Using The ATR Indicator For Smoother Sailing

The market loves a good nautical analogy. And right now, no term sums it up better than “chop.” Defined as “small, steep disorderly waves...

Why Backtests Are Important For Traders To Understand

Backtests are an important price pattern for active investors to understand. Today I want to highlight a couple of recent trading backtests that failed and...

Why Investors Should Be Careful Using Market Divergence Signals

Nearly all technical analysts of stocks and other securities make use of technical indicators to help them make trading and investing decisions.

Technical indicators are...

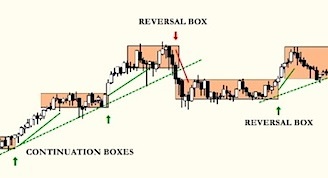

Trading Box Breaks: A Strategy For Winning In Competitive Markets

At its core, the stock market is little more than a competition. It is about winners and losers.

For companies, it is about gaining an...

Traders: Get An Edge By Thinking In Trading Categories

Wyckoff divided the market into an idealized cycle of accumulation, mark-up, distribution, and markdown. Though it can be difficult to apply this model in...

10 Great Technical Trading Rules

Only price pays. In trading, emotions and egos are expensive collaborators. Our goal as traders is to capture price moves inside our time frame,...

Market Masters: Using COT Data To Identify Turning Points In The Market

While I've been writing for See It Market for several months, it's a great honor to write a "Market Masters" article. With my focus...

VIDEO: Introduction To Non-Linear Indicators and Cycles

As many of you are aware, cycles and cycle analysis are a big part of my work and focus. But when they are paired...

The Importance Of Trend Lines In Price Confirmation

As a technical analyst I rely on price to lead my bias. To help find interesting setups in price I use various indicators and second derivative...

Market Masters: How Standing On Your Head Can Reduce Investor Bias

by Chris Kimble Warren Buffett famously said he’s not a fan of technical analysis because he got the same answer when he...