Here are two statements from the Federal Reserve’s Federal Open Market Committee (FOMC) immediately following their interest rate decisions of August 1, 2018 and September 26, 2018.

August 1, 2018 – In view ofrealized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1.75-2.00%. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

September 26, 2018 – In view ofrealized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 2.00-2.25%.

As you can see, the second statement eliminated language around its belief that monetary policy remained accommodative, which it clearly stated in the August release.

Since the media and analysts closely track changes in Fed statements to glean intent with regards to future rate increases and current and future economic conditions, the natural conclusion was that the 25 bps rate hike in September moved the Fed from “accommodative” to “not accommodative”, though not necessarily “restrictive”.

Interestingly, Chairman Powell’s subsequent comments to PBS six days after the September FOMC meeting seem to cast doubts on that conclusion:

“The really extremely accommodative low interest rates that we needed when the economy was quite weak, we don’t need those anymore. They’re not appropriate anymore,” Powell said.

“Interest rates are still accommodative, but we’re gradually moving to a place where they will be neutral,” he added. “We may go past neutral, but we’re a long way from neutral at this point, probably.”

So, is monetary policy currently accommodative or not?

This article provides a few charts aimed toward making sense of the contradictory statements from Fed officials so you can decide for yourself if policyis accommodative. Given the importance that monetary policy plays in asset pricing, a clear understanding of the Fed’s intent is extremely valuable. For more on our latest thoughts regarding Fed policy intentions and market expectations, please read our article Everyone Hears the Fed, But Few Listen.

Fed Funds

The Fed manages the level of the fed funds rate to influence other interest rates and thus meet their congressionally mandated employment and price objectives for the U.S. economy. To do so,the Fed conducts various operations in the money markets.

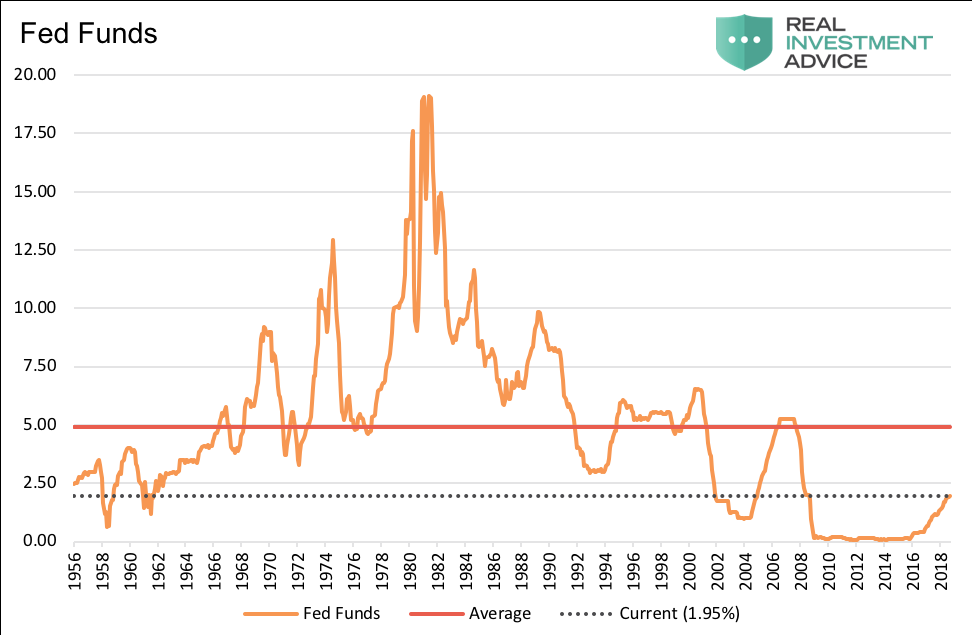

The graph below shows fed funds rate and its long-termaverage. Since the end of 2015, the fed funds rate has risen 2% from its level near 0% that persisted for many years in the wake of the financial crisis. Yet, the fed funds rate is still at a level that has only been experiencedin a few short-lived instances in the last 70 years.

Data Courtesy: St. Louis Federal Reserve

Comparing the fed funds rate over time is not the best determinant of whether policy is accommodative or restrictive. Better context is gained bylooking at the fed funds rate relative to the rate of nominal economic growth (GDP) and inflation (CPI).

