Understanding Market Structure For Better Trading Results

We can all agree that the markets are in constant ebb and flow, never moving in a straight line, always undulating. So how then,...

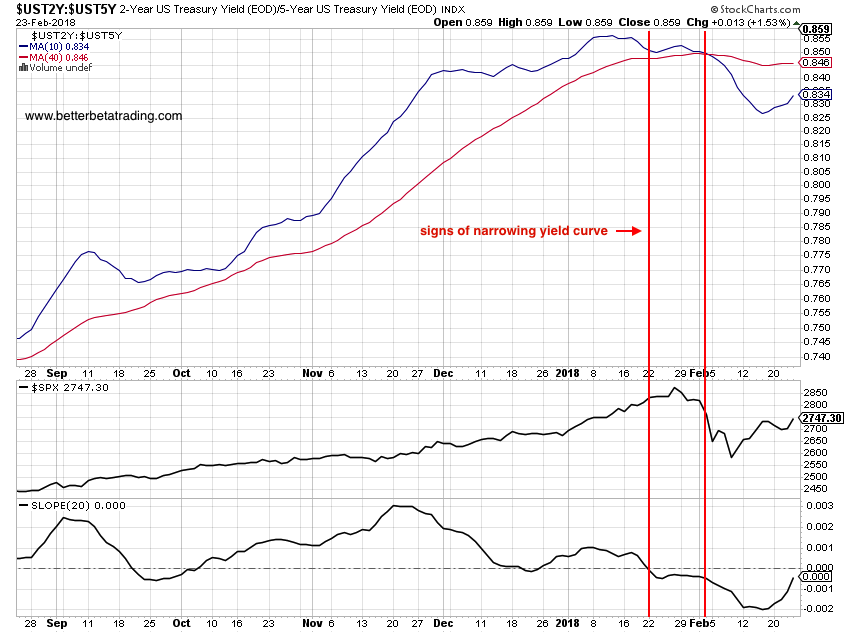

How To Use The Yield Curve As An Equities Risk On/Off Indicator

The drop in equity markets and subsequent V-shaped rebound has left many traders wondering: "Is it safe to increase long equity exposure?"

With pundits on...

How To Trade A Poor Man’s Covered Call

Most traders worth their salt have used, or at least heard of covered calls.

Covered calls are really easy to implement and are a proven...

Using Cash Secured Puts To Pick Up Stocks For Less

Getting paid while you wait, I like the sound of that.

A cash secured put is a conservative options strategy that can be used to...

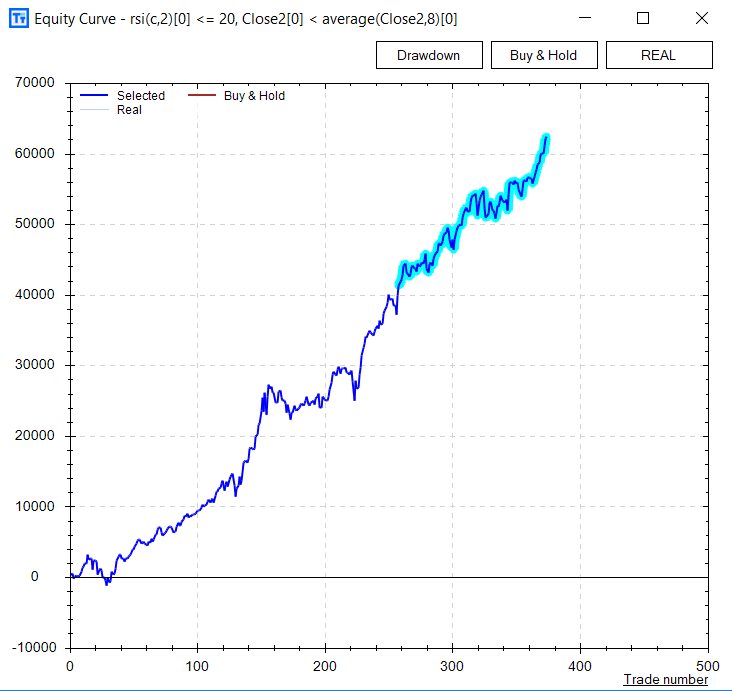

How To Improve Market Returns Using Alternative Data

Many people post fancy charts and data points but often times I wonder if they have actual use.

Recently, there is also a great infatuation...

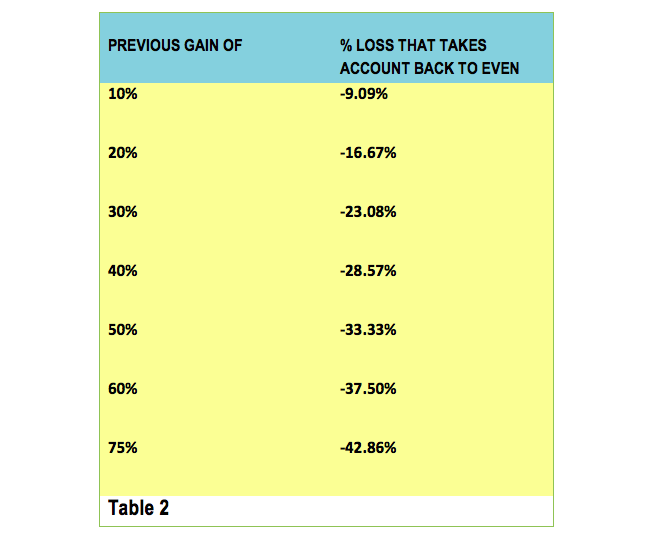

How Stock Corrections And Bear Markets Decimate Investor Gains

“Nobody ever lost money taking a profit” ~ Bernard Baruch

When is a 10 percent stock market correction not a 10 percent correction? How about...

