Traders: Why Your Trading Process Is All That Matters

So, we live in a world in which investors are nervous. Everyone knows the Fed is going to raise rates, it’s only a question...

Why You Shouldn’t Let Market Bottoms Consume You

Calling for a market bottom is the new rage. But, truth be told, what feels cool is often a very dangerous thing to do...

Staying Focused During Bear Markets In Sentiment And Stocks

Anyone that has been investing for any reasonable length of time knows that bear markets are inevitable. It’s just part of the normal cycle...

Using The ATR Indicator For Smoother Sailing

The market loves a good nautical analogy. And right now, no term sums it up better than “chop.” Defined as “small, steep disorderly waves...

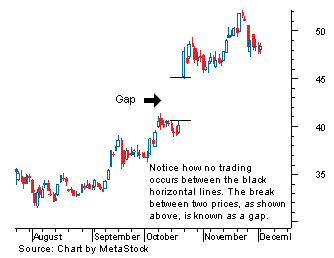

Mind Those Market Gaps

Among the many trading proverbs, the one about gaps is easily among the top ten in terms of how frequently it is (ab)used and...

Investors: Beware The Certainty Trap

Data availability is something of a double-edged sword in today’s financial markets. On the one hand, we now have a nearly unlimited supply of...

Why Backtests Are Important For Traders To Understand

Backtests are an important price pattern for active investors to understand. Today I want to highlight a couple of recent trading backtests that failed and...

The Art Of Trading And The Illusion Of Control

I’ve written and said many times before that simplicity is a good thing—if you have a trading methodology that is overly complex, there’s a...

4 Considerations When Making New Investments

The stock market is a constantly changing beast that loves to cause the greatest pain to the largest number of participants possible. What I...

Value At Risk (VaR): Insights And Considerations For Risk Managers

We looked at the calculation of Value at Risk (VaR) in my last article. The definition was “the possible loss a portfolio, or position,...