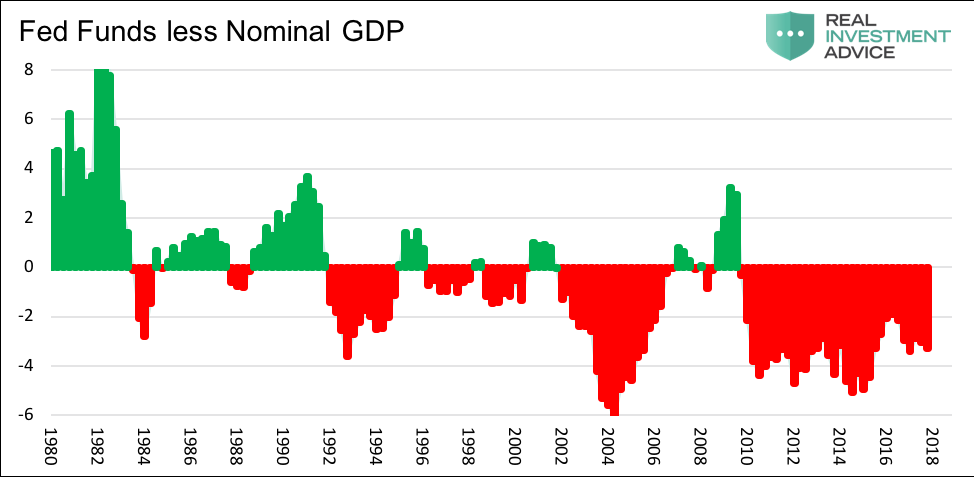

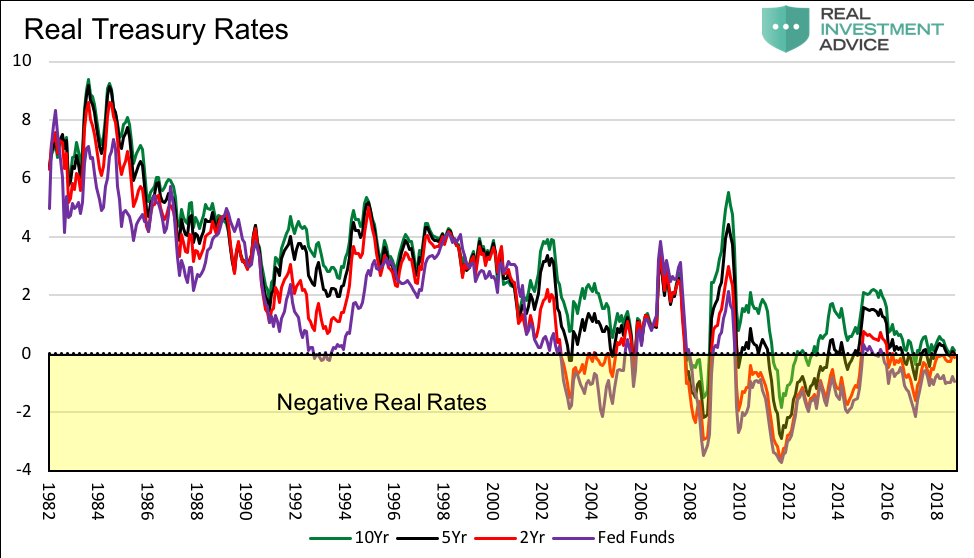

Data Courtesy: St. Louis Federal Reserve

As shown in the graphs, the current fed funds rate is 3.69% below the rate of nominal economic growth (based on Q2 2018 data) and 0.95% below the rate of inflation. It is also worth noting that longer-termreal (adjusted for inflation) Treasury yields, as shown in the second graph, are all near zero. This means that the current yields on Treasury securities are about equal with the current rate of inflation. While real rates have finally risen from financial crisis-eralevels, history shows us that real rates remain far from normal.

To better understand why this is important, please read our article Wicksell’s Elegant Model.

The bottom line is that, while the fed funds rate is on the rise,it is far below absolute and relative levels that serve as historical norms. Based on the data shown above, further increases of 2-4% would put the fed funds rate on par with historical comparisons.

