Has The Reflation Trade Turned A Bullish Corner For Stocks?

The reflation trade is also known as the weak-dollar trade; both refer to leadership from assets that tend to perform well during periods of...

Currency Hedged ETFs Weaken As Dollar Drops

The modest strength in the U.S. Dollar Index over the last several years has prompted many ETF investors to “hedge” their overseas currency risk....

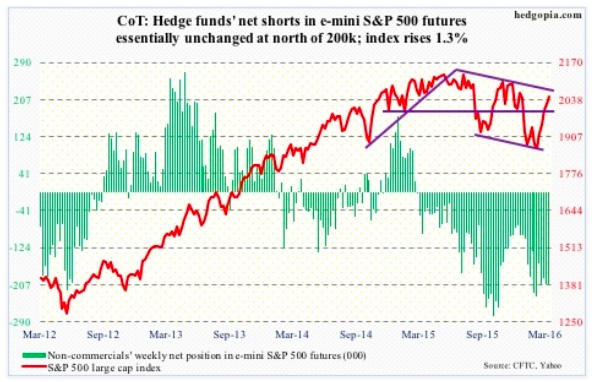

COT Futures Data: Momentum Intact But Reversal Risk Is High

The following is a recap of The COT Report (Commitment Of Traders) released by the CFTC (Commodity Futures Trading Commission) looking at COT futures...

USDJPY Chart Update: Dollar Yen Ready To Move Again

A couple weeks ago, I did an in depth look at the USDJPY chart over the near, intermediate, and longer term. We also looked...

COT Futures Data: Are Traders Readying For More Volatility?

The following is a recap of The COT Report (Commitment Of Traders) released by the CFTC (Commodity Futures Trading Commission) looking at COT futures...

Top Trading Links: A Peek Inside The Financial Markets

Stocks defied sentiment yet again to rise for the 4th straight week. And next week, the S&P 500 Index will attempt to break through...

Inside The ECB Decision: What It May Mean For U.S. Stocks

Once again, the European Central Bank (ECB) made their presence felt. Yesterday, the markets were greeted by a another ECB decision that played within...

Principal Component Analysis For Portfolio Composition

At Global Technical Analysis, our investable universe of futures contracts includes 28 individual markets across 7 asset classes.

They can be categorized as follows: Agriculture:...

Why A US Dollar Rally May Be Brewing

When we last wrote about the PowerShares U.S. Dollar fund (symbol UUP), it was working through the final stages of what we believe was...

Gold Rally Update: Be Careful With The Yellow Metal Here

Early this year, I postured that 2016 could see some mean reversion in the beaten and downtrodden stocks and sectors. Well, that has happened...