The German DAX Composite began its decline well before the Greek crisis found its way back to the forefront of our trading screens. The Euro also began to firm up well before the drama in Greece. That simply means that some of the fallout in Greece is likely priced into the markets.

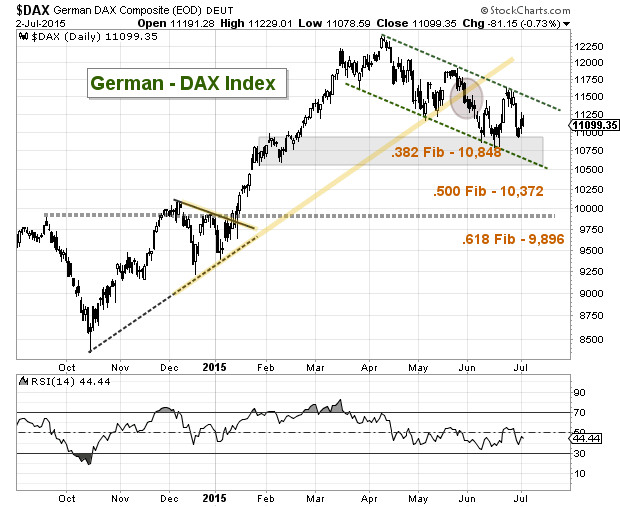

Now this doesn’t mean that there isn’t risk to fall further, it just means that capital often begins to reposition before “events”. As you can see in the chart below, the German DAX decline morphed into a correction after it broke support (yellow line) and accelerated lower. The lows came in at an important Fibonacci support level (.382). From intraday high to the recent low, the correction has dug as deep as 12.9 percent.

But you can also see below that the decline of the German DAX has been orderly and created a channel. A rise above the upper boundary (downtrend resistance) would neutralize the decline, while a dip below the lower boundary would indicate a momentum thrust lower that could put the .500 and .618 Fibonacci retracements in view.

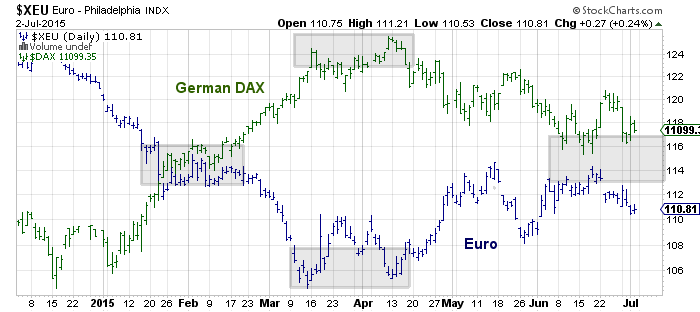

Now, let’s look at a quick chart pitting the Euro vs the German DAX. From a high level overview, you can see the that a weaker Euro was good for the German DAX. The two crossed paths in January as the German DAX broke out higher. And the recent decline has come at a time that the Euro has bounced.

Perhaps the next move in the Euro will be important in determining the extent of the DAX decline.

The outcome in Greece will initially affect both of these markets (and the global markets), but as a price follower I believe that its important to see how the markets react to key price support and resistance level. Trade safe over the coming week and thanks for reading.

Twitter: @andrewnyquist

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.