Balance Sheet

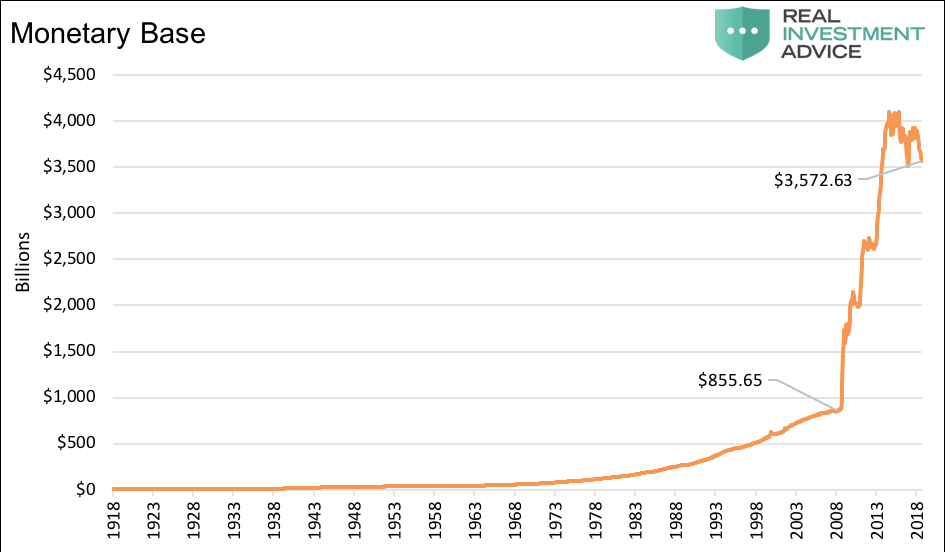

In 2009, with the fed funds rate pinned at zero percent, the Fed introduced Quantitative Easing (QE). Through three separate acts of buying U.S. Treasuries and mortgage backed securities (QE 1,2, and 3)the Fed’s balance sheet rose five-fold from about $800 billion to $4.3 trillion. The graph below charts the monetary base, which soared as a direct result of QE and has recently begun to decline due to Quantitative Tightening (QT), the Fed’s active effort to reduce the amount of assets on their balance sheet.

Data Courtesy: St. Louis Federal Reserve

Quantifying Stimulus

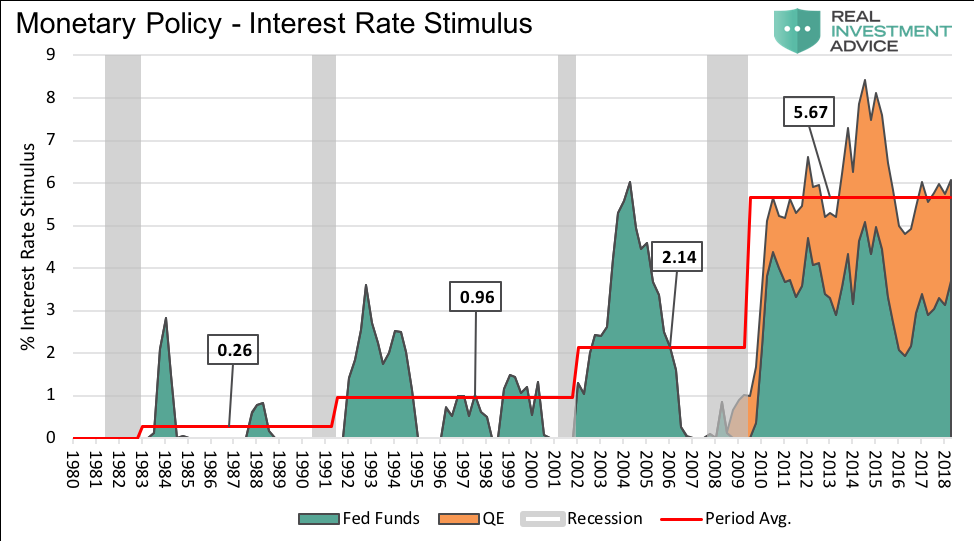

The next graph marries the two methods the Fed uses to conduct policy to quantify the amount of stimulus in interest rate terms. The amount of excess fed funds rate stimulus (teal) is calculatedas nominal GDP growth lessthe fed funds rate. QE related stimulus (orange) is basedon a rule Ben Bernanke laid out in 2010. He approximated that every additional $6-10bn of excess reserves held by banks (a byproduct of QE) was roughly equivalent to lowering interest rates onebasis point. Together the total represents the amount of interest rate stimulus.

