With the stock market well off the February lows, recent economic data showing signs of life, and US treasury yields climbing, it was conceivable that the Federal Reserve might raise interest rates again today. Whether or not that’s a smart decision is another discussion.

Well, the Fed decided not to rock the boat and leave rates unchanged, while talking up the labor market and recent signs of economic improvement. In all, the expectation was laid out for 2 more interest rate hikes this year.

So what did the market think of this? Stocks rallied higher, hoping this was a goldilocks type of approach. Slow and steady.

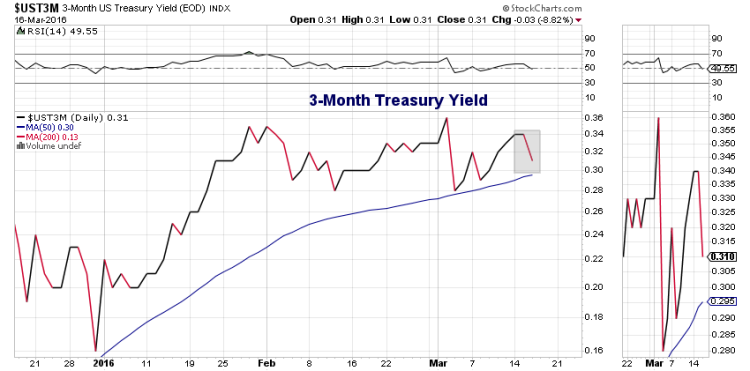

But US treasury yields weren’t so sure. Granted, much of this may have been priced in (i.e. sell the news)… but even so, short-term us treasury yields declined on the news. From the 3-month US treasury yield to the 10-Year US Treasury yield, they fell.

This may indicate that the treasury market expects interest rates to remain on the lower end (or at least controlled) with low volatility. It’s also a sign that the treasury market is taking a wait and see approach on the economy… and the Federal Reserve.

Either way, here are the charts:

3-Month US Treasury Yield

2-Year US Treasury Yield

5-Year US Treasury Yield

10-Year US Treasury Yield

Thanks for reading.

Further reading from Andrew: “Nasdaq Rally Nearing Big Resistance“

Twitter: @andrewnyquist

The author does not have a position in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.