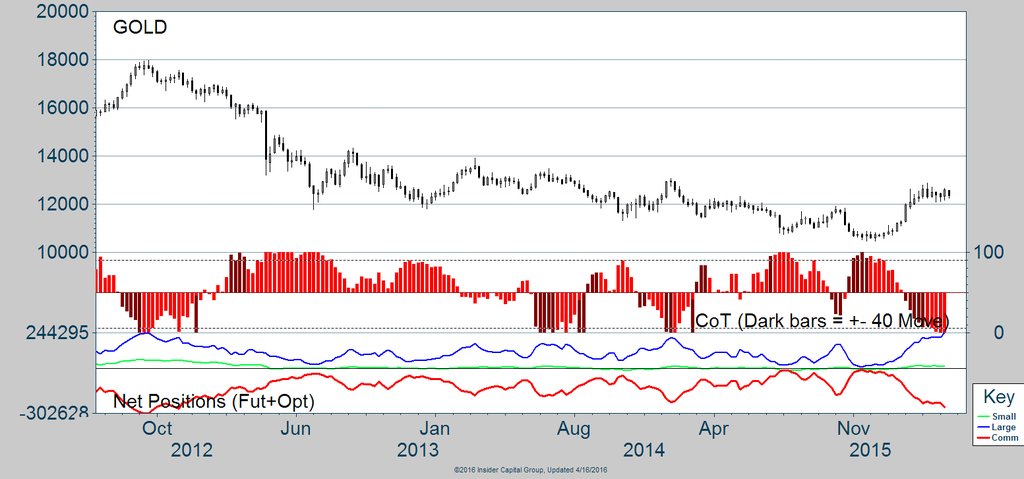

Is Gold COT Data A Reason To Be Bearish?

When it comes to futures markets, we can often turn to the Commitment of Traders (COT) report for insight into how certain traders are...

Silver And The US Dollar Send Bullish Signal To S&P 500

In my last article I outlined why I believe a huge move is brewing for the S&P 500. While I'm patiently waiting for the...

Copper’s Downward Trend May Resume Soon

Last November, we provided and update on Copper futures, suggesting that price was ready to put in a small fourth-wave consolidation or rally.

We also...

Crude Oil Insights: Doha, Drillers, And The Wrecking Bull

What went unnoticed Friday, April 15th is the bull market became the second longest on record.

As discussed in Stock Market Time Lapse: Tantrums, Reflux and...

Market Update With DeMark Indicators: Where To Next?

It's been a while since I posted a market update using DeMark analysis. And since the stock market has been red-hot since the February...

April 15 COT Report: Is The Market’s Glass Half Full?

The following is a recap of the April 15 COT Report (Commitment Of Traders) released by the CFTC (Commodity Futures Trading Commission) looking at...

S&P 500 Update: Futures Make New 2016 Highs

The monster bounce overnight for S&P 500 futures has the market in new highs territory on April 13. This move is still within a defined...

Gold ETF (GLD) Offers Opportunity For Bulls And Bears

Depending on your timeframe, a chart can offer traders opportunity on both sides (long and short). That appears to be the case with Gold...

Crude Oil And Energy Stocks Look Higher Once More

Late last week, crude oil price (WTI) reached my pullback target between $34 and $36/barrel and has broken its recent downtrend. You can read...

Stock Market Futures Rise, But Resistance Looms – April 11

We begin the second week of April in congestion territory with ranges between 2032.5 and 2053.75. This morning stock market futures are attempting to...