Data Courtesy: St. Louis Federal Reserve

Currently, between QE and a historically low fed funds rate, the amount of stimulus being applied would, under normal conditions, be equivalent to dropping the Fed Funds rate by 6.08%.While that figure may seem beyond belief, consider that excess reserves are currently $1.9 trillion as compared to near zero for the decades preceding the financial crisis andthe fed funds rate is currently 3.69% below nominal GDP.

Essentially, the combination of an abnormally low fed funds rate coupled with the still outsized, but declining gradually, effects of QE argue that stimulus is still grossly accommodative. Incredibly, this is all occurring at a point in time when most economists believe the economy to be at full employment, growth is improving, stocks are at all-time highs and all sentiment indicators are at or near record high levels.

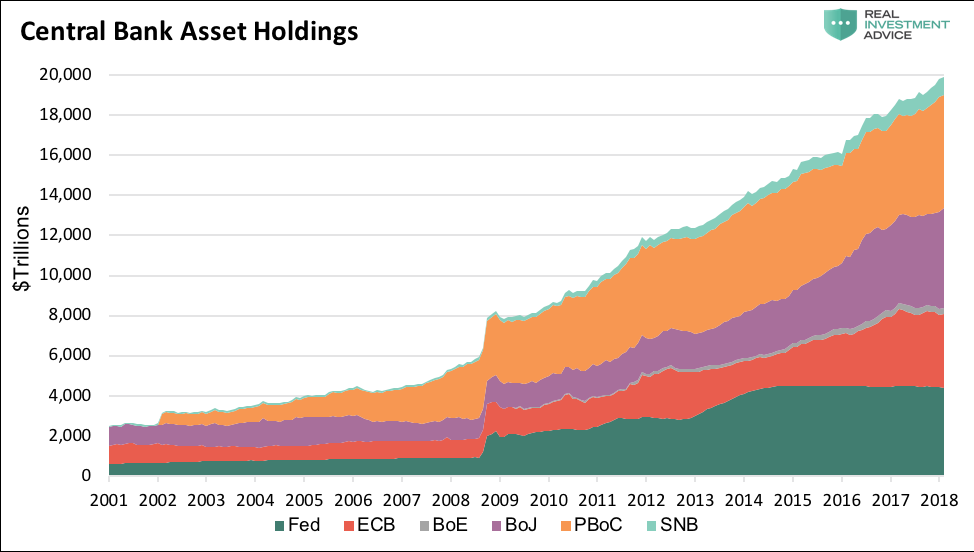

Global Accommodation

Thus far, we have only focused on the amount of accommodation provided by the Fed. Also worthy of consideration, the policies of the world’s largest economic powers have an impact on the U.S. economy. The following graph demonstrates the amount of stimulus being provided by the largest central banks.

Data Courtesy: St. Louis Federal Reserve and Bloomberg

Summary

Is Fed policy accommodative?

YES!

If you believe, as we do, that it is not only accommodative but irresponsiblyaccommodative, you will also appreciate the fact that the Fed has room to raise interest rates far more than investors are currently pricing in. Furthermore, any threats of inflation will likely push the Fed to restrain rising prices by acting more aggressively. This too falls outside the realm of current market expectations.

What we know is that financial asset prices have been the primary beneficiary of years of accommodative monetary policy at the expense of economic and social stability. As Stanley Druckenmiller said in his recent interview on RealVision TV:

“You know, intuitively, you can make a case that we’re going to have a financial crisis bigger than the last one because all they (the central bankers) did was triple down on what, in my opinion, caused it. I don’t know who the boogeyman is this time. I do know that there are zombies out there. Are they going to infect the banking system the way they did the last time? I don’t know. What I do know is we seem to learn something from every crisis, and this one we didn’t learn anything. And in my opinion, we tripled down on what caused the crisis. And we tripled down on it globally.”

Given the boost to asset prices caused by Fed policy, investors would be well-advised to pay close attention to the Fed’s words, their actions and critically, their inconsistencies.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.