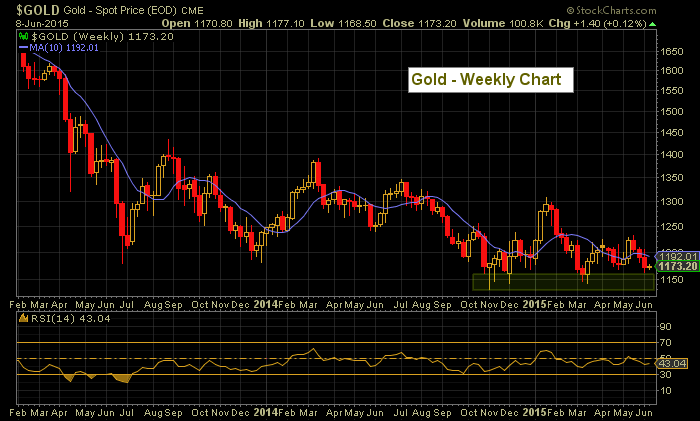

Gold prices continue to meander sideways. In fact, Gold has moved sideways for the better part of two years. For much of last year, Gold bulls chalked up the sideways move to strong consolidation in the face of a rising US Dollar. But the dollar has weakened over the past several weeks… and so has Gold.

And that’s not good news for Gold bulls.

On Friday, Gold prices slipped back down into a critical support zone: 1130 to 1165. This was the fifth time in 8 months that the yellow metal toyed with this area. The bearish scenario: 1130 breaks and Gold tumbles toward 1000. The bullish scenario: It may be short-lived, but bulls want to see a rally off of this support that see follow through higher.

A few questions to consider: Will interest rates continue to rise? What’s next for the dollar? What’s to come of Greece and the Euro? These questions are on Gold traders radars as Gold touches lower support again.

Spot Gold Prices – Weekly Chart

The coming days/weeks will be important for Gold prices. Stay tuned.

Twitter: @andrewnyquist

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.