3 Golden Nuggets of Wisdom for New Traders

One of the biggest hurdles in trading is overcoming our natural tendencies (or bad habits) we bring with us when getting started. If we're...

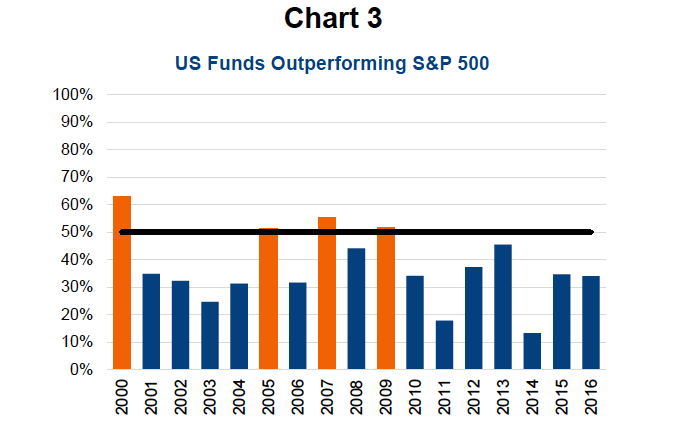

Passive vs Active Investing Debate: When and Why?

In 1950, 90% of U.S. stocks were owned directly by households, with the rest owned by international investors and funds. During the 1970s and...

No Need To Panic On Outside Days

The S&P 500 Index (INDEXSP:.INX) put in an outside day on Monday. This deserves respect from traders and investors of all time frames, as well...

Trading Day Classifications and the Prospects for a Year-End Rally

Much is made regarding price action and day type classification.

To keep things simple, let’s consider four possible day type classifications for this article.

We can...

Trading The Russell 2000: Here’s A Timing Strategy

In our previous article, we looked at using the small cap Russell 2000 Volatility Index (INDEXCBOE:RVX) to better time long entries in the Russell...

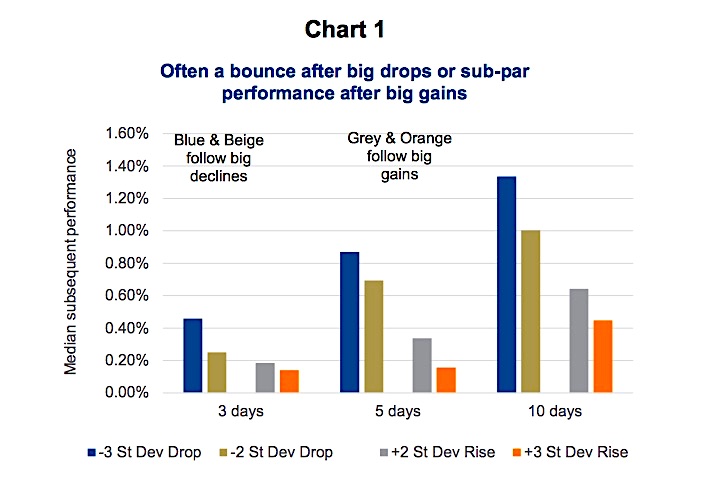

Mean Reversion: The Market’s Way Of Rationalizing Irrational Moves

After the apple hit Sir Isaac Newton’s noggin, he, and subsequently the rest of the world, understood gravity – what goes up must come...

3 Things I Learned From Mike Epstein

I was honored to receive the Mike Epstein award last week in New York from the MTA Educational Foundation. This is an award given "for...

Using RVX Small Cap Volatility Index to Time Your RUT Entries

With the Russell 2000 index (INDEXRUSSELL:RUT) sitting at record highs, many traders are wondering how much longer it can continue to climb without a...

