Leveraged ETFs: Why Investors Should Know Their Risks

Leveraged ETFs are alluring in that they offer the potential for quick gains. But they also come with little concern towards common-sense investing risks. Recently,...

Why Investors Should Be Careful Using Market Divergence Signals

Nearly all technical analysts of stocks and other securities make use of technical indicators to help them make trading and investing decisions.

Technical indicators are...

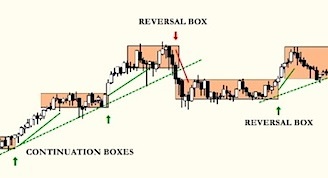

Trading Box Breaks: A Strategy For Winning In Competitive Markets

At its core, the stock market is little more than a competition. It is about winners and losers.

For companies, it is about gaining an...

Traders: Get An Edge By Thinking In Trading Categories

Wyckoff divided the market into an idealized cycle of accumulation, mark-up, distribution, and markdown. Though it can be difficult to apply this model in...

Why Traders Should Consider The Other Side Of The Trade

Think you’ve found the perfect trading setup? A textbook bull flag ready to take off? An exhausted gap just begging for an opportunistic short?

Trading-focused social...

4 Core Beliefs That Define My Trading “Edge”

A while back I was honored to write a post for the "Market Masters" series on See It Market. But today marks my first official post...

Why Core Tier 1 (CET1) Is Important To Banks and Investors

In my last two articles we looked at the Liquidity Coverage Ratio and Net Stable Funding Ratio. These are important liquidity standards and the...

Why Trading Is Harder Than One Thinks

Being a trader is not just a numbers game, it is a way of thinking, analyzing and outsmarting all the other players in the...

Why Market Ratios Deserve A Place In Your Trading Toolkit

Many traders, especially when first starting out, focus on the individual chart of whatever they are trading. If you’re trading the S&P 500, watch...

Trading In The Information Age: Adjusting To “Quick Fix” Markets

Our society seemingly has given way to shorter time frames. We simply revel in looking at the next minute rather than "tomorrow". In this fast-paced...