Is Euro EURUSD Reversing Higher Off At Elliott Wave Support?

Higher US treasury bond yields are causing some reversals in the market, with metals rallying while the US Dollar is lagging. Even better examples...

Natural Gas ETF (UNG) Testing Top Of 7-Year Falling Price Channel

Over the past several weeks, I have dedicated a hefty sum of my time to looking at the rise in commodities (as it ties...

Is A Bullish Pattern Developing For U.S. Treasury Bond Yields?!?

As you might imagine, US Treasury Bond Yields (and interest rates) crashed following the news of the coronavirus in 2020.

But it didn't take long...

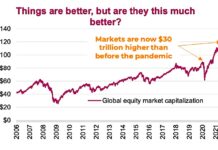

Global Equities Market Capitalization $30 Trillion Higher Than Pre-Pandemic

The stock market advance over the past year has truly turned a lot of heads, in a good way.

After the initial bear market and...

Stock Market Outlook Mixed, Something’s Gotta Give

The S&P 500 Index fell (-0.24%) for the third straight day on Tuesday, but is still clinging to its weakly bullish posture for now....

Key Sector ETFs Hover Over Price Support While Stock Indices Flounder

On Monday, we talked about specific sectors weakening as they teetered on the edge of support from their major moving averages.

The main three sector...

Q3 Earnings Outlook: Expectations Are Trending High

The following research was contributed by Christine Short, VP of Research at Wall Street Horizon.

Q3 Earnings Outlook Executive Summary

- Third quarter earnings season kicks...

Are Copper Futures Prices About To Move Higher Again?

The price of copper is already elevated and one of may inflationary indicators investors are watching. Well, it appears to be headed higher again.

On...

Silver Futures Traders: It’s No Time to Slip Here!

Silver futures recorded a major bullish price reversal in early 2020, leading to a multi-month rally that pushed prices as high as $30.

Since peaking...

Is The Stock Market Ready For Another Step Lower?

On Monday, the major stock market indices attempted a reversal of Friday's price action but failed. This created another late-day selloff.

Does this mean we...