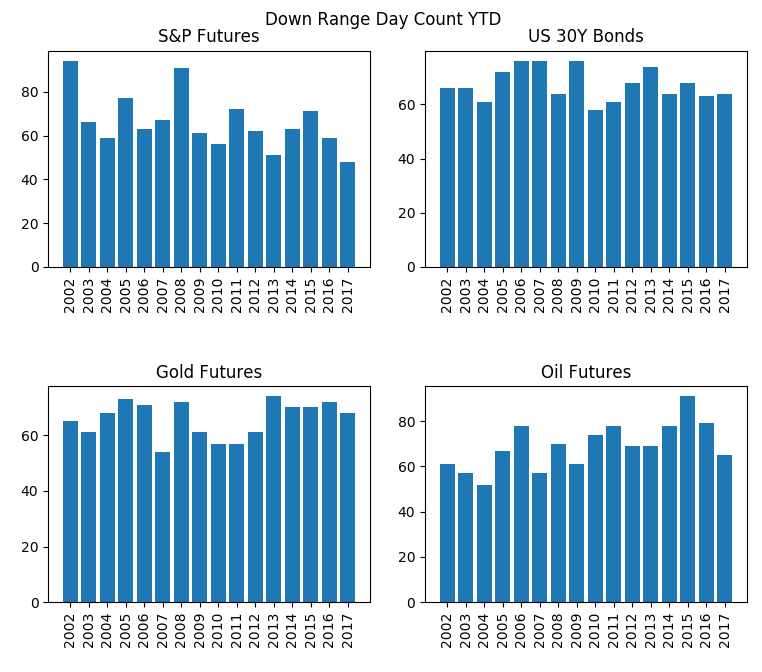

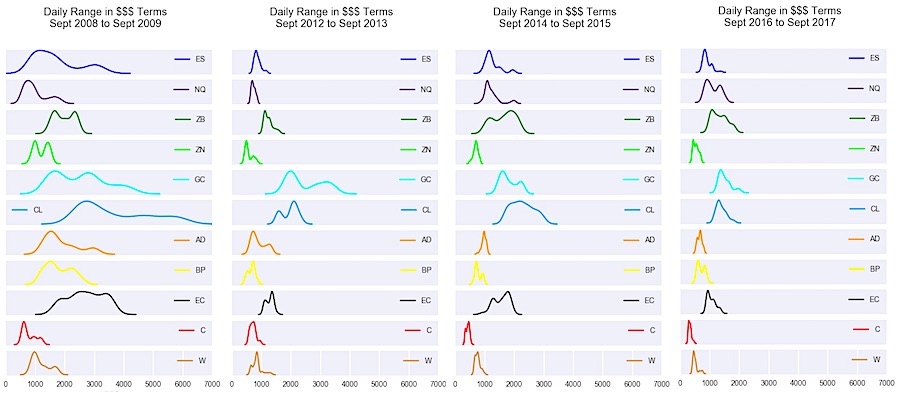

Market Volatility And Opportunity Over The Years

I am often asked what is the best market to create intraday trading strategies.

There are maybe literally one million factors - both market related...

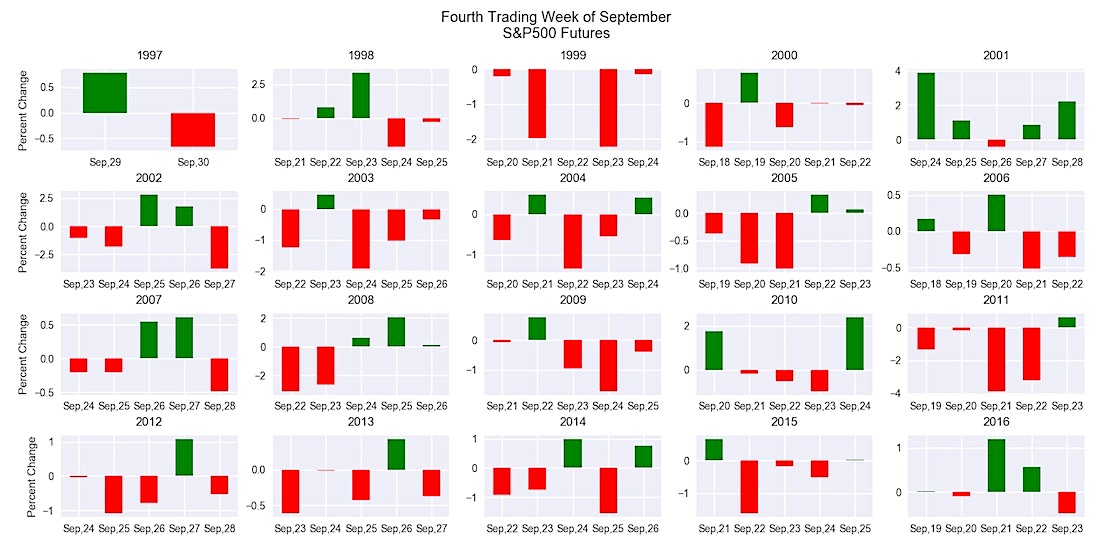

S&P 500 Seasonality Turns Negative In Late September

As summer trading (hopefully) comes to an end we all might be in store for a bit more volatility and an increased likelihood for...