4 Prevalent Investor Biases And How To Manage Them

If you had to analyze every decision you make on a given day, you probably wouldn’t get much done. You might not even make...

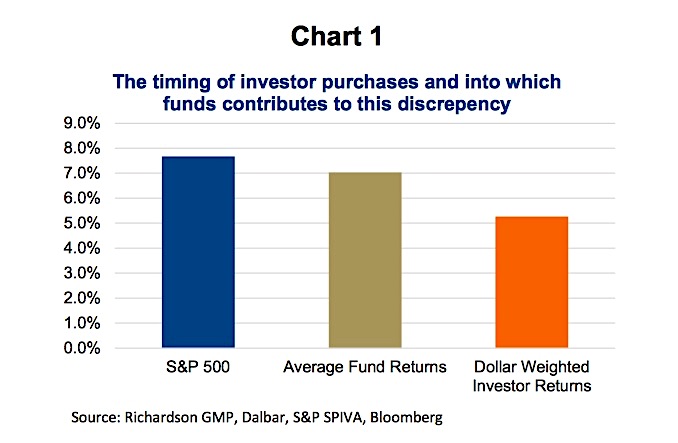

Investors: The Dangers Of Performance Chasing

The most prevalent disclaimer in the investments world goes something like this – “past performance may not be repeated”. If you don’t believe us,...

Behavioral Bias: How Investors Can Profit From It

All investors make errors that can often be traced back to a behavioral bias or emotional mistake.

If under certain circumstances these mistakes are systematic,...

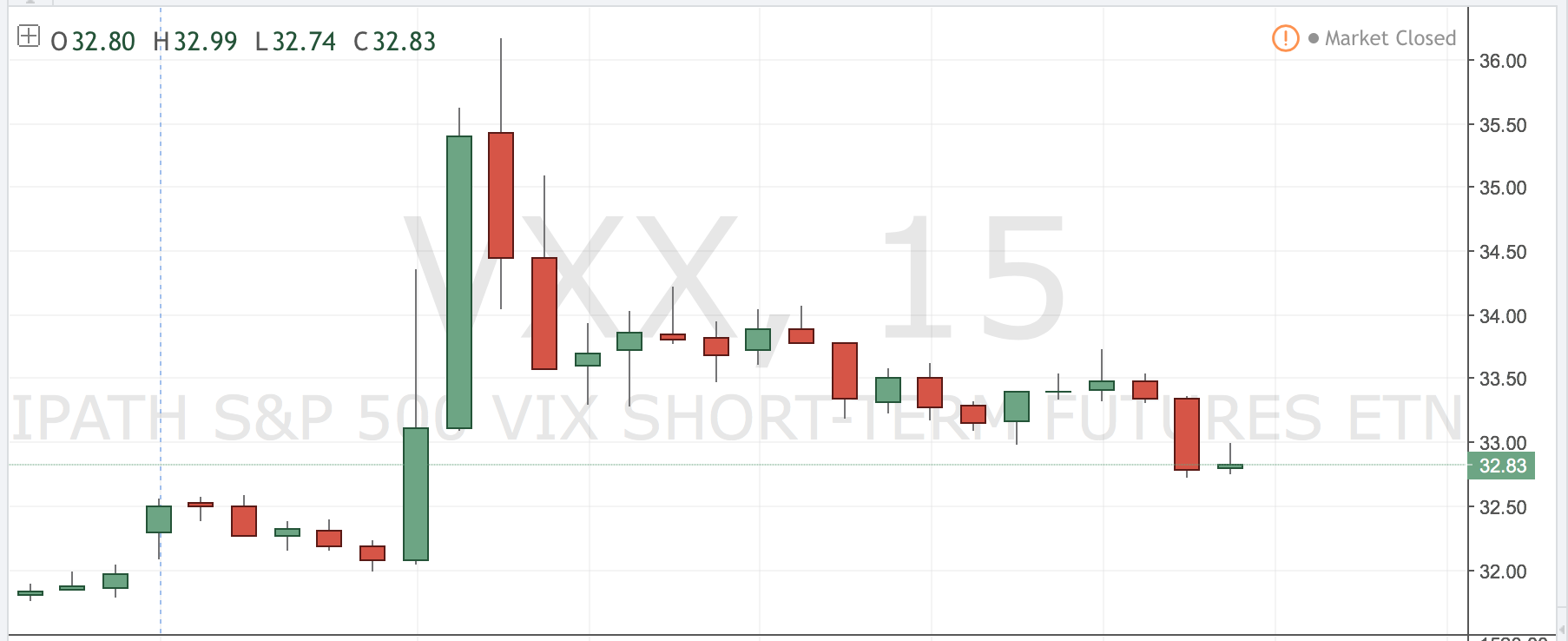

Trading Strategies: Intra-day VXX Spikes

With the equity markets in a steady melt up, multi-day implied volatility spikes have all but disappeared. Any dip in equities now lasts mere...