Making Sense Of A Market Of Stocks

I regularly run screens for stocks making new highs and new lows on different time periods. While it’s always been a source of new...

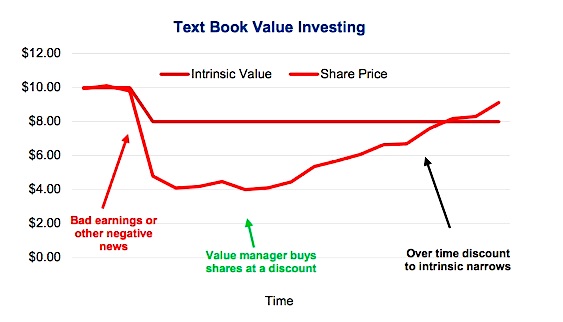

Uncovering Value: Price Discovery And Irrational Investing Behavior

This post was written with Chris Kerlow and Craig Basinger.

The essence of money management can be encapsulated in searching for investments that are trading...

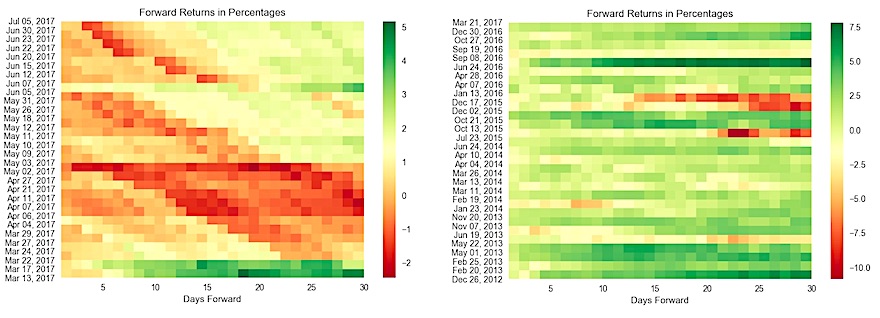

Want To Automate Your Trading Edge? Start Here

I have spent most of this entire year working on automating my edge. For my style of swing trading, the only discretionary input now...

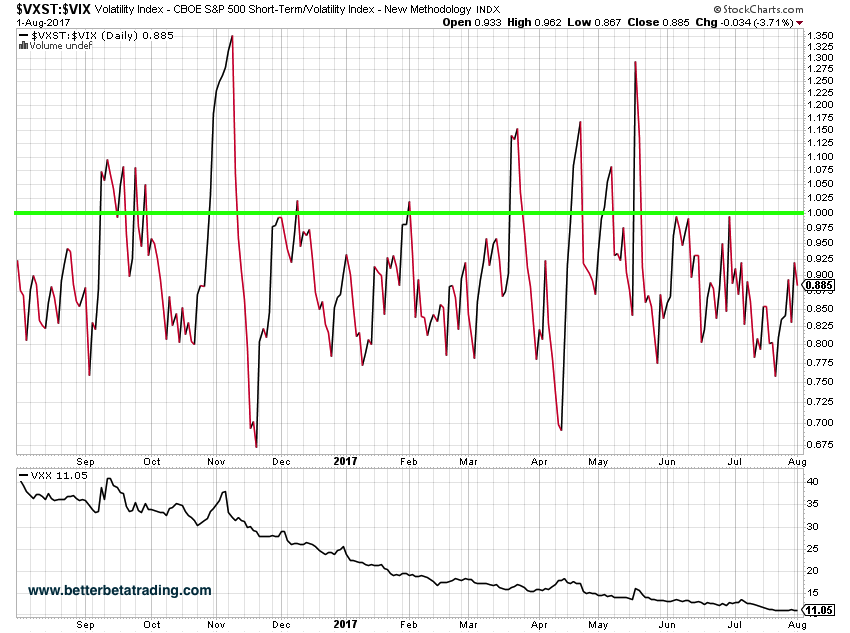

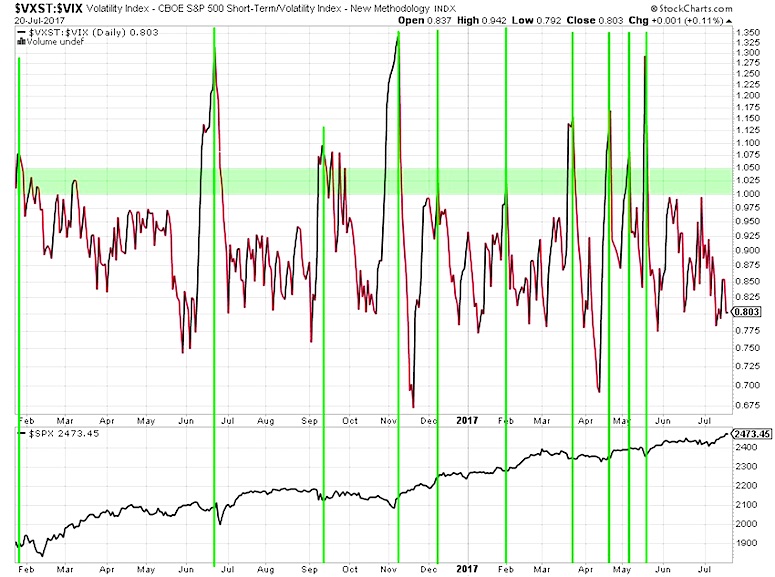

Using The $VXST To $VIX Ratio For Shorting $VXX

Recap:In our first article we examined the ratio of the CBOE VXST Short-term Volatility Index (INDEXCBOE:VXST) to the CBOE VIX Volatility Index (INDEXCBOE:VIX) as a...

