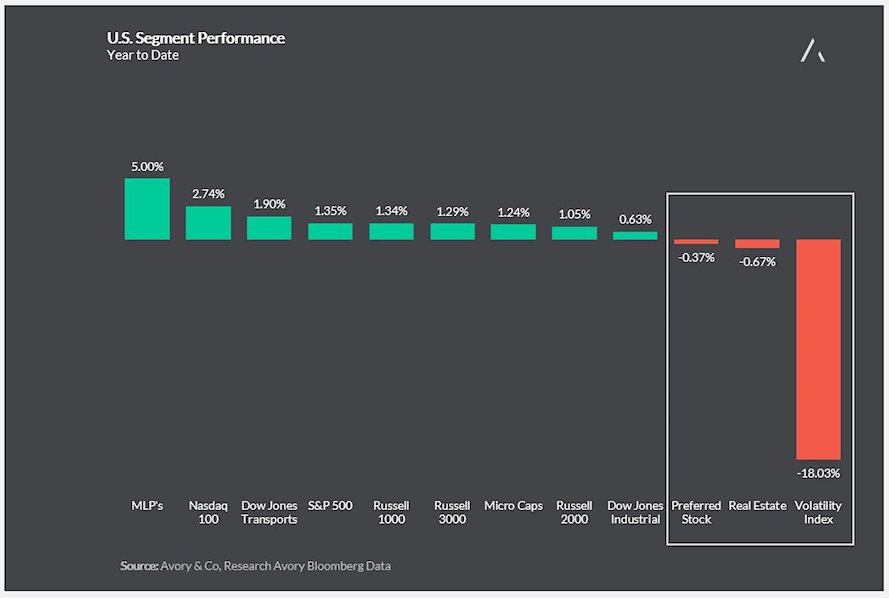

While yesterday we highlighted SKEW was signaling fear or at least accumulation of protection to a significant drawdown, market participants need to understand that like rates, volatility is difficult to predict. The start of 2018 is proof of this as the VIX ETF (VXX) is already down 18% in 3 days. This means those betting on higher volatility now need a 22% spike to get back to even. Even worse, if you are using ETF’s to make this call, you are also getting eroded away by contango.

U.S. Markets YTD Segment Performance – Volatility Crushed

Twitter: @_SeanDavid

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.