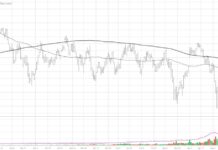

Gold Prices Clear Downtrend, Important Breakout Next?

Gold prices have bounced around during a volatile multi-month pullback. Each rally has been met with more selling.

Could that be changing soon?

Today's "daily" chart...

Energy Sector (XLE): Will “Long” Moving Averages Hold Again?

Energy stocks have remained strong as crude oil prices remain elevated.

But the Energy Sector ETF (XLE) has traded sideways this year and finds itself...

Will Rising Oil Prices Smack the S&P 500?

As the market and economy cheer the rise in GDP, we can thank consumer spending: 70% of GDP, services (what consumer pay for in...

Investing In Commodities and Stores of Value

For today, I used ChatGPT to ask which companies store raw materials.

After all, you cannot have capital investing in infrastructure without raw materials.

You cannot...

US Dollar Deja Vu? Repeating Bearish Pattern In Play!

Recent weakness in the US Dollar has helped to propel commodities such as Gold and Silver higher.

Today's analysis showing a potential repeating pattern that...

CPI, Bonds, Inflation: What’s Next For Stocks and Gold?

For today’s market update, I am providing an interview (video) I did on Real Vision with Ash Bennington.

Herein we cover the following topics:

CPI Inflation...

Bearish at the Bottom: Why Institutions Are Wrong On Crude Oil

Crude Oil Futures

On June 12th, Goldman Sachs came out with this:

Goldman Sachs has slashed its forecast for oil prices by nearly 10%, citing weak demand in...

Gold Price Actions Suggests Bulls Need a Refresh

Gold remained elevated for much of this spring, but trading became "heavy".

In trading terms, that's when price stalls out in a consolidation pattern but...

Investors: Time To Go For Gold?

For the third time in as many years, gold is brushing up against the US$2,000 per ounce zone, which of course raises the question...

Precious Metals and Mining Stocks Ready to Rally

In gold futures, we were looking for a correction to around $1940 an ounce.

The June contract fell to $1932.

Now, it closed on the exchange...