How To Take Advantage Of The Earnings Catalyst

A catalyst can provide what most traders I know prefer…volatility, or a higher than average increase in price movement.

Trading Catalysts can range from potential...

Backtesting The VXST VIX Ratio For Trading The S&P 500

Last week, we took a dive into a key volatility ratio that traders can use for timing equity trades.

Recap: In last week's article, we...

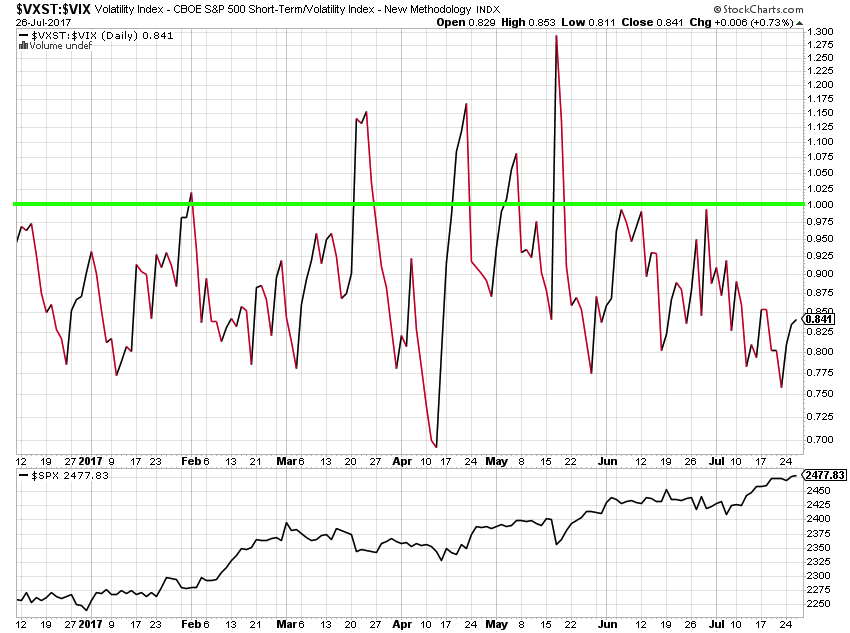

What The VXST:VIX Volatility Ratio Is Saying About Stocks Now

With the lack of a buyable stock market dip dominating the financial news (see: WSJ's "Markets’ Steady Climb in 2017 Defies Historic Odds"), many...

What Does “Edge” Look Like?

Everyone talks about edge and every successful trader I know has one (most have a few trading edges or more). However, what does "edge"...

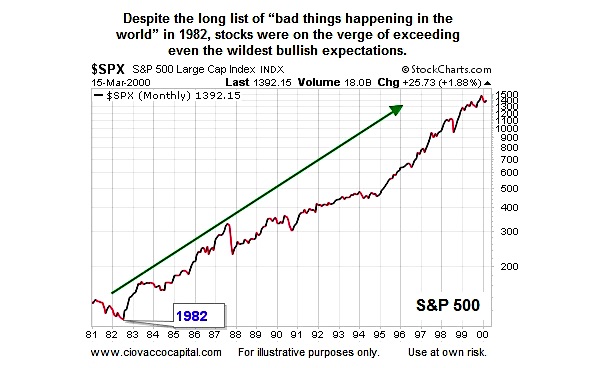

Investing Trends: Why It Pays To Stay In The Now

A Simple And Powerful Concept

Eckhart Tolle’s New York Times Best Seller The Power Of Now has sold over 3 million copies worldwide and has...

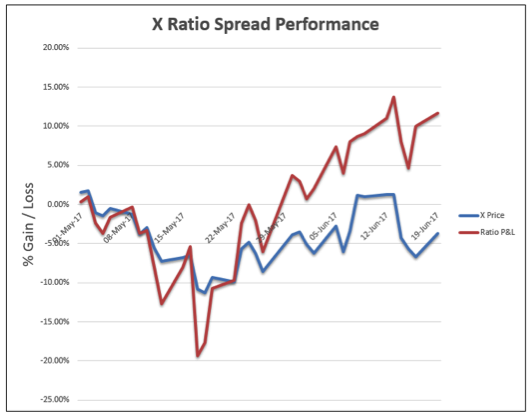

Options Education: How To Trade Put Ratio Spreads

The put ratio spread is generally considered a neutral options trading strategy, although it has the ability to make a profit in up, down...