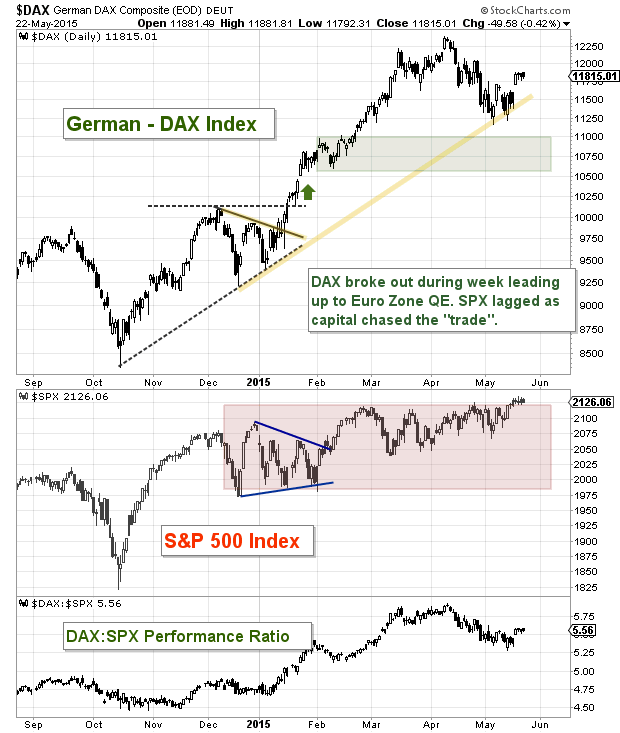

Over the last two weeks, the German DAX stock market index has tested and held its uptrend line from last October. Holding this trend line would be a huge win for European stocks, as well as other major stock market indices. Here’s why.

First, the German DAX has been a global leader since last October. While U.S. equities (i.e. the S&P 500) were consolidating in early 2015, the German DAX was pushing higher. From October to April, the German DAX jumped over 40 percent. This big time run has made the DAX a visible leader within global equities – and losing leaders isn’t a good sign for any market.

Second, Europe is still dealing with a wounded currency (the Euro) and lingering sovereign debt concerns. A significant drop in the German DAX would likely damage psychology across the European markets. Any thoughts of this scenario can be avoided by the DAX holding its uptrend line.

Last week’s rally was a good sign. 11,300 looks like the line in the sand over the near-term.

Twitter: @andrewnyquist

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.