Investing Strategies and Insights: The Trend Is Your Friend

Last week we ventured away from our normal market / economics topics and discussed the value of investing advice with a few of the...

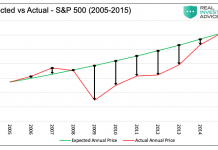

3 Questions to Ask About the 200-day Moving Average

All eyes are on the 200-day moving average as the S&P 500, along with many individual stocks, begins to test this key long-term barometer.

Why...

Thoughts On Managing Positions Through Volatile Markets

One would think that a topic regarding managing trading/investing positions would be worthy of a long article.

Perhaps even a book.

Not here. Not today.

However, I...

Wait for the Fat Pitch : Buy and Hold vs Active Management

“Ted Williams described in his book, ‘The Science of Hitting,’ that the most important thing – for a hitter – is to wait for...

Quantifying Candlesticks for Trading Systems

Candlesticks are often a trader’s first exposure to technical analysis.

As a quantitative system developer for a high frequency and market making firm I can...

6 Interesting Similarities Between Golf and Trading

With another Golf season winding down here in the North East, I decided to put together my thoughts on what I've come to realize...

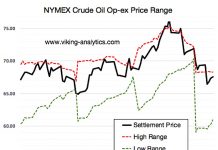

The Limitations of Max Pain Theory For Options Traders (into Op-ex)

The Max Pain theory suggests that stock and commodity prices will often move towards specific prices on specific option expiration dates. “Max pain” is the price...

Why Every Investor Needs An Articulate Exit Strategy

In my formative years as a technical analyst, I learned all about different methods of calculating stops and how to incorporate them into a...

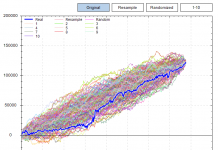

3 (of many) Uses for Monte Carlo Simulations in Trading

What is the likelihood the past repeats itself? I don’t have to tell you that those odds are pretty low. Monte Carlo simulations allow...

5 Behavioral Biases That Infect An Investor’s P&L

While the word certainly carries a negative connotation, it is essentially a preconceived opinion or feeling. Sometimes these opinions are based on accurate, objective...